Key moments

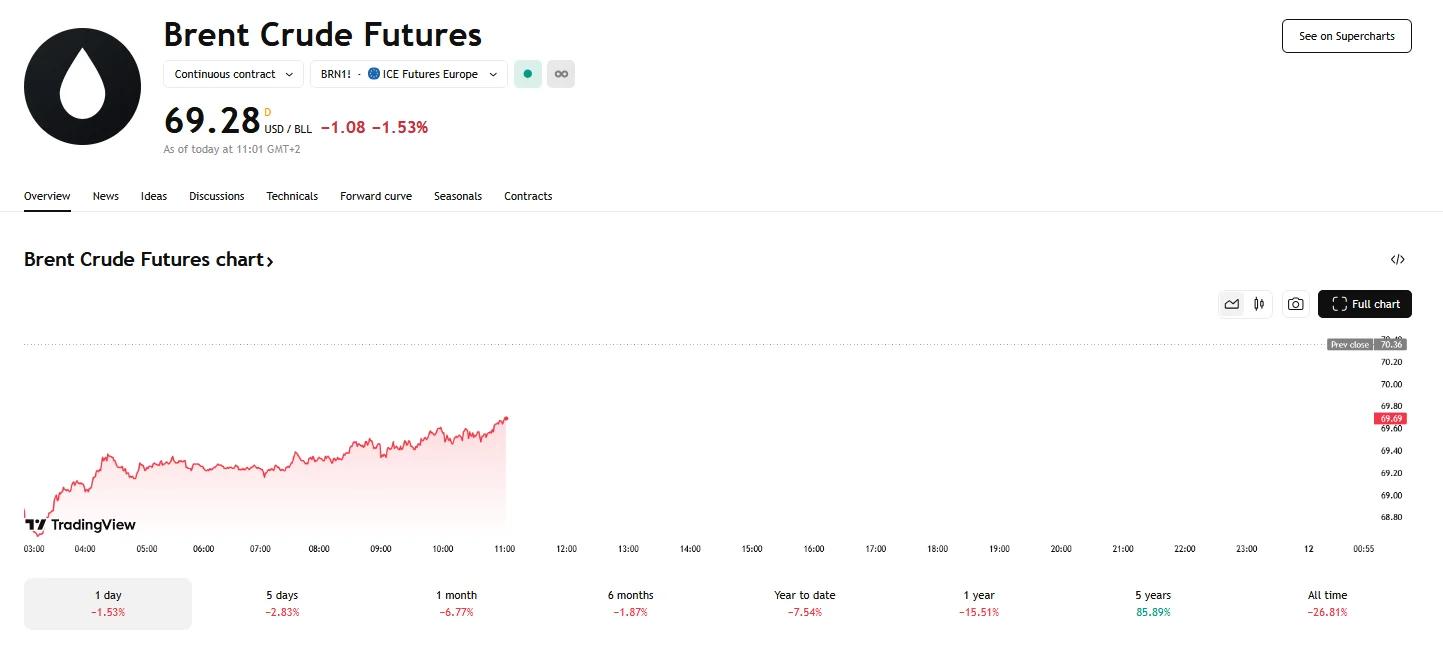

- On Tuesday, Brent crude oil surpassed $69 per barrel.

- Brent crude oil futures recovered after an initial dip to $68.60.

- Broad market fluctuations stemmed from intricate influences, primarily U.S. recession concerns and fluctuating tariffs impacting major oil producers and consumers.

Tuesday’s Trading Session Saw Brent Crude Oil Rally Past $69

Despite a confluence of economic headwinds, Brent crude oil demonstrated resilience on Tuesday, managing to climb above the $69 per barrel mark. The day’s trading saw Brent crude oil initially dip to around $68.60, before staging a recovery. This upward movement, a 0.3% gain, occurred even as the market grappled with concerns ranging from potential U.S. recession to the impact of escalating tariff disputes and the planned increase in OPEC+ production.

The underlying forces influencing these fluctuations are complex. The threat of a U.S. economic slowdown, a concern amplified by recent comments from U.S. leadership, has weighed heavily on market sentiment. The imposition and subsequent adjustments of tariffs, particularly those involving major oil-producing nations and significant consumers, have further complicated the outlook.

Adding to the complexity is the decision by OPEC+ to begin increasing oil production from April. While this move is intended to address market imbalances, it introduces the potential for increased supply at a time when demand-side uncertainties persist. It is important to note that OPEC+ has also indicated flexibility, that the production increase decision can be reversed if there is a market imbalance.

According to market analysts at DBS Bank, the Brent crude oil price of around $70 a barrel serves as strong support, and this may be contributing to the oil price’s ability to rise from the lower price levels. In essence, the internal mechanics of the oil market are working to stabilize the price.

The impact of U.S.-issued tariffs on imports from Canada, China, and Mexico has been felt across global markets, creating an atmosphere of heightened uncertainty. This has created a situation where economic indicators are closely scrutinized, and small pieces of new information can cause large market swings.