Key moments

- Unilever CEO announces plans to accelerate the disposal of underperforming food brands within the European and smaller market divisions.

- The company aims to streamline its portfolio, focusing on high-profit brands like Knorr and Hellmann’s.

- Unilever outlines cost-cutting measures, including job reductions and the spin-off of its ice cream business, to enhance overall efficiency.

Unilever Streamlines Portfolio, Accelerates Food Brand Sales

Unilever’s Chief Executive Officer, Fernando Fernandez, has signaled a strategic shift towards accelerating the company’s turnaround efforts through the divestiture of underperforming food brands. This decision comes as part of a broader plan to streamline the company’s portfolio and concentrate on its most profitable assets. The CEO identified approximately 1 billion euros worth of local brands within the European food division that are deemed unsuitable for the company’s long-term strategy. Additionally, brands worth 500 million euros in smaller markets, which lack scalability potential, are also slated for disposal.

The decision to expedite the sale of these brands aligns with Unilever’s objective to enhance its business performance by focusing on high-margin and cash-generating brands. Notably, Knorr and Hellmann’s, which constitute 60% of the food business’s 13.4 billion euro turnover in 2024, are central to the company’s growth strategy. Fernandez emphasized Unilever’s commitment to expanding these core brands.

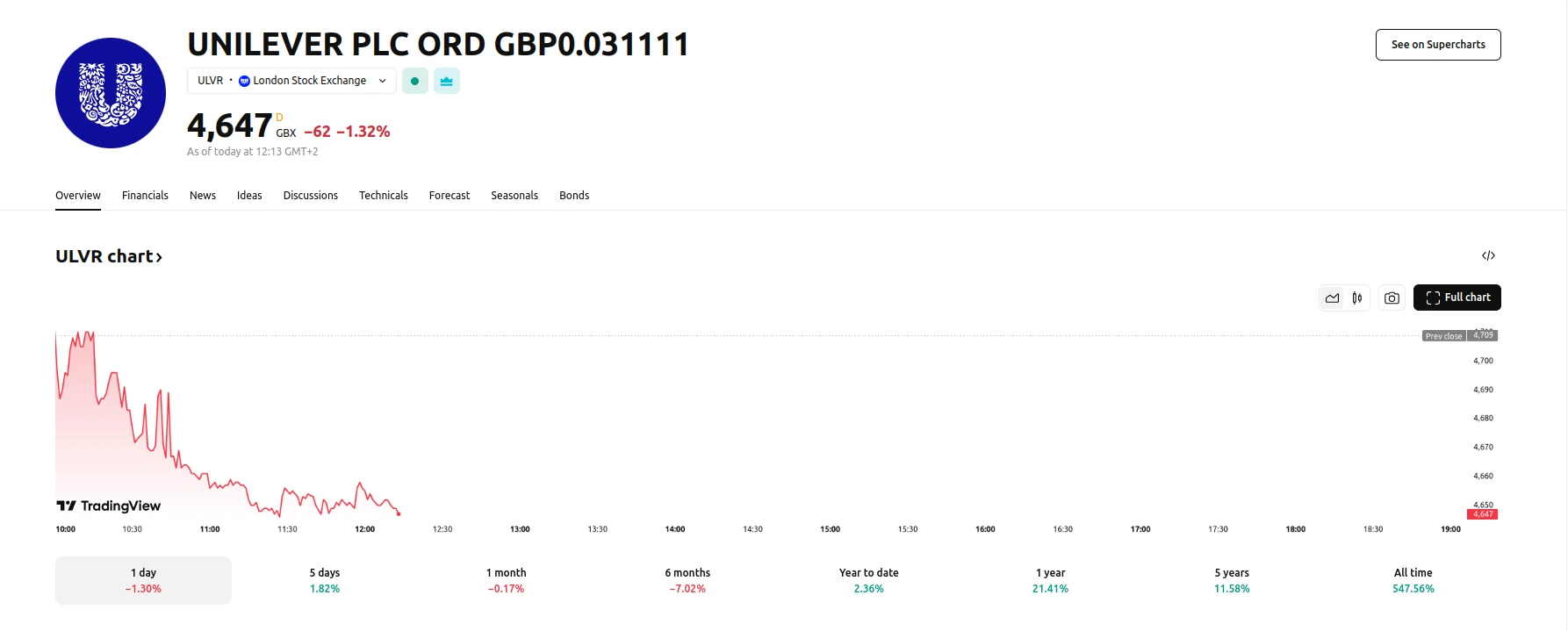

In conjunction with the portfolio restructuring, Unilever is implementing comprehensive cost-cutting measures. These initiatives include a plan to save 800 million euros over the next three years, which will involve the reduction of 7,500 jobs globally. Furthermore, the company is proceeding with the spin-off of its ice cream business into a separate entity. These strategic moves are intended to optimize operational efficiency and improve overall financial performance. The ULVR stock saw a decrease of -1.30% in the last trading day and -7.02% within the last 6 months.