Key moments

- DNO has finalized the purchase of 100% of Sval Energi from HitecVision, with a $450 million cash transaction for the company’s shares.

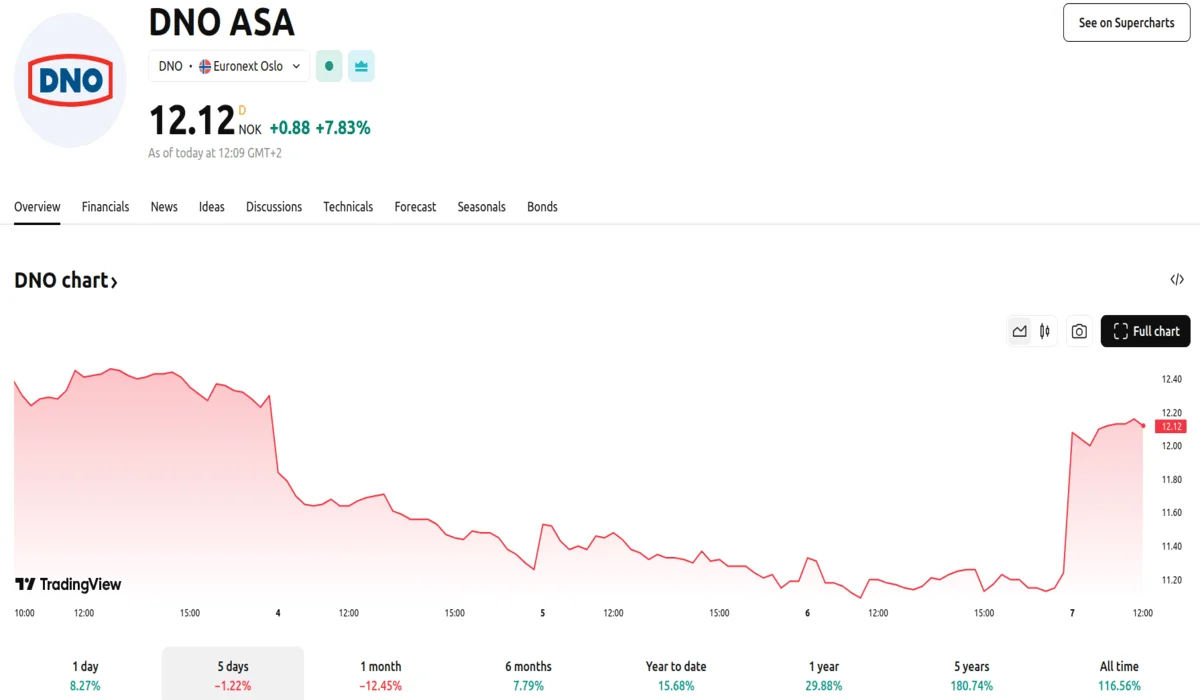

- The Oslo-listed DNO experienced a 7.8% increase in its share value by 9:14 GMT, significantly exceeding the broader European oil and gas index’s 0.1% decline.

- This acquisition is set to quadruple DNO’s North Sea production, elevating it to approximately 80,000 barrels of oil equivalent per day.

Deal to Quadruple DNO’s North Sea Output to 80,000 BOEPD

DNO, a Norwegian oil and gas company, has strategically acquired Sval Energi from the private equity firm HitecVision, marking a significant consolidation within the North Sea oil and gas sector. The transaction, valued at $1.6 billion, includes a $450 million cash payment for all of Sval Energi’s shares, alongside the assumption of its existing debt. The acquisition signifies DNO’s renewed focus on its North Sea operations, marking a return to its roots after decades of activity in the Middle East.

The company’s shares saw a substantial rise as a result as they climbed 7.8% in early trading, demonstrating strong investor confidence in the acquisition. This increase notably outperformed the wider European oil and gas index, which experienced a slight decline of 0.1%. The deal is projected to significantly enhance DNO’s production capabilities. Specifically, North Sea production will increase to roughly 80,000 barrels of oil equivalent per day (boepd). DNO’s total output is projected to reach approximately 140,000 boepd based on 2024 projections.

DNO’s existing production primarily originates from two operated fields in the Kurdistan region of Iraq. The company has faced challenges in this region due to a legal dispute related to the shutdown of an export pipeline to Turkey in 2022, forcing them to sell oil at discounted prices. Discussions between the Iraqi federal government, the Kurdistan Regional Government (KRG), and international oil companies are ongoing to potentially resume pipeline exports.

Sval Energi’s portfolio includes stakes in 16 producing fields offshore Norway, notably the ConocoPhillips-operated Ekofisk and the Equinor-operated Martin Linge. Sval’s net total production for 2024 was estimated at 64,100 boepd last year, with an even split between liquids and gas. The acquisition of these assets is expected to complement DNO’s existing North Sea portfolio, providing increased scale and diversification.

While the acquisition promises to boost DNO’s cash flow, it is also expected to increase the company’s leverage. The company’s exposure to the Kurdish region adds an element of uncertainty. Analysts have suggested that a spin-off could be a potential strategy to mitigate this risk.