Key moments

- UBS analysts significantly lowered Tesla’s price target to $225 from $259.

- UBS revised Tesla’s Q1 2025 delivery forecast downwards, projecting a year-over-year and quarter-over-quarter decline.

- Zacks Research also adjusted Tesla’s EPS estimates downward for Q1 2025, reflecting broader analyst concerns about the company’s near-term financial performance.

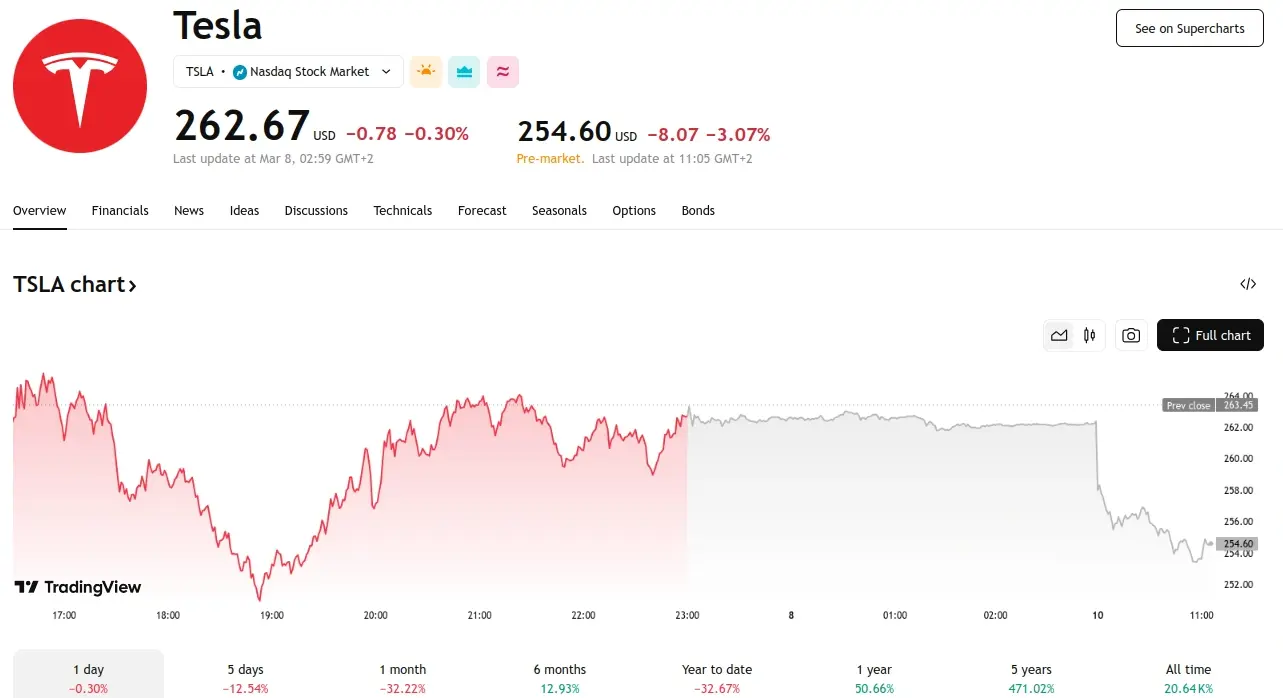

Tesla Stock Declines 3% Premarket, Following Stock’s Downgrade by Several Analysts

UBS analysts have revised their financial projections for Tesla (NASDAQ:TSLA), lowering the stock’s price target to $225.00 from $259.00 while reiterating a Sell rating. According to InvestingPro data, Tesla’s current price-to-earnings (P/E) ratio stands at 117.18x, with analysis indicating that the stock’s valuation is aligned with its present market price.

The stock has experienced a significant downturn, declining by nearly 35% year-to-date, with InvestingPro highlighting 18 additional key insights into Tesla’s valuation and performance. This adjustment follows UBS’s reduction of its first-quarter 2025 delivery forecast to 367,000 vehicles, down from the previously estimated 437,000, which was initially placed after the company’s fourth-quarter 2024 results.

Analysts anticipate a slower delivery pace currently, but foresee a potential uptick towards the end of the quarter, possibly spurred by increased promotional activities. The revised delivery forecast represents a 5% year-over-year decrease and a 26% quarter-over-quarter drop, placing UBS’s projection 13% below the current Visible Alpha consensus. Tesla’s revenue for the trailing twelve months reached $97.69 billion, demonstrating a modest growth rate of 0.95%, based on InvestingPro data.

UBS analysts cite data from their Evidence Lab, which reveals reduced delivery times for Tesla’s Model 3 and Model Y in key markets, suggesting a softening demand. This observation has led to a downward revision of Tesla’s first-quarter auto gross margin excluding credits to 10.3%, a notable decline from 13.6% in the fourth quarter of 2024 and 16.4% in the first quarter of 2024. Recent InvestingPro data shows Tesla’s gross profit margin at 17.86%, with the company demonstrating strong financial health, as evidenced by its current ratio of 2.02 and a robust cash position that exceeds its debt. This revised margin is significantly below the consensus estimate of approximately 13.5%, which UBS considers overly optimistic, particularly in light of the reduced delivery outlook.

Tesla’s stock has also been subject to recent analysis by investment analysts at Zacks Research, who have lowered their Q1 2025 EPS estimates for Tesla shares in a research report issued on Monday, March 3rd. Zacks Research analyst R. Singhi now projects that the electric vehicle manufacturer will report earnings of $0.57 per share for the quarter, down from their previous forecast of $0.59. The consensus estimate for Tesla’s current full-year earnings is $2.56 per share. Zacks Research also provided estimates for Tesla’s Q2 2025 earnings at $0.70 EPS, FY2025 earnings at $2.85 EPS, Q1 2026 earnings at $0.83 EPS, Q2 2026 earnings at $0.98 EPS, and FY2026 earnings at $3.99 EPS.