Key moments

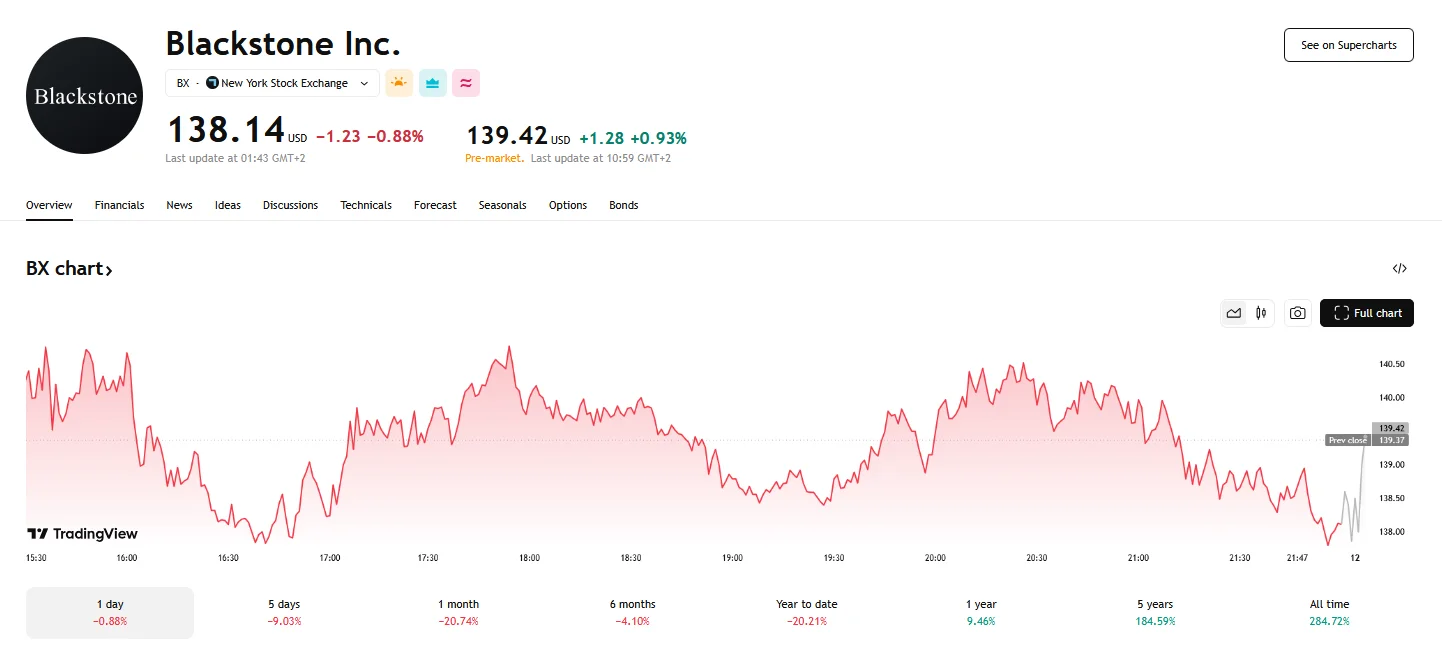

- Blackstone’s stock reached the $138 mark.

- Tuesday’s $140 peak was short-lived, but pre-market figures stand at roughly $139 at press time.

- The company is moving forward with reacquiring Trans Maldivian Airways.

Blackstone Shares Shares Retreat to $138

Blackstone’s stock experienced a notable downturn on Tuesday, with shares settling at around $138, a price point that reflects a volatile week for the investment giant. This followed a brief ascent to $140, further highlighting the fluctuating nature of the company’s market performance.

Blackstone shares dipped below the $138 mark at points, a sharp contrast to the company’s position earlier in March when it traded above $163, indicating substantial selling pressure. However, Wednesday’s pre-market figures managed to at least reach $139.

This week’s fluctuations follow a significant 12.09% decline that was observed last week. The recent drop underscores the impact of broader market forces and specific strategic decisions on the company’s valuation.

Blackstone’s volatility coincides with several key developments for Blackstone. While the firm nears the completion of reacquiring Trans Maldivian Airways, discussions with Haldiram’s were terminated, a decision attributed to valuation disagreements.

The broader economic climate, influenced by heated talks surrounding the U.S. tariff policies, has contributed to heightened market volatility. The Dow Jones and S&P 500, both experiencing declines, reflect the uncertainty affecting sectors sensitive to policy changes. This environment has likely amplified the recent dip in Blackstone’s stock, despite the company’s ongoing efforts in areas like energy transition, as demonstrated by the successful closure of its Energy Transition Partners IV fund.

Even with the recent price decline, institutional investors are still showing confidence in Blackstone. In the fourth quarter, Smartleaf Asset Management LLC boosted their Blackstone Mortgage Trust holdings by 125.7%, adding 1,204 shares worth $38,000. Coordinated Financial Services Inc. also invested, acquiring 4,264 Blackstone Inc. shares valued at $735,000. Further demonstrating this trend, Amundi also made the decision to acquire more Blackstone shares. These investments, alongside Blackstone’s diversified portfolio, point to a resilient foundation capable of navigating market fluctuations.