Key moments

- Visionary Holdings secures a $1 billion financing consent letter from Qatar’s Alfardan Group for EV expansion.

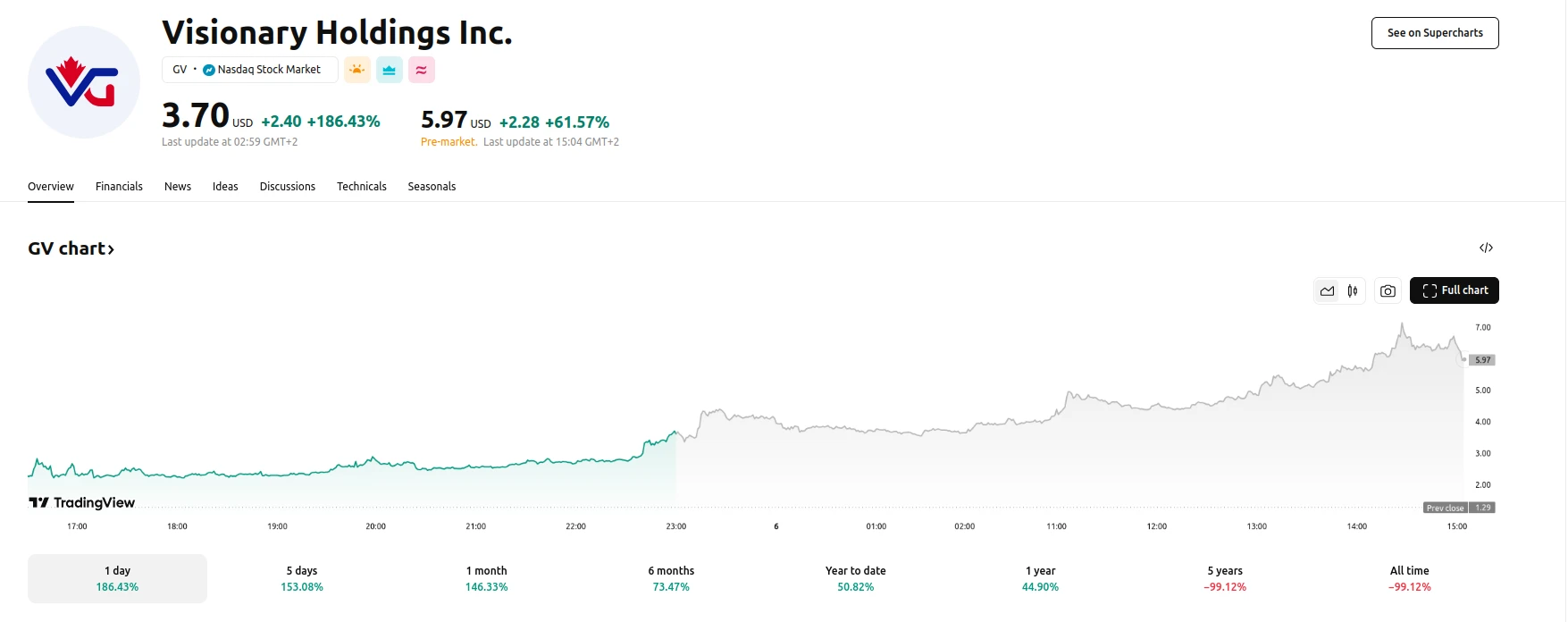

- The company’s stock price experiences a significant 68% surge following the financing announcement.

- Investors express concerns regarding the substantial funding relative to the company’s existing market capitalization.

Education Technology Firm’s Bold Move into Electric Vehicles Raises Questions About Feasibility

Visionary Holdings Inc., traditionally known for its presence in the education technology sector, has announced a significant $1 billion financing consent letter from Qatar’s Alfardan Group. This substantial investment is earmarked for the development and global expansion of the company’s new energy vehicle (NEV) initiative, PEGASUS. While the announcement triggered a 68% increase in the company’s stock price, it has also sparked considerable debate among investors. The core of the concern lies in the sheer magnitude of the financing relative to Visionary’s current market capitalization, which stands at a mere $5.59 million. This disparity has led to questions about the company’s ability to effectively manage such a significant capital infusion and execute its ambitious EV strategy.

Visionary’s foray into the NEV market represents a significant departure from its established education technology focus. In recent years, the company has actively pursued this new venture, introducing a range of electric vehicle products that have garnered some recognition within the industry. The newly secured $1 billion financing is intended to accelerate the company’s research and development efforts and facilitate a rapid scale-up of its manufacturing capabilities. The funds will be strategically allocated to bolster advanced R&D, establish a state-of-the-art manufacturing infrastructure, and expand the company’s market presence through enhanced brand awareness and international sales channels.

However, the fundamental question remains whether Visionary possesses the requisite technological expertise, supply chain capabilities, and industry knowledge to effectively compete in the highly competitive EV market. The company’s ability to navigate the complexities of EV development and manufacturing will be crucial in determining the success of its ambitious expansion plans. The next six to twelve months will be critical in assessing Visionary’s ability to translate this substantial financial backing into tangible results. Investors and industry observers will be closely monitoring the company’s progress, seeking to determine whether this bold move will establish Visionary as a significant player in the EV industry or result in a cautionary tale of overambition and operational challenges.