Key moments

- The euro has surged against the dollar this week, climbing over 4.5% in its most significant rise since 2009.

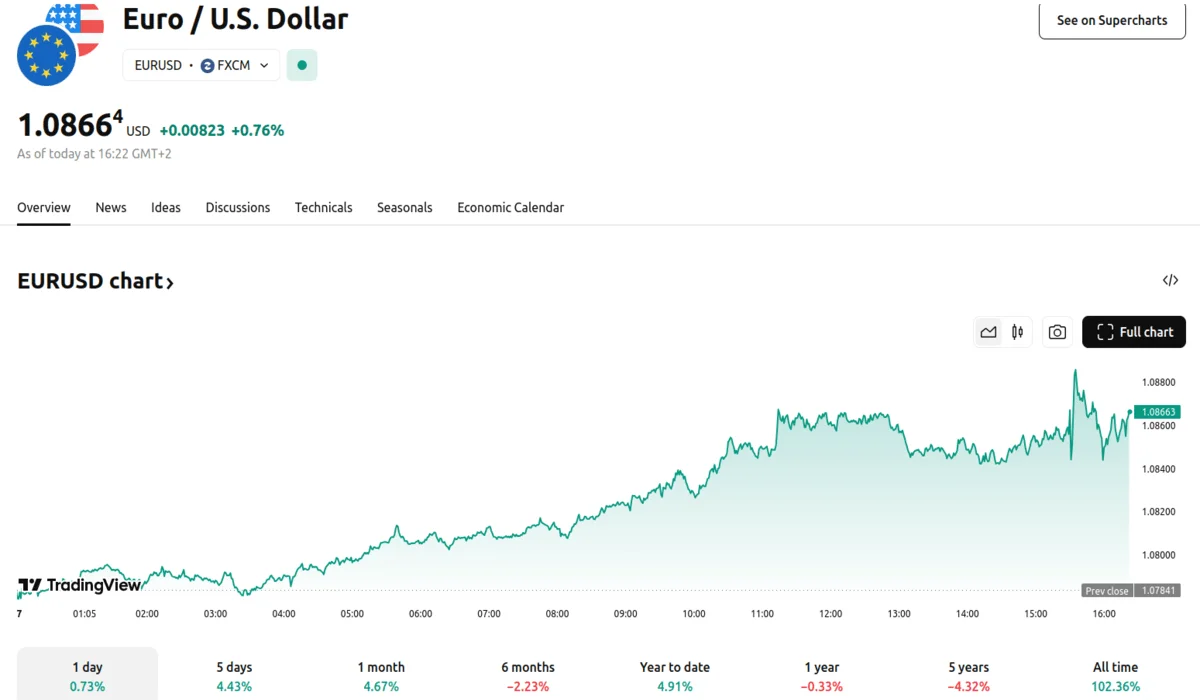

- The EUR/USD pair traded at 1.0866, marking a 0.76% increase as of 16:22 GMT+2.

- Financial institutions are revising their forecasts, moving away from predictions of euro-dollar parity.

Euro Gains Momentum Amidst Economic Shifts, Climbs to 1.0866 against U.S. Dollar

The euro is witnessing a substantial resurgence against the U.S. dollar, driven by evolving economic landscapes and policy decisions. The single currency has demonstrated a remarkable upward trajectory, reflecting a notable shift in investor sentiment. The euro’s climb of more than 4.5% against the dollar this week marks its largest spike since 2009.

This “lightning rally” comes in the wake of German Chancellor-in-waiting Friedrich Merz announcing a deal to fund investment in defense and infrastructure, as European leaders prepare to shoulder more of the burden for the region’s security and support for Ukraine. On Thursday, the European Central Bank lowered interest rates to 2.5%, while also indicating that future rate reductions may be less frequent. Traders are now fully pricing just one cut this year, down from two from a week earlier. The EUR/USD pair traded strongly at 1.0866, up 0.76% around 16:22 GMT+2.

Conversely, the U.S. dollar is facing headwinds due to a string of disappointing U.S. economic data and growing fears over the impact of Trump’s erratic tariff policies. Analysis of swap market data reveals that traders are now pricing in three quarter-point interest rate cuts by the Federal Reserve this year, a shift from earlier projections of fewer than two.

The monthly U.S. jobs report, released on Friday, showed the economy added 151,000 positions in February, short of the 160,000 expected by economists. The euro’s value reached $1.087, a gain of 0.8%, marking its highest point since early November. With the swift implementation of the fiscal package, Goldman Sachs analysts foresee a potential economic expansion of up to 2% in the following year, revising their previous forecast upward from 0.8%.

The euro’s current strength is a stark turnaround from its post-November dip following Trump’s election, when the dollar surged on optimism that the U.S. president’s agenda of tax reductions and deregulation would invigorate the U.S. economy. Changes in interest rate expectations within both the Eurozone and the U.S. provide additional evidence of this change in market sentiment.

Adjustments to trader forecasts indicate increasing confidence in the Eurozone’s potential for economic growth. The dollar’s broad weakness against other major currencies reinforces the notion of a significant currency market realignment. It appears that the dollar may soon lose all the ground it gained against other major currencies after Trump’s election.