Key moments

- TD Cowen upgraded Tesla to “Buy” with a substantial price target increase, and Wedbush labeled it a “table pounder,” signaling strong confidence in the stock’s long-term potential.

- Despite positive analyst sentiment, Tesla’s stock experienced premarket declines, reflecting lingering investor concerns about competition, potential regulatory changes, and CEO Elon Musk’s public engagements.

- Analysts point to upcoming product launches, including a lower-priced EV and advancements in autonomous driving and robotics, as key drivers for Tesla’s future growth and stock performance.

Tesla Shares Face Minor Premarket Headwinds Despite Significant Analyst Upgrade and Strong Bullish Sentiment

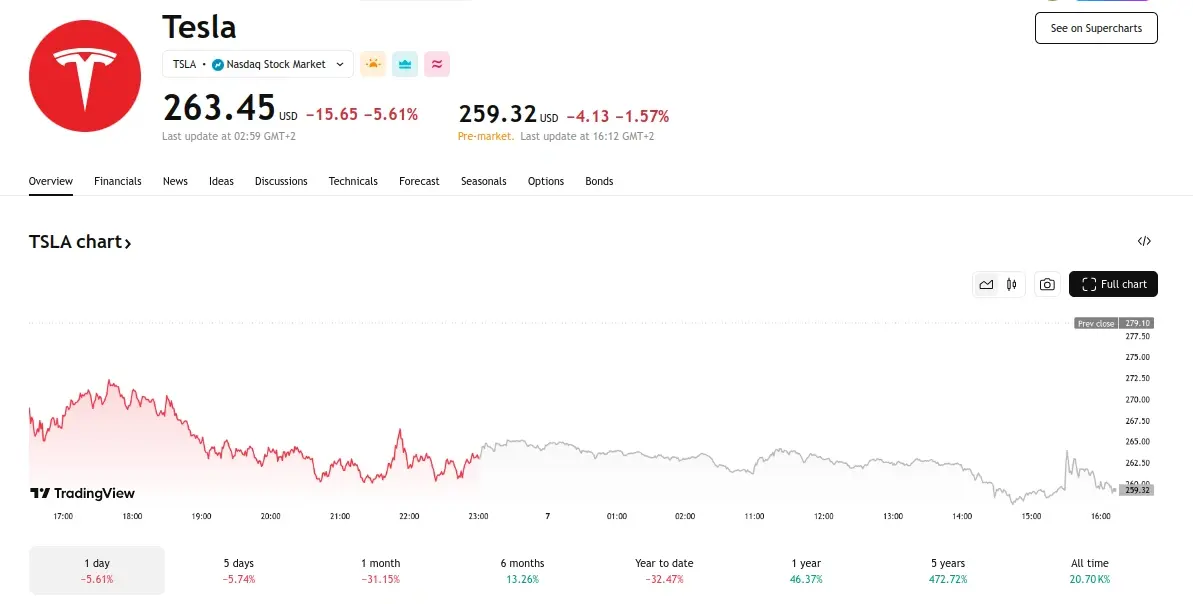

Tesla’s stock experienced a slight dip in premarket trading on Friday, despite receiving a notable analyst upgrade and a strong endorsement from a prominent market watcher. This comes at a time when the electric vehicle manufacturer’s shares have been struggling after a period of significant growth.

Specifically, Tesla’s shares were down 0.6% in premarket trading, trading at $261.82, while broader market indicators like the S&P 500 and Dow Jones Industrial Average futures showed gains. The recent volatility in Tesla’s stock reflects a period of investor uncertainty following a substantial decline from its peak.

The positive development for Tesla was an upgrade from TD Cowen analyst Itay Michaeli, who shifted his rating from Hold to Buy. Michaeli also significantly increased his price target for Tesla shares, moving it from $180 to $388. This dramatic adjustment, a $208 increase, is noteworthy. Michaeli’s prior price target at Citi, where he recently worked, was $258, indicating a substantial shift in his outlook.

Michaeli, who recently assumed coverage of Tesla at TD Cowen, highlighted the complex landscape facing the company, acknowledging both positive and negative factors. He believes that while Tesla faces immediate challenges, the potential for transformative developments in electric vehicles, autonomous driving, and robotics creates a favorable risk-reward scenario.

The challenges cited by Michaeli include potential changes to federal EV tax credits, import tariffs that could increase component costs, and intensifying competition within the EV market. Conversely, he pointed to several potential catalysts for growth, including the anticipated launch of a new, more affordable EV model, the development of a self-driving robotaxi service, and the planned expansion of Tesla’s humanoid robotics division.

Adding to the positive sentiment, Wedbush analyst Dan Ives included Tesla on his firm’s “best ideas” list, labeling it a “table pounder,” signifying a high level of confidence in the stock’s future performance. Ives emphasized that this is a critical juncture for Tesla investors, particularly after the recent sell-off. He believes that while concerns about CEO Elon Musk’s political activities and brand perception exist, they are likely overblown.

Ives estimates that the potential negative impact on Tesla’s global sales due to these concerns is less than 5%. He also expressed optimism that Musk will prioritize his time between his various ventures, including Tesla and SpaceX, in the coming year. Ives maintained his Buy rating and $550 price target for Tesla.

Following Michaeli’s upgrade, approximately 49% of analysts covering Tesla now rate the stock as a Buy, according to FactSet data. This is slightly below the average Buy rating for S&P 500 stocks, which is around 55%. The average analyst price target for Tesla is approximately $379 per share, suggesting that analysts, on average, see significant upside potential.