Key moments

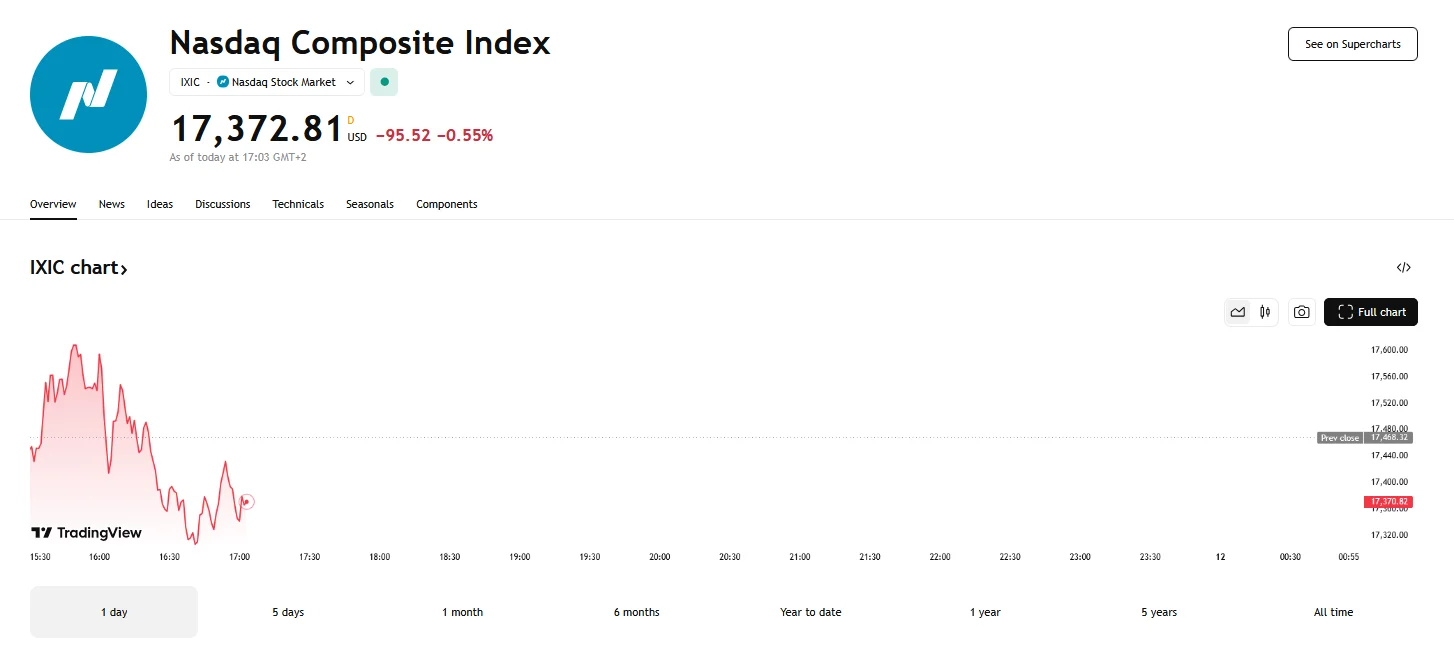

- The Nasdaq Composite (IXIC) index dropped roughly 0.5% on Tuesday.

- Tuesday’s decline occurred after a major 4% crash that occurred on the day prior.

- The broader market saw losses, with the S&P 500 and Dow Jones Industrial Average declining by approximately 0.8% and 1.1%, respectively.

Wall Street’s tech-centric index, the Nasdaq Composite (IXIC), experienced a volatile trading session on Tuesday that culminated in a roughly 0.5% decline. This serves as a continuation of the market’s unease following a significant sell-off that took place on the previous day.

Monday’s market activity was marked by a substantial 728-point crash of 4%, representing the Nasdaq Composite’s most significant single-day loss since 2022. This downturn was largely attributed to the performance of the “Magnificent Seven” technology giants, a group of high-profile companies like Tesla and Apple that had previously been instrumental in driving market growth. The collective market capitalization of these influential firms witnessed a considerable reduction, indicating a shift in investor sentiment and a reassessment of their valuations.

Political pronouncements and trade-related developments played a significant role in exacerbating market volatility. The implementation of new tariffs on Canadian steel and aluminum, along with threats of increased tariffs on imported vehicles, heightened investor concerns about potential trade disputes and their potential to trigger an economic downturn.

The broader market indices, including the S&P 500 and the Dow Jones Industrial Average, also experienced losses, signaling widespread investor apprehension. The S&P 500 and the Dow Jones Industrial Average concluded the trading day with declines of approximately 0.8% and 1.1%, respectively.

The current market landscape is characterized by a pervasive sense of uncertainty, with investors grappling with conflicting economic signals. While certain economic indicators, such as job openings data, suggest underlying strength, other factors, including trade tensions and revised economic forecasts, paint a more concerning picture. The potential for stagflation, a combination of sluggish economic growth and elevated inflation, has emerged as a significant source of anxiety for market participants. Moreover, the rapid reversal of gains in the “Magnificent Seven” demonstrates the potential for swift and significant market corrections, particularly in sectors that have experienced substantial growth in recent periods.