Key moments

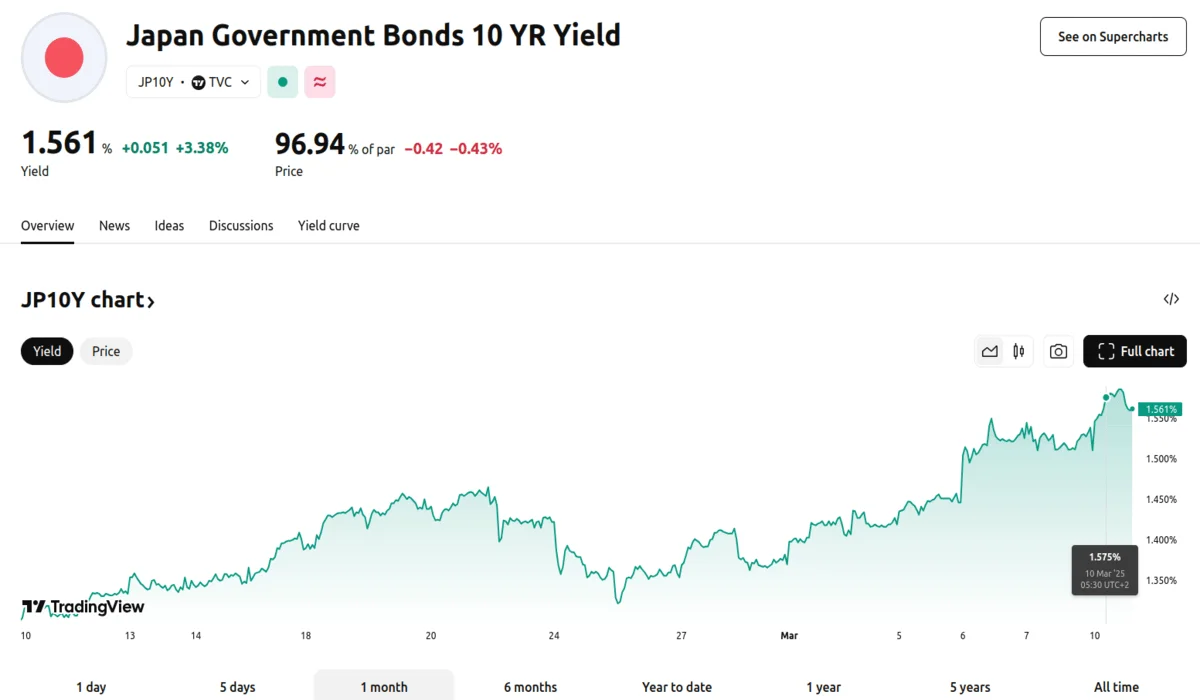

- The 10-year Japanese Government Bond (JGB) yield reached 1.575%, a level unseen since October 2008.

- The 5-year JGB yield increased by 4 basis points, settling at 1.16%.

- JPMorgan Chase & Co. has adjusted its year-end forecast for the 10-year JGB yield from 1.55% to 1.70%.

JGB Yields React Positively to Wage Data and Auction Results

The Japanese government bond market experienced a significant surge as the benchmark 10-year JGB yield escalated to 1.575% this Monday, marking a more than 16-year high. The movement occurred against a backdrop of increasing expectations for further interest rate adjustments by the Bank of Japan. The 5-year JGB yield also saw an uptick, rising by 4 basis points to 1.16%. Benchmark 10-year JGB futures experienced a decline, however, falling by 0.38 points to ¥138.24.

A recent auction of 5-year bonds revealed subdued demand, with the bid-to-cover ratio dropping to 3.17, the lowest figure since June 2022, down from 3.52 in February. This indicates a decrease in investor appetite, potentially due to anticipations of rising interest rates. Market observers are keenly awaiting the outcomes of spring wage negotiations due by Friday, which are expected to provide further insights into the Bank of Japan’s potential monetary policy actions, particularly after data showed the fastest gain in base pay in over three decades.

JPMorgan Chase & Co. has revised its year-end forecast for the 10-year JGB yield upwards, from 1.55% to 1.70%. Some market participants are even anticipating a climb to 2%. The 2-year JGB yield also saw an increase, climbing 2 basis points to 0.865%, a multi-year peak. The 20-year JGB yield rose by 2.5 basis points to 2.27%, and the 30-year JGB yield reached 2.555%.

Overnight index swaps indicate a high probability of a rate hike by the BOJ by July, with certainty by September. While some analysts believe the BOJ will hold rates steady in May, the market is pricing in a strong possibility that the next BOJ meeting will not be “smooth-sailing”. The contrast between rising JGB yields and lower US Treasury yields highlights the unique position of Japan’s monetary policy. Global uncertainties, including trade tensions and US economic outlook concerns, add further complexity to the current market environment.