Key moments

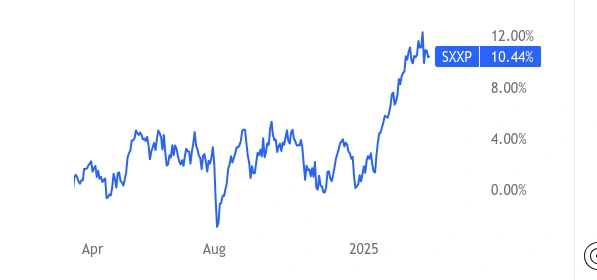

- The Stoxx Europe 600 is significantly outperforming the S&P 500 in the last quarter, driven by factors like increased defense spending and a perceived stabilization of the European political landscape.

- Changes in US foreign policy, particularly regarding security alliances and tariffs, are prompting investors to diversify and consider European markets as a more attractive investment option.

- There’s a noticeable shift in investor sentiment, with substantial capital flowing into European equity funds, signaling a move away from the “buy-US-growth-at-any-cost” mentality.

European Stocks Are Gaining Significant Traction, with Stoxx Europe 600 Notably Outpacing S&P 500

European equities are poised for a potentially positive opening Monday, as investors anticipate increased infrastructure and defense expenditures across the region, aimed at bolstering security and sustaining support for Ukraine.

The changing stance of the U.S. President, which has challenged the established reliability of the U.S. as a security ally, is prompting EU member states to intensify their self-defense efforts in an increasingly complex global landscape.

Trump’s revised approach to import tariffs is generating optimism regarding a potentially less severe tariff impact on European businesses than initially feared. Simultaneously, the resulting policy instability has triggered significant sell-offs in the S&P 500 Index and the U.S. dollar.

While the U.S. confronts heightened uncertainty concerning inflation and economic growth, Europe’s political landscape has seen a sudden stabilization. Germany is moving forward with substantial stimulus measures, the continent is demonstrating unity in defense spending, the potential for a ceasefire in Ukraine exists, and corporate earnings are projected to improve.

As investors divest from U.S. stocks, European equities are emerging as an attractive investment option. Recent data indicates the Stoxx Europe 600 Index is outperforming the U.S. S&P 500 by approximately 11% this quarter, marking its strongest relative performance since 2015.

“We believe European equities have further to go,” stated Amelie Derambure, senior multi-asset portfolio manager at Amundi SA.

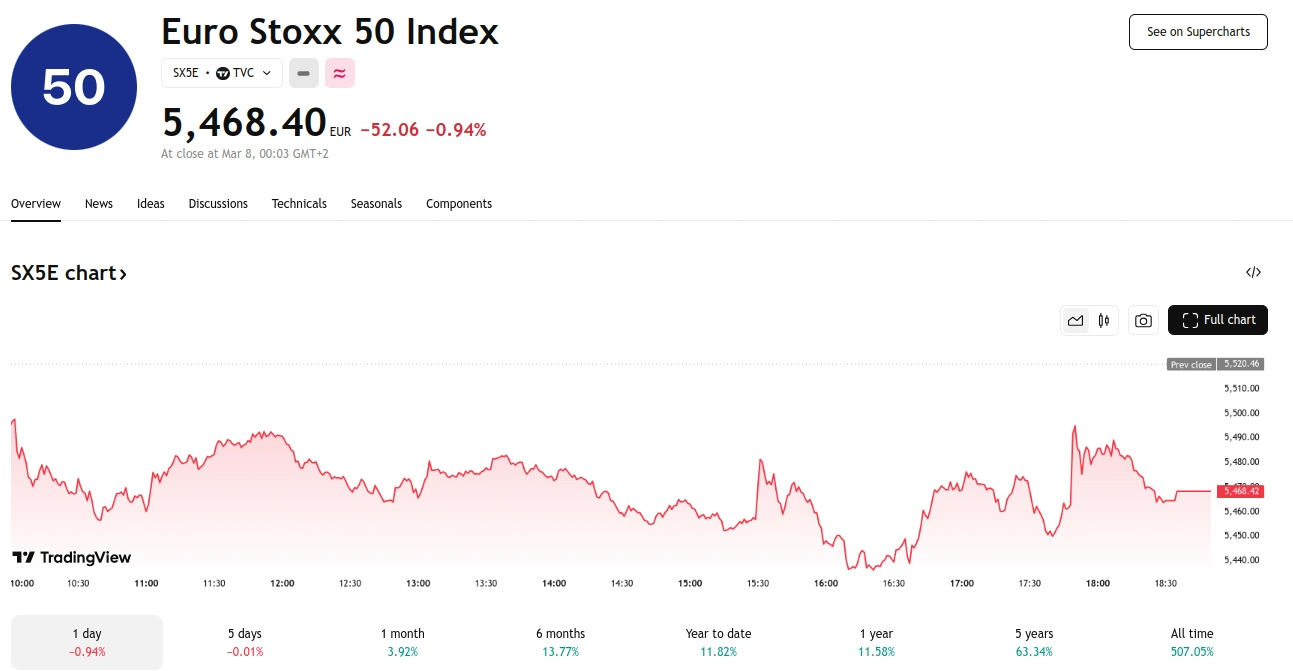

With investors moving away from the “buy-US-growth-at-any-cost” strategy, the U.S. weighting in the Bloomberg World Index has decreased to 63% from a peak of 65% in November. Concurrently, while the S&P 500 has declined by roughly 2% year-to-date, the Euro Stoxx 50 has surged by 12%, and China’s Hang Seng Index has rallied by 19%.

This geopolitical shift has prompted several Wall Street strategists, including Deutsche Bank AG’s Maximilian Uleer, to employ the phrase “Make Europe Great Again,” echoing Trump’s campaign slogan, to suggest a new era of superior performance for European assets.

EPFR Global data reveals that approximately $12 billion flowed into European equity funds in the four weeks leading up to March 5, representing a pace unseen in nearly a decade, according to a report from Bank of America Corp. In parallel, emerging markets experienced their largest weekly inflows in three months, amounting to $2.4 billion.