Key moments

- Wednesday’s market rally driven by White House tariff concession announcement.

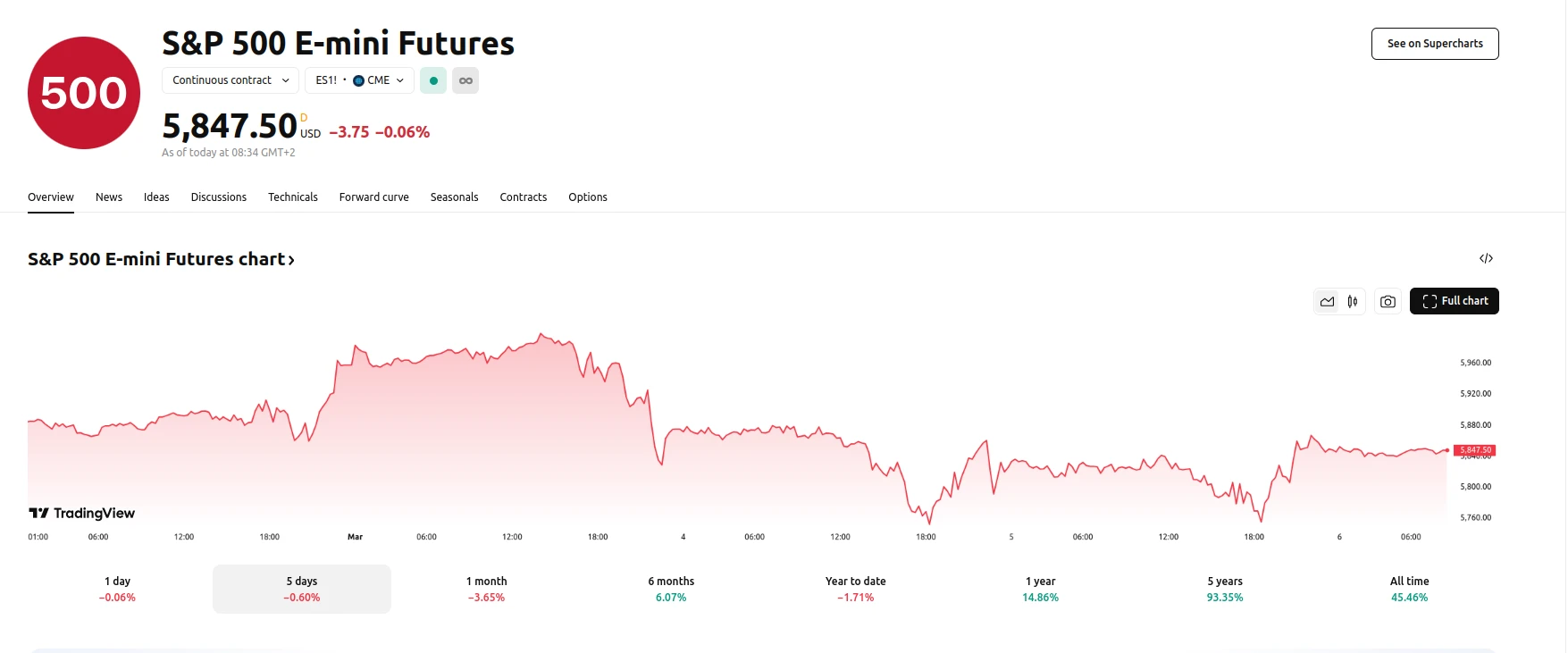

- Futures remain stable overnight, indicating a pause in recent volatility.

- Traders anticipate upcoming economic reports and corporate earnings releases.

S&P 500 Futures Hold Steady Post-Rally

After a volatile week marked by significant market fluctuations, S&P 500 futures remained mostly unchanged early Thursday. This period of stability comes on the heels of a notable rebound on Wednesday when major U.S. indexes saw substantial gains. The catalyst for this resurgence was the White House’s announcement of a one-month delay in tariffs for automakers complying with the United States-Mexico-Canada Agreement. This development sparked optimism among traders about the potential for broader tariff exemptions, contributing to a notable upswing in market sentiment.

Despite Wednesday’s positive performance, the broader market remains within a context of ongoing uncertainty. The week commenced with significant declines, influenced by President Trump’s implementation of tariffs on key trading partners, including Mexico, Canada, and China. These actions prompted retaliatory measures from the affected nations, fostering an environment of unease among investors. Market analysts attribute the observed volatility to a confluence of factors, including concerns regarding economic growth, inflationary pressures, and policy uncertainties emanating from D.C. This “three-headed monster,” as described by Mark Hackett, chief market strategist at Nationwide, has contributed to a notable decline in investor sentiment and a broad-based market correction.

Looking ahead, market participants are closely monitoring upcoming economic data and corporate earnings releases. Thursday’s focus includes the release of weekly jobless claims, providing insights into the labor market’s current health. Furthermore, anticipation builds for Friday’s release of the February payrolls report, which holds the potential to influence market direction significantly. In addition to economic indicators, a slate of companies, including Macy’s, Broadcom, Costco Wholesale, and Hewlett Packard Enterprise, are scheduled to report their quarterly results, offering further insights into corporate performance and market trends. The market remains in a state of watchful anticipation, as traders assess the implications of both economic data and corporate financial reports.