Key moments

- OPEC+ announces a production increase of 138,000 barrels per day, the first rise since 2022.

- U.S. crude oil stockpiles increase by 3.614 million barrels, exceeding market expectations.

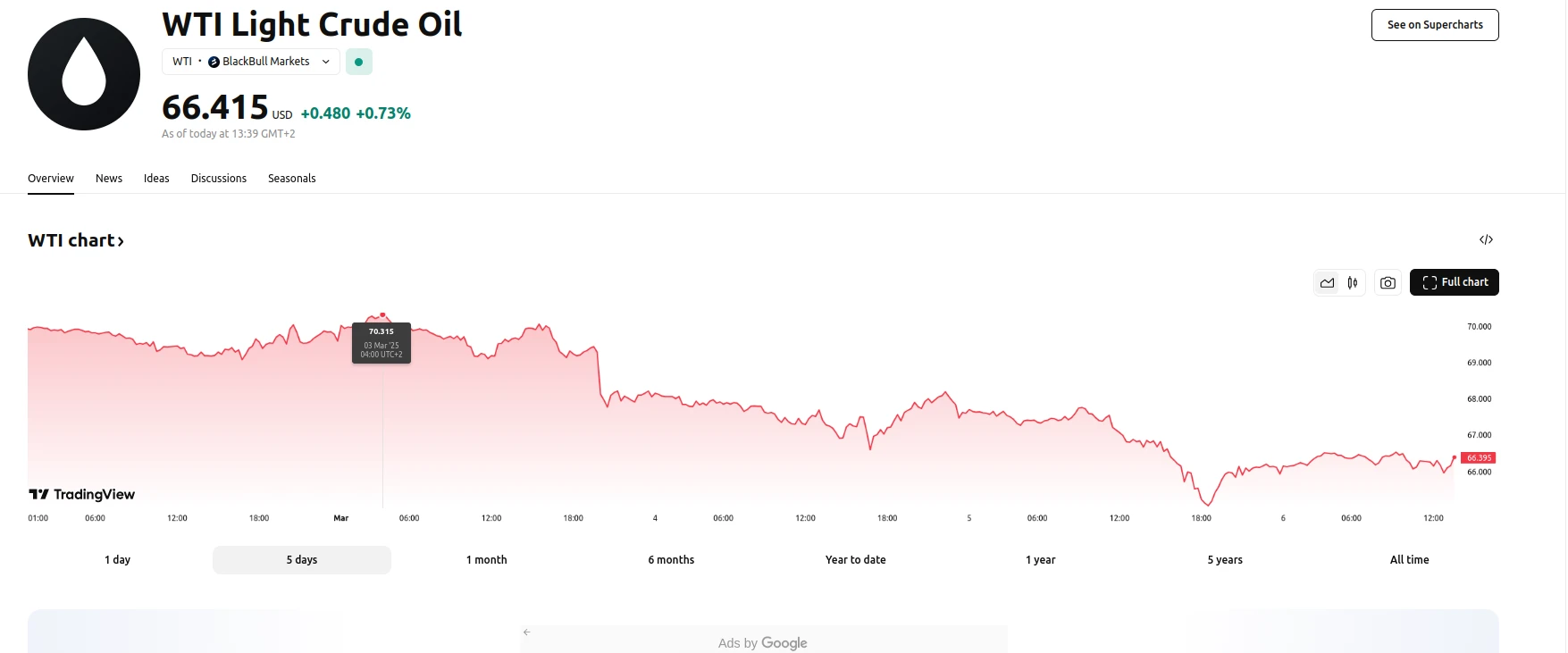

- WTI crude oil price extends its losing streak, approaching $66 per barrel.

OPEC+ Production Hike Triggers Market Downturn

West Texas Intermediate (WTI) crude oil prices have experienced a sustained decline, nearing the $66 per barrel mark amid growing concerns regarding OPEC+’s decision to increase production. This downward trend, marking the fifth consecutive day of losses, is primarily driven by a bearish market sentiment stemming from the alliance’s planned output increase. The OPEC+ group, which includes OPEC members, Russia, and other affiliated nations, has confirmed its intention to enhance production in April. This decision, amounting to a 138,000 barrel per day increase, represents the first production rise since 2022 and comes amidst pressure from U.S. President Trump to lower oil prices.

The increased production from OPEC+, combined with rising U.S. crude oil inventories, has contributed to concerns about oversupply. Data released by the U.S. Energy Information Administration (EIA) revealed a significant increase in crude oil stockpiles, with a rise of 3.614 million barrels for the week ending February 28. This substantial increase reversed the previous week’s decline and significantly exceeded market expectations, which had anticipated a minor decrease. This unexpected build-up has further reinforced concerns about a potential surplus in the oil market, placing downward pressure on prices.

Despite the prevailing bearish sentiment, some analysts suggest that the sharp decline in oil prices may lead to a period of stabilization. The drop below the key $70 per barrel level has pushed technical indicators into oversold territory, potentially prompting a temporary pause in the downward momentum. However, market strategists caution that any recovery is likely to be fragile, as unfavorable supply-demand dynamics continue to weigh on bullish sentiment. The potential removal of U.S. tariffs on Canadian energy imports, as suggested by a U.S. official, provides a small level of support to the market, but the overarching concerns regarding OPEC+ production and rising U.S. inventories remain the dominant factors influencing WTI crude oil prices.