Key moments

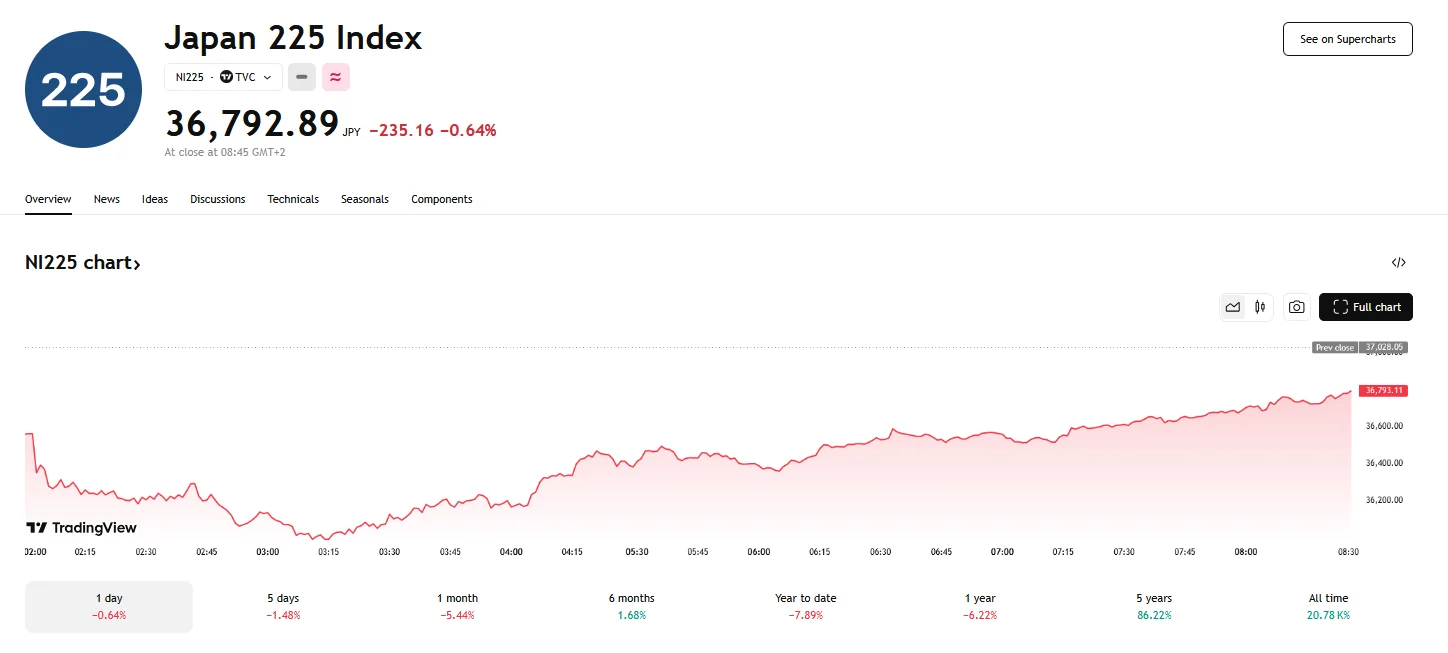

- Tuesday saw Asian markets gripped by apprehension, resulting in a widespread index decline. Japan’s Nikkei 225 suffered a notable drop, plunging below 37,000 and briefly breaching 36,000.

- Other regional indices also declined: South Korea’s Kospi fell 1.19%, Hong Kong’s Hang Seng dropped by 0.75%, Mainland China’s CSI 300 experienced a 0.66% drop, and Taiwan’s Taiex fell approximately 1.61%.

- U.S. recession fears and tariff policy concerns, amplified by President Trump’s recent comments, drove the market downturn.

U.S. Economic Uncertainty Sends Asian Indices Reeling

A wave of apprehension swept through Asian financial markets on Tuesday, triggering a significant downturn in major indices, with Japan’s Nikkei 225 bearing the brunt of the sell-off. The Nikkei index experienced a sharp decline past 37,000, briefly dipping below the 36,000 threshold, a level unseen since September. This dramatic drop neared a 3% loss in early trading before managing a partial recovery, stabilizing above 36,700 but failing to reach 37,000. The Tokyo Stock Price Index (Topix) also felt the impact of Tuesday’s volatility and registered a notable fall, barely hovering above the 36,000 mark.

Contributing to the market jitters was the revised GDP data for Japan’s fourth quarter, which indicated an annual growth rate of 2.2%. The outcome was less than the anticipated figures, falling below the initial 2.8% estimates.

The negative sentiment was not confined to Japan. South Korea’s Kospi index fell 1.19%, while Hong Kong’s Hang Seng Index experienced a 0.75% drop. Mainland China’s CSI 300 registered losses as well (0.66%). Another index to register losses was the Taiwan Stock Exchange (Taiex), dropping roughly 1.61%.

The primary drivers behind this market downturn were escalating fears of a potential U.S. recession and concerns over the impact of U.S. tariff policies. President Trump’s recent comments, in which he did not dismiss the possibility of a recession, amplified investor anxieties. Furthermore, Trump’s tariffs, particularly those targeting steel and automobiles, added to the uncertainty, casting a shadow over future trade relations.

The market’s reaction was swift and decisive. The losses were widespread, affecting various sectors and industries. Technology shares, in particular, faced significant pressure, with major players experiencing substantial declines. U.S. Treasury yields also declined as investors sought the relative safety of government bonds. Despite some pockets of resilience, such as the surge in Xpeng’s shares following announcements about its flying car ambitions, the overall market sentiment remained decidedly negative.