Key moments

- Futures Prices Rise on Monday, Following Strong Gains at Week’s End

- Record Net Short Positions Held by Speculators Despite Price Increases

- Export Data Shows Slight Decline Year-Over-Year, While Stocks Remain Stable

Cotton Futures See Gains Amid Fluctuating Market Dynamics

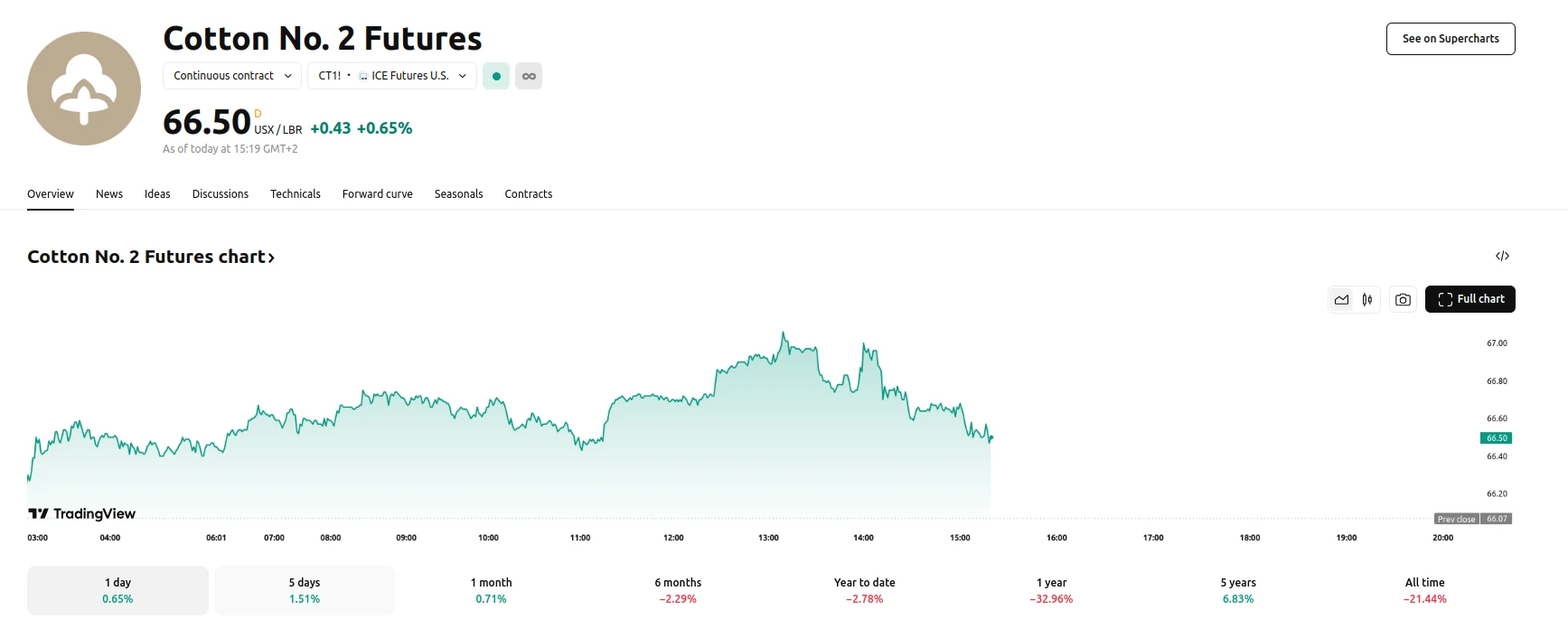

Cotton futures experienced gains on Monday morning, continuing the upward trend observed at the end of the previous week. The price increases, ranging from 55 to 65 points, followed Friday’s session where front-month contracts saw gains of 82 to 86 points. This positive movement in cotton prices was supported by favorable conditions in outside markets, including increases in crude oil futures and a weakening US dollar.

Despite the recent price increases, data from the Commodity Futures Trading Commission (CFTC) revealed a continued expansion of record net short positions held by speculators in cotton futures and options. As of March 4th, these positions increased by an additional 11,504 contracts, bringing the total net short to a record 79,957 contracts. This indicates a divergence between speculative market activity and actual price trends, suggesting that factors beyond immediate market sentiment are influencing price movements.

Regarding export data, the United States Department of Agriculture (USDA) Export Sales report indicated that total cotton export commitments reached 9.852 million running bales (RB), representing a 6% decline compared to the previous year. However, this figure represents 96% of the USDA export forecast and is 1% ahead of the average export sales pace, suggesting that export activity remains relatively consistent with projections. Additional market data showed that The Seam’s online auction resulted in the sale of 2,961 bales at an average price of 59.94 cents per pound, while the Cotlook A Index increased to 75.45 cents per pound. ICE cotton stocks saw a minor increase, reaching 14,488 bales. The USDA also adjusted the World Price (AWP) downwards by 201 points to 51.88 cents per pound. These varied data points reflect the dynamic and complex nature of the cotton market, where multiple factors contribute to price fluctuations.