Key moments

- Walgreens’ market capitalization has plummeted to $9.3 billion, a 90% decrease since 2015.

- The companies have agreed to an acquisition price of $11.45 per share.

- The final sale price, while roughly $10 billion, is a stark contrast to the company’s valuation of $100 billion a decade prior.

$10 Billion Deal Concludes Decades of Public Trading

Walgreens Boots Alliance is set to transition to private ownership under a $10 billion acquisition deal by Sycamore Partners, concluding years of efforts to restructure the struggling pharmacy giant. This move follows prolonged attempts to sell assets or the entire company, spanning at least six years back. In 2019, preliminary talks with KKR yielded a $70 billion offer, as reported by Morgan Stanley, but did not materialize.

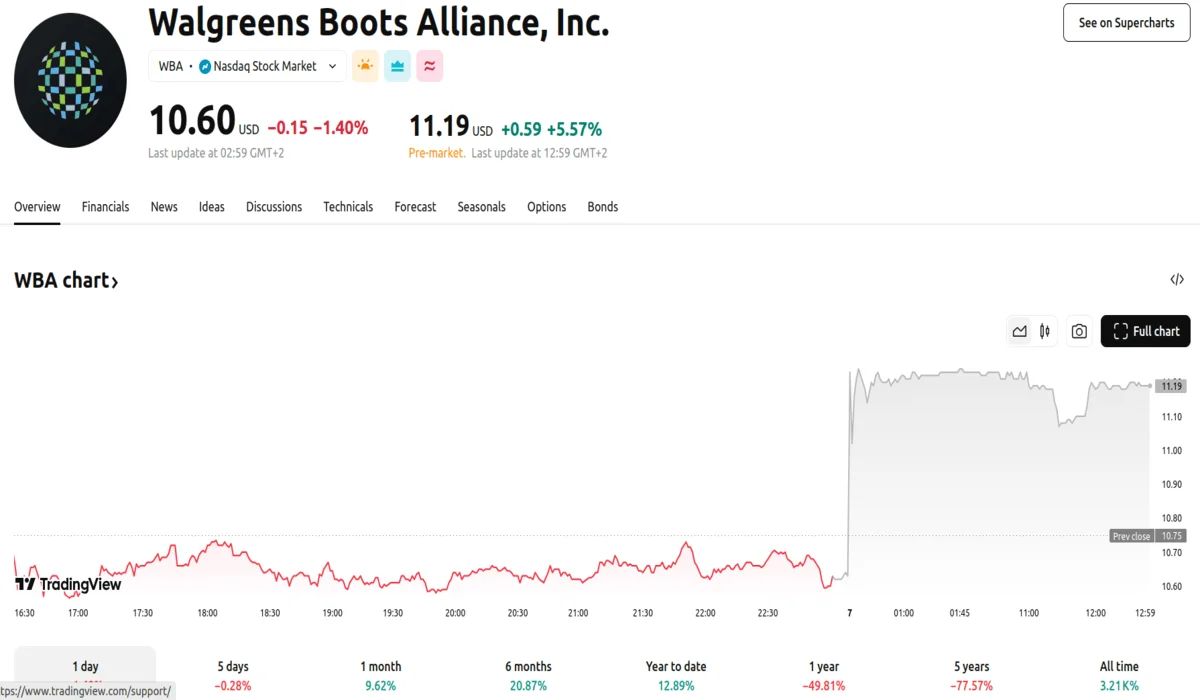

The company’s market capitalization has plummeted by 90% since 2015, reaching $9.3 billion on Thursday. Sycamore Partners will acquire the company for $11.45 per share. Notably, Walgreens shares rose nearly 6% to $10.60 in extended trading and 5.57% in pre-market trading, reaching prices of $11.19. The $10 billion deal contrasts sharply with the company’s $100 billion valuation a decade ago.

The company’s financial health has deteriorated, marked by declining cash flow and a $7 billion debt load, with over half due next year. Cost-cutting measures, including a $1 billion savings initiative and store closures, are underway. Walgreens’ global presence has shrunk to 12,000 stores in eight countries, employing 312,000 people, down from 21,000 stores in 25 countries with 450,000 employees four years ago.

Strategic missteps under former CEO Stefano Pessina, who departed in 2021, contributed to a halving of the company’s market capitalization, which fell below $50 billion. Investments like the $5.2 billion majority stake in VillageMD in 2021 after an initial stake in 2019, have become financial drains for the company. The 2014 acquisition of Alliance Boots, a Swiss-based pharmacy and beauty group, and the 2018 acquisition of nearly 2,000 Rite Aid stores, which led to subsequent closures, are also under scrutiny.

Walgreens’ failure to diversify, unlike competitor CVS’s acquisition of Aetna for nearly $70 billion in 2018, has further impacted its performance. The reported consideration of acquiring Humana was ultimately abandoned.

Sycamore’s acquisition deal includes a 35-day “go-shop” period. However, analysts, such as Michael Cherny of Leerink Partners, anticipate limited competing bids, given the deal’s complexity and potential asset divestitures, including the U.S. business, Boots, and Health divisions. The total transaction value, including payouts and debt, is approximately $23.7 billion, according to Leerink Partners investment bank. Walgreens has almost $30 billion in debt and lease obligations.