Key moments

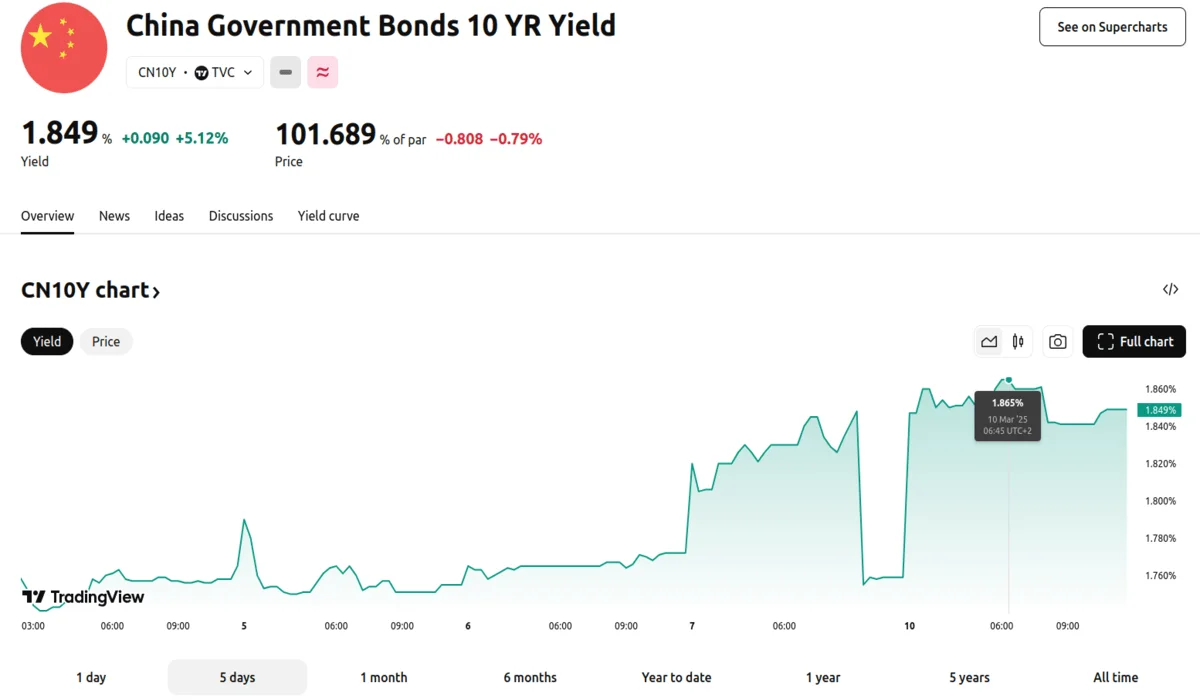

- China’s 10-year bond yield hit 1.865% on Monday, a 25 basis-point rise from January lows.

- The country’s fiscal deficit amounts to 4% of GDP, with CN¥1.3 trillion in bonds planned for 2025.

- MSCI China rose nearly 20%, while Hang Seng has increased over 18% year-to-date.

10-Year Bond Yields Rise 25 Basis Points From January’s Record Lows

Chinese government bond yields have experienced a notable increase, reaching their highest levels this year, as market participants adjust their expectations for future interest rate cuts. The yield on China’s 10-year government bond, which moves inversely to bond prices, climbed over 10 basis points on Monday, settling at 1.865%. This figure represents a rise of 25 basis points from the record lows observed in January. The surge in yields comes in the wake of a rally in the Chinese offshore stock market, indicating a shift in investor liquidity towards riskier assets.

Yields on 30-year sovereign bonds surpassed the 2% threshold, reaching 2.030% today. One-year note yields also increased by 10 basis points to 1.643%. The positive movement reflects growing optimism regarding China’s economic prospects, particularly following the government’s announcement of an ambitious growth target of around 5% in a recent high-level work report.

Beijing has also revealed a rare expansion of its fiscal budget deficit to 4% of GDP, the highest since at least 2010. Furthermore, the government also unveiled plans to issue CN¥1.3 trillion in ultra-long-term special treasury bonds in 2025, an increase of CN¥300 billion from the previous year. These fiscal measures, combined with the government’s pro-growth stance, have contributed to the upward pressure on bond yields. The increased supply of bonds, as a direct result of the governmental fiscal policy, has decreased the attractiveness of existing bonds, and therefore pushed down prices, supporting the rising yields.

Investors have moderated their expectations for near-term interest rate cuts, as the People’s Bank of China (PBOC) prioritizes currency stability amid ongoing trade tensions with the United States. PBOC Governor Pan Gongsheng reiterated the central bank’s intention to adjust interest rates and reserve requirements “at an appropriate time,” while emphasizing the importance of maintaining the yuan at a “reasonable and balanced level.” This stance is being carefully monitored, especially in the context of potential trade negotiations with the US.

The Chinese offshore yuan experienced a decline of approximately 0.24% on Monday, trading at 7.2588 against the US dollar. In contrast, the US 10-year Treasury yield has decreased by over 50 basis points since January to around 4.2839% on Monday. The emergence of artificial intelligence startup DeepSeek has also contributed to increased investor interest in Chinese equities.

The MSCI China index has surged by nearly 20% year-to-date, and the Hong Kong-listed Hang Seng Index has outperformed global peers, rising by over 18% during the same period. This shift towards equities, coupled with the rising bond yields, signifies a broader recalibration of investor portfolios.

While some analysts anticipate a potential slowdown in the bond sell-off due to the PBOC’s focus on growth, and the possibility of the monetary policy stance remaining tilted toward easing, the current market sentiment is bullish, with a clear shift towards riskier assets. The potential for further bond issuance, particularly of long-term bonds, coupled with the government’s efforts to stimulate the property market and consumption, suggests that long-end rates may continue to adjust.