Key moments

- Anticipation of US Nonfarm Payrolls: Traders exhibit caution leading up to the release of the US Nonfarm Payrolls report, resulting in a decline in the AUD.

- Impact of Global Trade Dynamics: Fluctuations in the AUD are influenced by China’s trade data, United States-Mexico-Canada Agreement tariff exemptions, and ongoing geopolitical tensions.

- Australian Economic Indicators vs. Global Pressures: While Australian GDP figures surpass expectations, the AUD faces downward pressure from external factors.

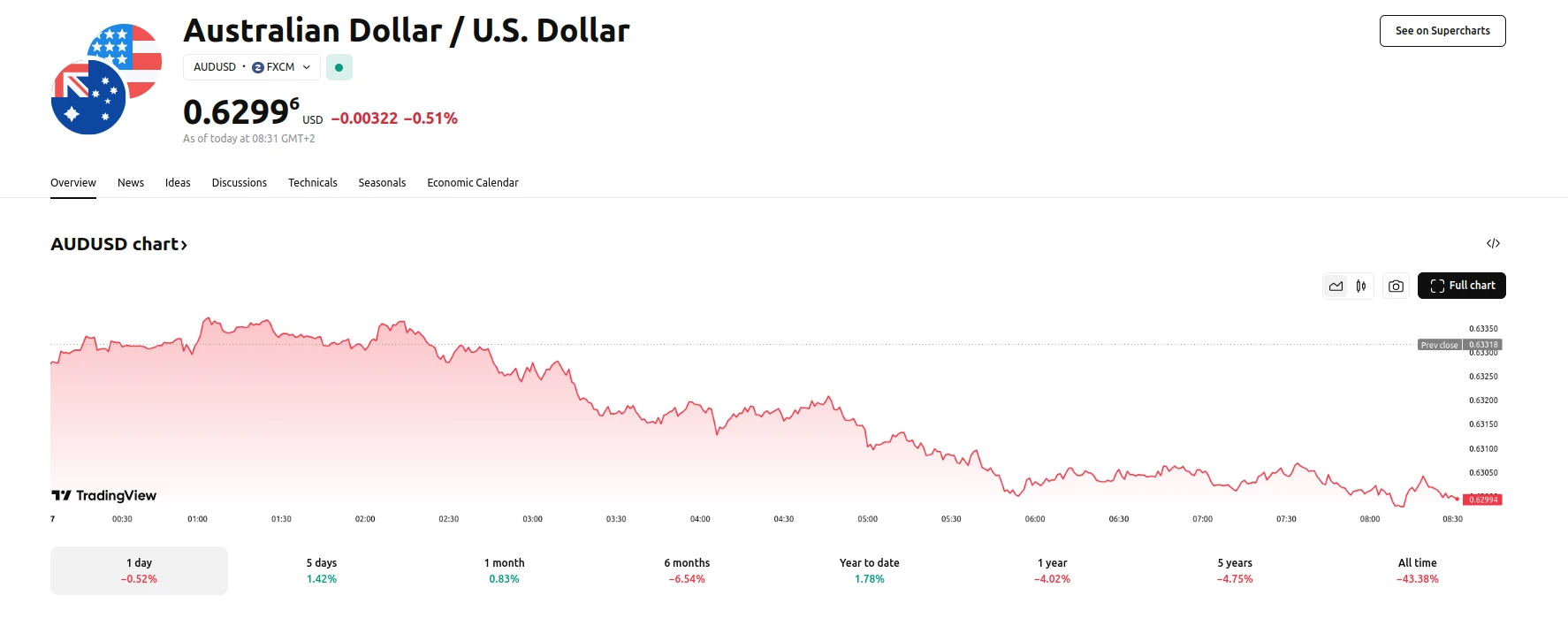

Australian Dollar Down 0.52% Before NFP Release Amid Global Trade Uncertainty

The Australian Dollar (AUD) experienced a 0.52% decline against the US Dollar (USD) within the last 24 hours as market participants adopted a cautious stance ahead of the highly anticipated US Nonfarm Payrolls (NFP) release. The subdued performance of the AUD reflects a broader market sentiment characterized by uncertainty, particularly concerning global trade developments. This downturn marks the second consecutive day of losses for the AUD/USD pair.

The market’s focus was significantly drawn to China’s trade balance data, which revealed a substantial increase in the trade surplus for February (USD 170.52 billion). While export figures fell slightly short of forecasts, a notable import decline contributed to the surplus exceeding expectations. This data, coupled with ongoing trade policy discussions, including Canada’s delayed implementation of retaliatory tariffs and President Trump’s USMCA tariff exemptions for Mexico and Canada, has introduced a layer of complexity into market assessments. The geopolitical climate, further strained by warnings from Chinese officials regarding potential responses to escalating US trade tariffs, adds to the prevailing sense of unease.

Despite stronger-than-expected Australian GDP data for the fourth quarter of 2024 (an increase of 0.6% quarter-over-quarter), which indicated a healthy expansion, the AUD has struggled to maintain its strength. The Reserve Bank of Australia (RBA) maintains its economic growth projections, however, investors remain wary of how potential policy adjustments might be made in response to evolving inflation and labor market conditions. The discrepancy between positive domestic economic indicators and the AUD’s performance underscores the significant influence of external factors on the currency’s value. The confluence of global trade uncertainties, geopolitical tensions, and the anticipation of key US economic data has created a challenging environment for the Australian Dollar.