Key moments

- Positive Sales Data: Fastenal reports a 5% year-over-year increase in February organic daily sales.

- Investor Presentation Announcement: Company to host a comprehensive investor event on March 13, 2025.

- Key Executive Presentations: Event to feature insights from CEO, President, and CFO on strategic initiatives.

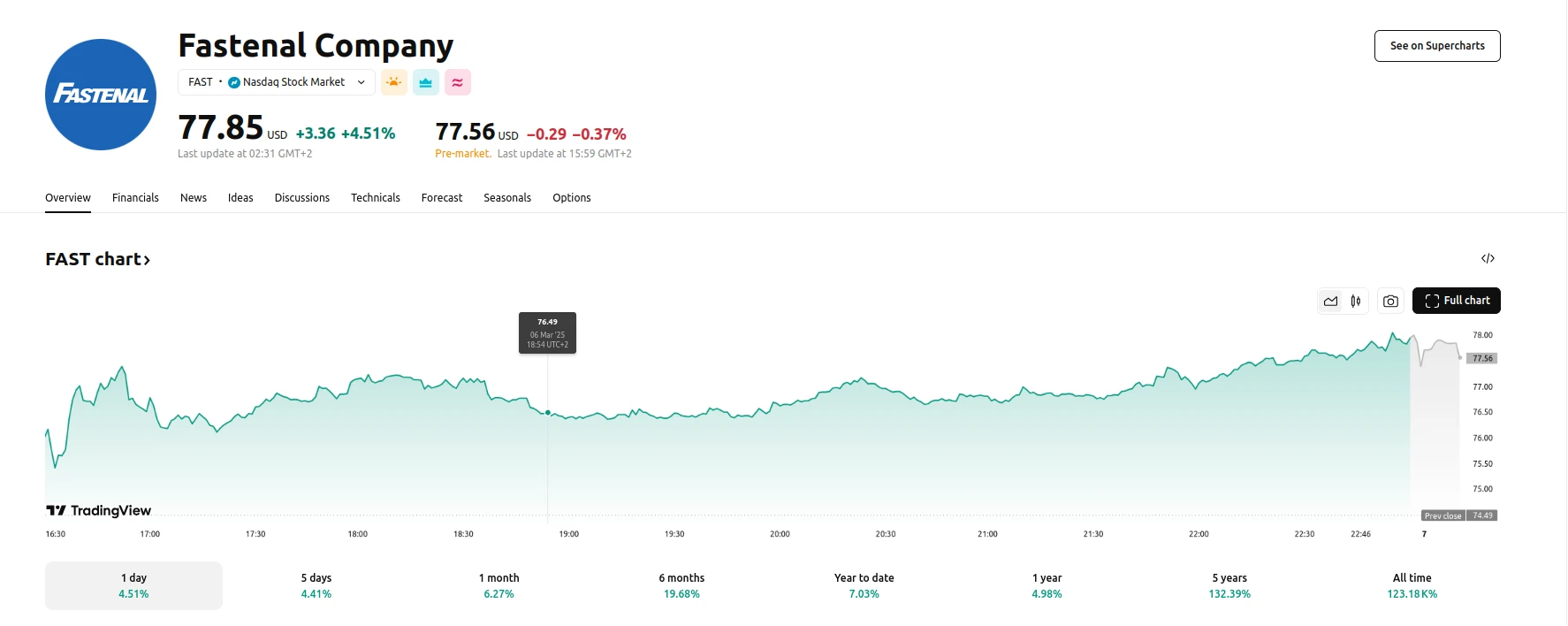

Fastenal Shares Jump 4.51% on Upcoming Investor Event and Strong Sales Growth

Fastenal Co. (FAST) saw its shares rise by 4.51% as the company announced plans for an investor presentation and reported robust sales growth, signaling positive momentum to market participants.

The company’s announcement of an investor presentation, scheduled for March 13, 2025, in St. Paul, Minnesota, has generated significant market interest. This event, accessible both in person and online, is set to provide a detailed overview of Fastenal’s current operations and strategic growth initiatives. Key executives, including CEO Dan Florness, President and Chief Sales Officer Jeff Watts, and Senior Executive VP and CFO Holden Lewis, will deliver presentations covering a range of topics. These include the company’s “Focus 40” and key account sales strategies, supply chain cost and risk reduction tools, and the utilization of data to strengthen market positioning.

Adding to the positive sentiment, Fastenal reported a 5% year-over-year increase in February’s organic daily sales, a significant uptick from the 1.9% rise seen in January. This growth has been attributed to strong performance within manufacturing end markets, indicating healthy demand for Fastenal’s products and services. The combination of strong sales figures and the upcoming investor presentation has contributed to the positive market reaction.

The investor presentation will offer participants an opportunity to gain deeper insights into Fastenal’s operational strategies and plans. The webcast, available through the company’s investor relations website, will ensure accessibility for a broad audience. An online archive of the webcast will be available for viewing until April 12, 2025, providing investors with continued access to the information presented.