Key moments

- Earnings Beat Expectations: Myers Industries reports adjusted earnings significantly above analyst estimates.

- Revenue Growth Driven by Material Handling Segment: Acquisition and strong performance in the Material Handling sector boost overall revenue.

- Strategic Cost-Saving and Share Repurchase Programs: Company announces initiatives to enhance efficiency and shareholder value.

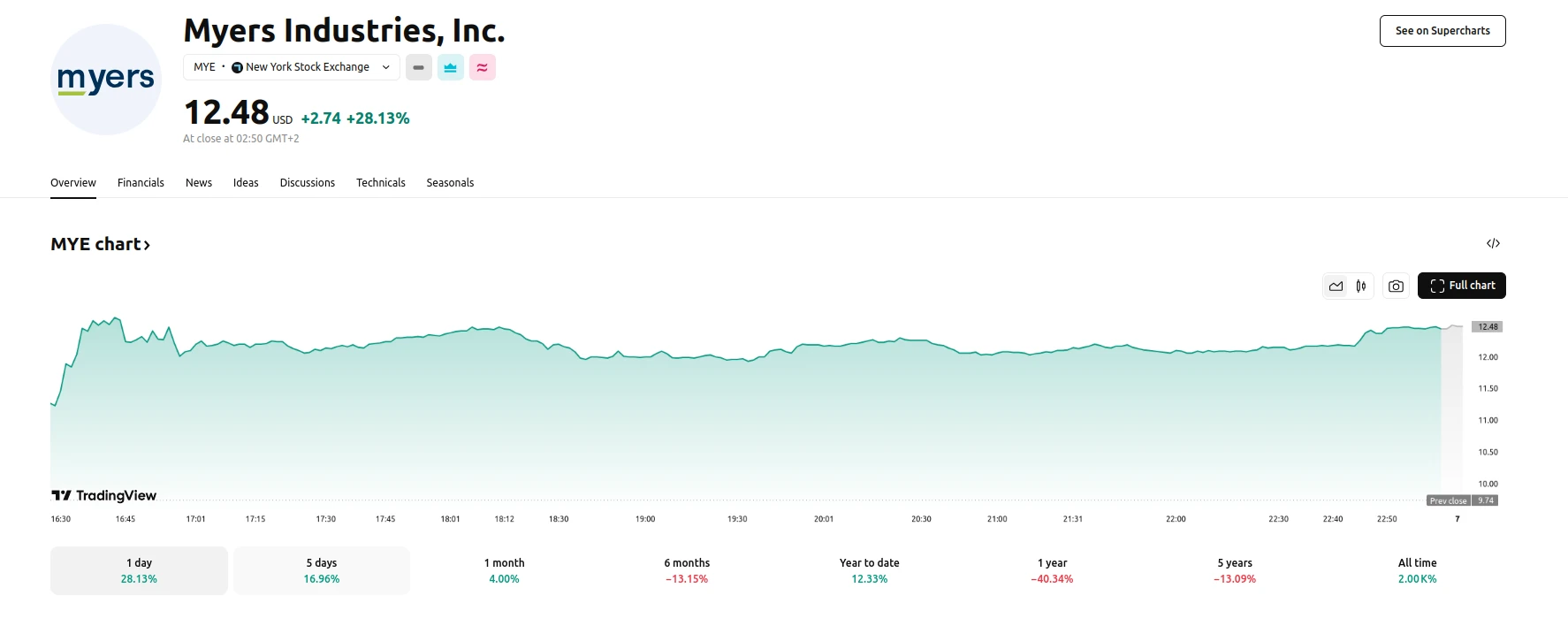

Myers Industries Stock Surges on Strong Q4 Performance and Strategic Initiatives

Myers Industries Inc. (NYSE: MYE), a manufacturer of polymer products, witnessed a 3.08% surge in its share price during premarket trading following the release of its fourth-quarter financial results on Thursday, which exceeded analyst expectations. The company’s performance was bolstered by robust growth in its Material Handling segment and the announcement of strategic initiatives aimed at improving profitability and shareholder returns.

The company reported adjusted earnings of $0.19 per share, significantly exceeding the consensus estimate of $0.10 per share. This strong earnings performance was accompanied by a 6.7% year-over-year increase in revenue, reaching $203.9 million, which also exceeded analyst forecasts. The Material Handling segment played a pivotal role in this revenue growth, experiencing a 20.3% increase to $152.7 million, primarily driven by the recent acquisition of Signature Systems. Conversely, the Distribution segment faced challenges, with sales declining by 20.2% to $51.2 million due to lower volumes and pricing.

In addition to the strong financial results, Myers Industries announced a “Focused Transformation” program designed to achieve $20 million in annualized cost savings by the end of 2025. The program will primarily focus on reducing selling, general, and administrative (SG&A) expenses. Furthermore, the company’s confidence in its financial position was demonstrated by the announcement of a new $10 million share repurchase program. In a shift from previous practices, Myers Industries has suspended the issuance of formal annual guidance as it conducts a comprehensive business assessment. The company also reported a gross margin improvement of 230 basis points year over year, reaching 32.3%, a result of a favorable product mix and the contributions of Signature Systems.