Key moments

- Japanese chip-related stocks, led by Advantest, rebounded significantly, mirroring gains in U.S. technology shares.

- Global trade tensions, particularly concerns over fluctuating tariff policies, created significant market turbulence, limiting the Nikkei’s gains despite positive sector performance.

- The Nikkei experienced sharp intraday swings, initially hitting a multi-week low before recovering, with Lasertec and SMC Corp leading the percentage gains.

Nikkei Staged Volatile Recovery Monday, Driven by Semiconductor Gains, but Ongoing Tariff Uncertainties Capped Index’s Upward Potential

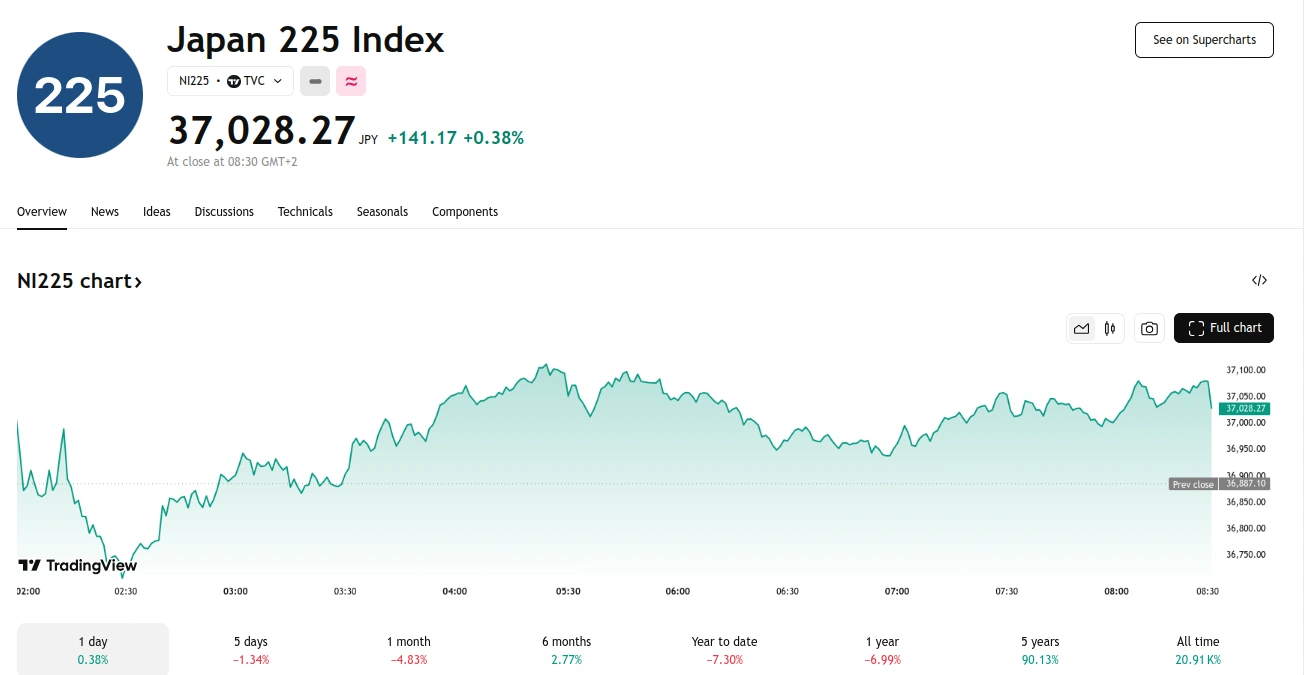

Japan’s Nikkei index recovered in a volatile trading session on Monday, driven by gains in semiconductor stocks mirroring their U.S. counterparts and bargain hunting following last week’s sharp declines. However, the index’s upward momentum was tempered by fluctuating global tariff policies.

The Nikkei initially dropped to an intraday low of 36,705.02, a level not seen since September 18, before rebounding to close the midday session up 0.6% at 37,095.85. The broader Topix index also saw gains, rising 0.2% to 2,714.54.

This rebound followed the Nikkei’s third consecutive week of losses, including a 2% drop on Friday. Leading the charge among individual stocks was chip-testing equipment manufacturer Advantest, which surged 2.7%, benefiting from the positive performance of U.S. technology shares.

The Philadelphia SE Semiconductor Index saw a significant 3.2% increase on Friday, contributing to the broader Wall Street rally. This rebound came after Federal Reserve Chair Jerome Powell’s comments that the U.S. economy was “in a good place,” which helped alleviate earlier market concerns.

Despite these positive signals, global uncertainty persisted. A recent television interview added to investor concerns about potential economic downturns amid ongoing discussions about tariffs on goods from Mexico, Canada and China.

During Asian trading hours, U.S. stock futures experienced declines, which may have contributed to a tempering of the Nikkei’s gains. Market strategists noted that apprehensions surrounding ongoing tariff policies and related retaliatory actions were creating market volatility.

Lasertec, a company specializing in inspection equipment for chip manufacturing, witnessed a 6.5% surge, emerging as the top percentage gainer on the Nikkei. Industrial automation systems provider SMC Corp also saw a significant rise, gaining nearly 6%.

Other notable gains included AI startup investor SoftBank Group, up 2.1%, chip equipment manufacturer Tokyo Electron, which rose 1.8%, and Disco Corp, another chip testing equipment maker, which rallied 4.9%.