Key moments

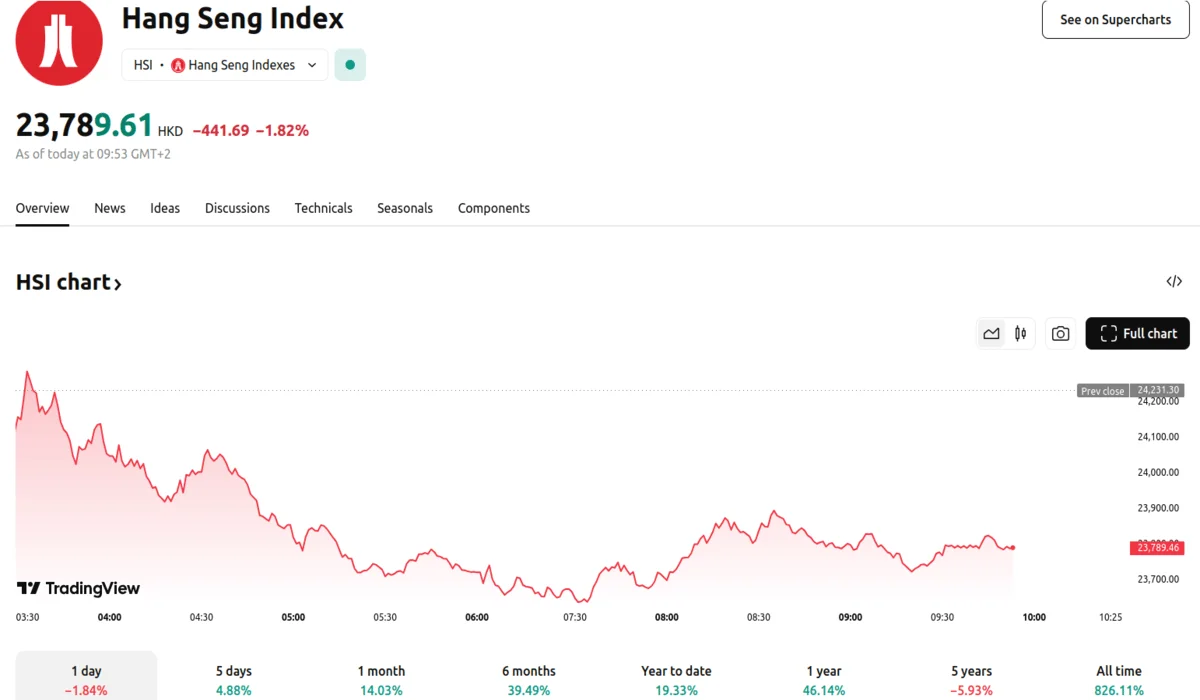

- The Hang Seng Index experienced a 1.6% drop, settling at 23,840.33 by mid-afternoon.

- The Hang Seng Tech Index saw a decrease of 2.98%, concluding the trading session at 5,857.46.

- China’s consumer price index (CPI) revealed a 0.7% reduction YoY in February.

China’s 0.7% Deflation Sparks Market Downturn

Hong Kong’s stock market witnessed a downturn, pushing the Hang Seng Index below the 24,000-point threshold and causing it to settle at 23,840.33 by 2:45 pm local time, as anxieties surrounding China’s economic health intensified. This shift occurred amidst newly released data indicating a decline in China’s consumer price index, signaling potential deflationary pressures.

The technology sector faced notable setbacks, with the Hang Seng Tech Index experiencing a substantial decrease of 2.98%, concluding trading at 5,857.46 points. The total market turnover reached HK$177.901 billion for the Tech Index. Concurrently, mainland Chinese markets also exhibited declines, with the CSI 300 and Shanghai Composite indices registering losses of 0.3% and 0.2%, respectively.

The data concerning the 0.7% drop in the CPI for February, down from 0.5% the previous month, reversed the previous January’s gains, marking the first negative reading in 13 months. Additionally, the Producer Price Index (PPI) demonstrated a continued downward trend, falling by 2.2% YoY, extending to 29 consecutive months of decreases since October 2022.

Market observers attribute the downturn to a combination of factors, including concerns about subdued domestic demand within China and unease surrounding global trade policies. Investor confidence has been further shaken by the potential for economic recession. Despite certain sectors like robotics and AI medical stocks showing resilience, the broader market sentiment remains cautious. The need for further economic stimulus from Beijing has been emphasized by financial analysts.

Within the market, a contrasting trend in performance emerged, with robotics and AI medical concept stocks demonstrating relative strength against the prevailing trend. Conversely, technology and chip-related stocks experienced notable weakness. Specifically, JLMAG (06680.HK) recorded an increase of 7.84%, while Alibaba Health (00241.HK) saw a gain of 1.45%.

On the other hand, Alibaba (09988.HK) experienced a decline of 4%, and Semiconductor Manufacturing International (SMIC) (00981.HK) fell by 5.59%. These individual stock movements reflect the broader market dynamics, where specific sectors and companies diverged from the overall downward trend. The significant decrease in the Hang Seng index, and the tech index, paired with the Chinese CPI data, created a climate of investor uncertainty.