Key moments

- Escalating trade disputes contribute to market uncertainty, particularly with the U.S. and Canada.

- Chinese economic data, revealing a decline in consumer price index and previously released disappointing trade figures, raises concerns about economic stability.

- Despite a weakening U.S. dollar, the yuan experiences downward pressure, highlighting specific vulnerabilities within the Chinese economy.

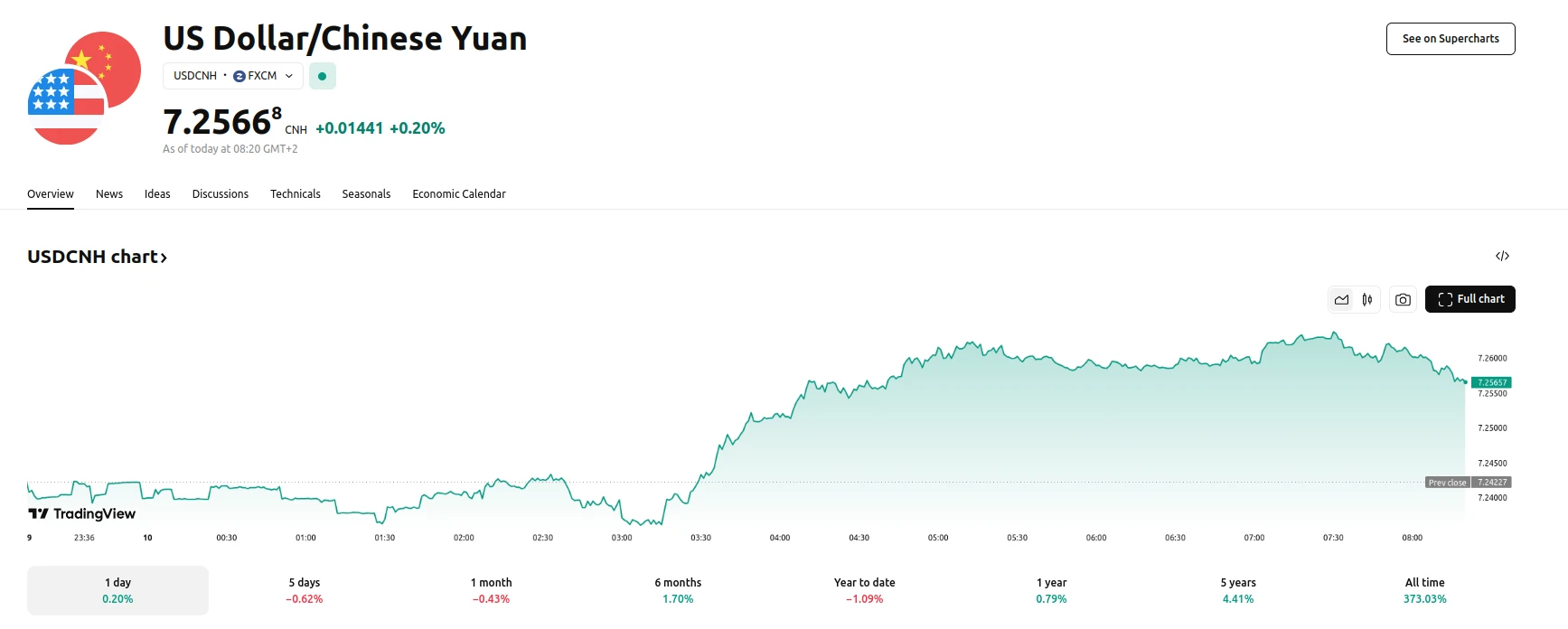

Trade Tensions and Economic Data Weigh on Currency: USDCNH Dips 0.62% in Five Days

The offshore yuan experienced a notable decline of 0.62% over five trading days, amidst a confluence of factors that have unsettled financial markets. The primary driver of this downward trend is the escalating global trade tension, notably the ongoing disputes with the United States, and the recent imposition of tariffs on Canadian agricultural products. This atmosphere of uncertainty has created a climate where investor confidence is fragile, and market volatility is amplified.

Adding to the yuan’s vulnerability are the emerging signs of economic strain within China. Recent data releases have indicated a weakening consumer price index, which fell to a 13-month low, and previous trade data that has shown signs of a slowdown. These indicators have fueled concerns about the health of the Chinese economy, further contributing to the depreciation of the yuan. Despite the general weakening of the U.S. dollar, which would typically provide some relief to other currencies, the yuan has continued to experience downward pressure. This divergence suggests that the specific challenges facing the Chinese economy are outweighing the broader trends in the global currency markets.

Analysts are closely monitoring the People’s Bank of China’s (PBOC) policy responses. While some suggest that the PBOC may be less inclined to utilize currency devaluation as a primary tool at this juncture, the central bank’s actions, such as maintaining a relatively stable yuan guidance rate, indicate a strategic approach. The PBOC appears to be preserving its policy options, potentially anticipating further shifts in the global economic landscape. The market is also watching for further tariff news, especially with the US trade probe conclusion date of April 1st looming. Furthermore, analysts have noted that if the US economy does begin to show signs of a recession, due to the tariff impact, then the USD may weaken, and thus limit further Yuan weakness.