Key moments

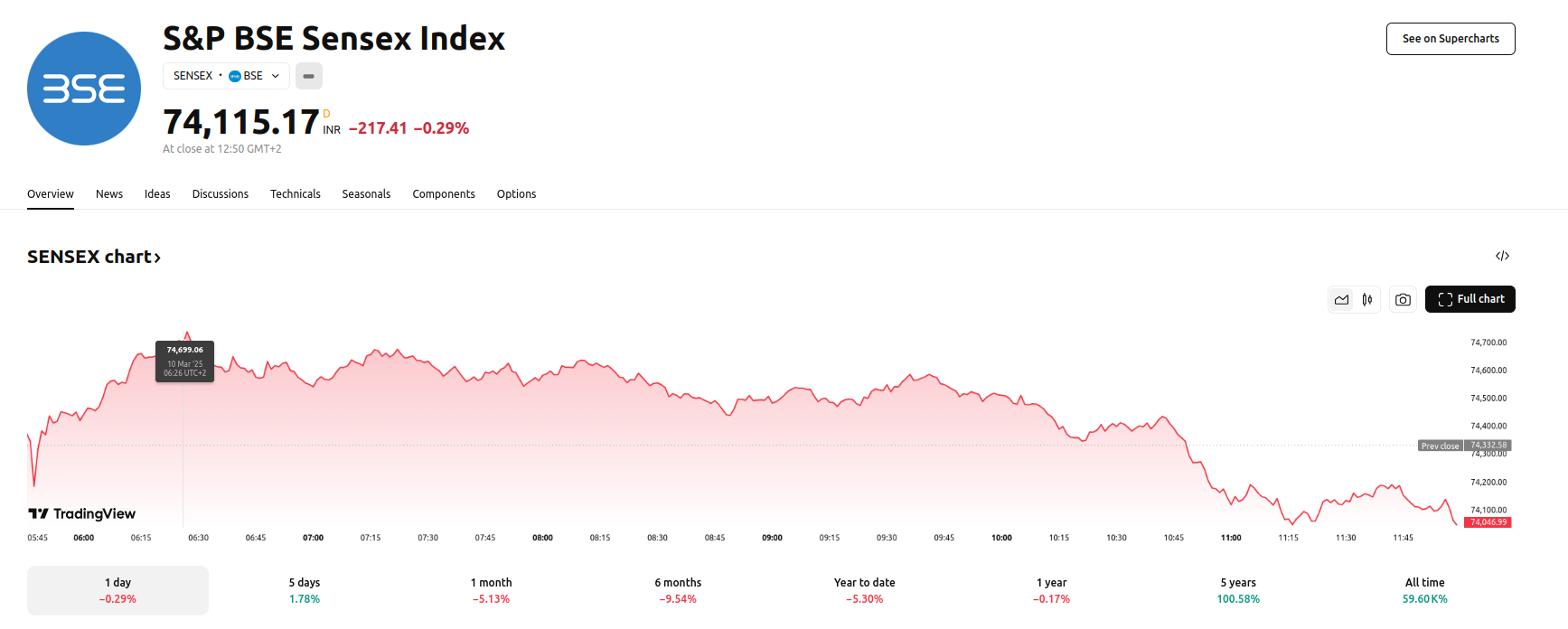

- Sensex opens higher and experiences a rapid climb, surpassing 74,700 points, driven by positive global market signals.

- Financial, metal, and FMCG sectors lead market gains, reflecting broad-based investor confidence.

- Easing of foreign institutional investor (FII) selling and positive statements from US Federal Reserve officials contribute to improved market sentiment.

Index Climbs Over 350 Points, Reaching 74,713.17 High, Driven by Financial, Metal, and FMCG Stocks

The Indian stock market began the week with a notable surge, as the S&P BSE Sensex experienced a rapid climb, surpassing the 74,700-point mark and reaching a daily high of 74,713.17. This upward momentum, with the index gaining over 350 points, followed a strong performance in the previous week and was largely attributed to positive global cues and robust domestic sector performance. The market’s positive start reflected a renewed sense of optimism among investors, driven by encouraging economic data and statements from key financial figures.

A significant factor contributing to the market’s positive performance was the release of steady US jobs data, which alleviated concerns about a potential economic slowdown. Additionally, statements from US Federal Reserve Chair Jerome Powell, indicating the stability of the US economy, further bolstered global market sentiment. These positive signals from the US helped to create a favorable environment for equity markets, including the Indian stock market. Domestically, the rally was led by strong performances in the financial, metal, and FMCG sectors. Financial stocks, in particular, demonstrated significant gains, with major financial services companies posting strong results.

Furthermore, there were signs of easing in the aggressive selling by foreign institutional investors (FIIs), which had been a concern in recent months. This slight reduction in FII selling contributed to improved market stability. Analysts have suggested that investors should focus on domestic consumption themes, which are less likely to be impacted by potential trade tariffs, and consider calibrated systematic buying in fairly valued large-cap stocks. However, the market remains sensitive to potential shifts in US trade policies, with concerns about future tariffs potentially affecting investor sentiment.