Key moments

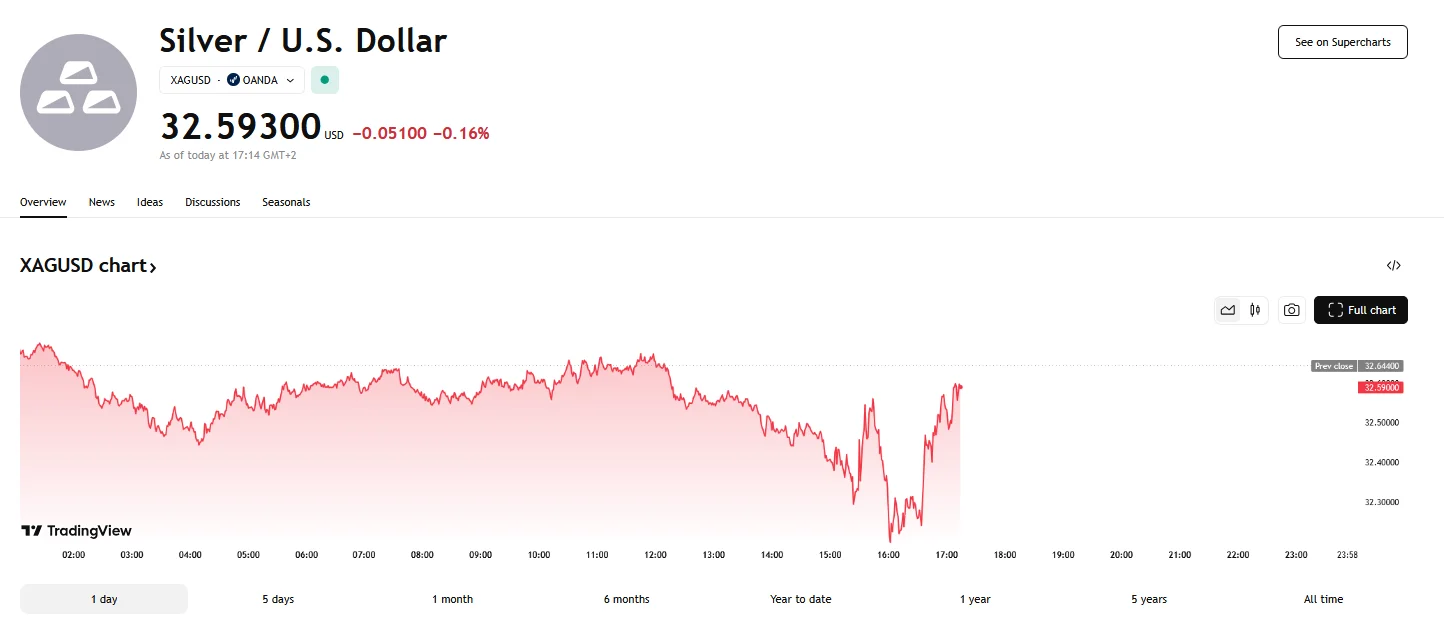

- After an earlier dip to $32.20, XAG/USD recovered, exceeding $32.50.

- The upcoming US Nonfarm Payrolls report is driving market volatility, with traders carefully positioning themselves ahead of the release and its potential impact on Fed policy.

- Silver’s recovery was aided by a declining US dollar, making the metal more attractive to investors holding other currencies.

Market Uncertainty Reigned on Friday, With Silver Prices Experiencing a Plunge Before Climbing Past $32.50

Following a drop to $32.20, XAG/USD rallied past the $32.50 mark during a Friday marked by fluctuating market dynamics. This recovery unfolded against the backdrop of heightened anticipation for the United States’ February Nonfarm Payrolls (NFP) data, a critical economic indicator influencing investor sentiment and Federal Reserve policy expectations.

Silver faced downward pressure, testing lower support levels. The initial drop to $32.20 reflected a period of market uncertainty, with traders cautiously positioning themselves ahead of the NFP release. This data, widely regarded as a barometer of the US labor market’s health, held the potential to significantly sway the Federal Reserve’s monetary policy decisions.

A robust NFP report, signaling a strong labor market, would likely reinforce the Fed’s stance on maintaining current interest rates, potentially dampening the appeal of precious metals like silver. Conversely, a weaker-than-anticipated report could fuel speculation of future rate cuts, bolstering silver’s attractiveness as a hedge against economic uncertainty.

The projected figures for the February NFP indicated an expected addition of 160,000 jobs, surpassing the 143,000 recorded in January. The unemployment rate was anticipated to remain steady at 4%, while average hourly earnings were projected to show a consistent year-on-year growth rate. These figures were closely monitored by market participants, as they provided insights into the overall strength of the US economy.

Despite the initial pullback, silver demonstrated a capacity to recover, at some point surging past the $32.60 mark. This rebound was supported by a confluence of factors, including a weakening US dollar and growing expectations of future Fed policy easing. The dollar’s decline, reflected in the Dollar Index’s (DXY) movement, provided a tailwind for silver, making it relatively cheaper for holders of other currencies.

The recovery also occurred amidst ongoing global trade uncertainties, which traditionally support safe-haven assets like silver. The market remained sensitive to geopolitical developments and economic uncertainties, which could further drive demand for precious metals.