Key moments

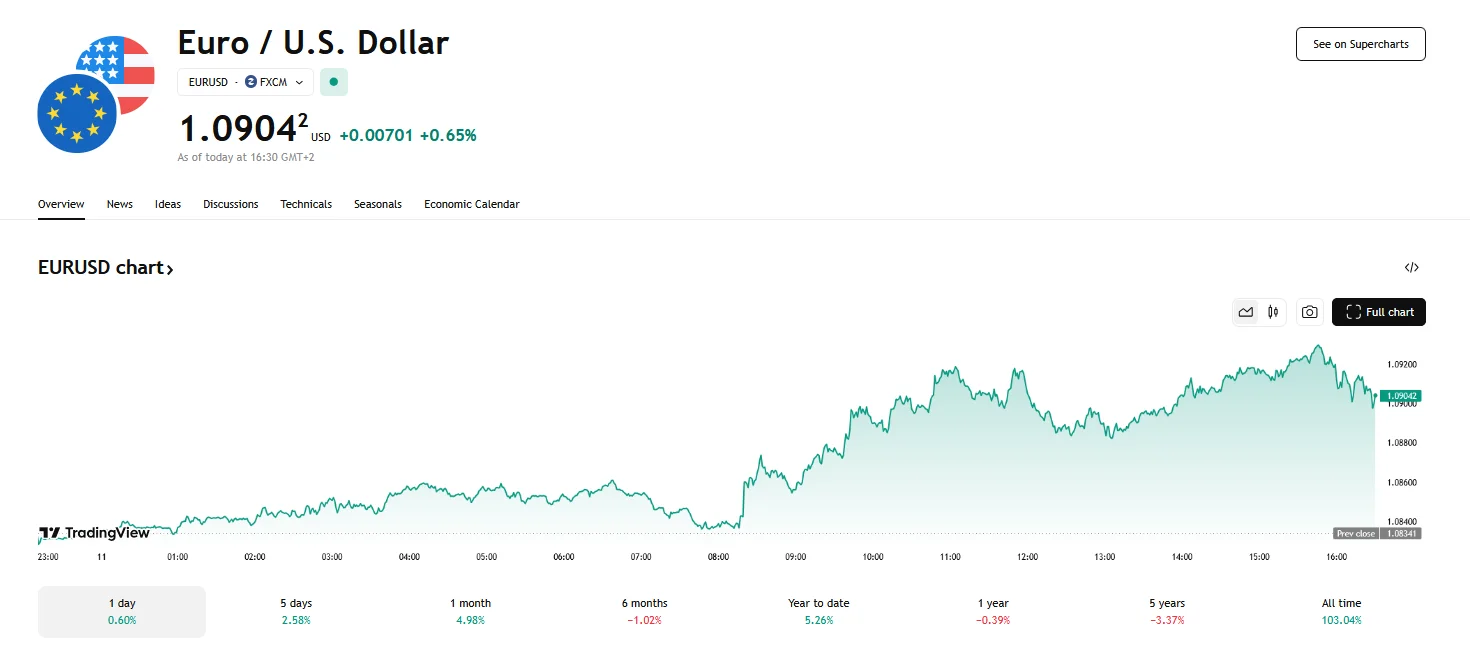

- Renewed optimism regarding Germany’s potential defense spending increase drove the EUR/USD past the $1.0900 level.

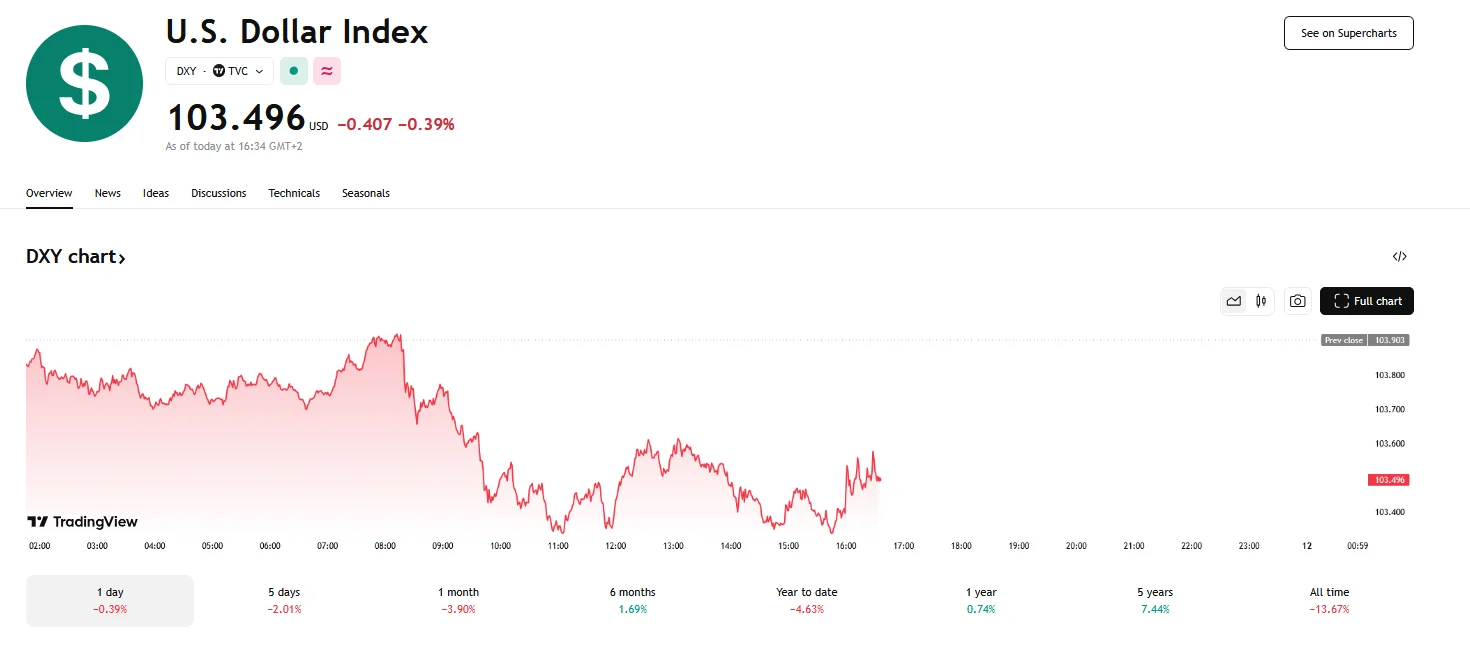

- Marking a seven-day decline, the dollar index plummeted to a low not seen since October 2024.

- Growing anxieties regarding a potential U.S. recession have diminished the dollar’s diminished appeal as a safe-haven asset.

German Defense Spending Hopes Fuel Euro’s Climb as Dollar Weakens

The EUR/USD has surged past the $1.0900 mark, propelled by renewed optimism surrounding Germany’s potential increase in defense spending. The catalyst for the Euro’s ascent lies in indications that Germany’s political landscape is shifting towards greater fiscal flexibility. Statements from key figures within the Greens Party suggest a willingness to negotiate increased state borrowing to bolster defense capabilities and stimulate economic growth. This prospect has injected fresh confidence into the Eurozone’s economic outlook, particularly as it signals a potential departure from previous fiscal constraints.

This upward trajectory for the Euro coincides with a significant weakening of the dollar, which has seen its index plummet to exceptionally low levels. The dollar index, a measure of the dollar’s value against a basket of major currencies, has been on a downward trend for seven days. This decline is largely attributed to growing concerns about a potential U.S. recession. The anxieties surrounding the U.S. economy have diminished the dollar’s appeal as a safe-haven asset, prompting investors to seek alternative currencies.

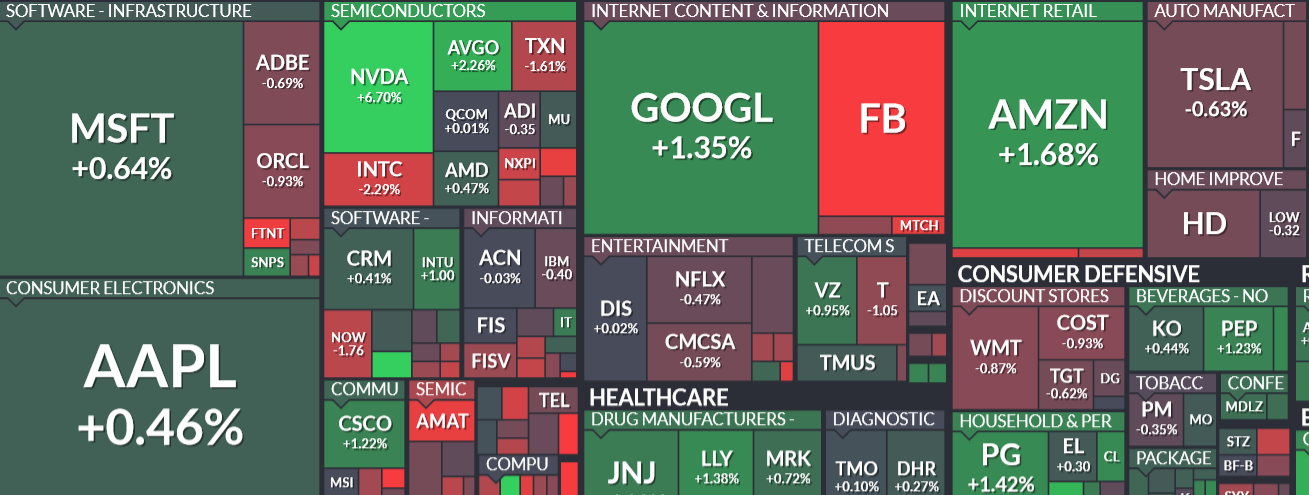

The divergence in economic sentiment between the Eurozone and the U.S. has created a favorable environment for the Euro. While Germany’s potential defense spending deal is boosting confidence in the Eurozone, fears of an economic slowdown are weighing heavily on the dollar. The recent volatility in U.S. equity markets, triggered by concerns over economic growth and trade uncertainties, has further contributed to the dollar’s decline.

The narrowing yield differentials between U.S. bonds and those of other major economies, such as Germany and Japan, have also played a role in the dollar’s decline. As U.S. bond yields have fallen, the gap between them and yields in other countries has shrunk, reducing the relative attractiveness of dollar-denominated assets.