Key moments

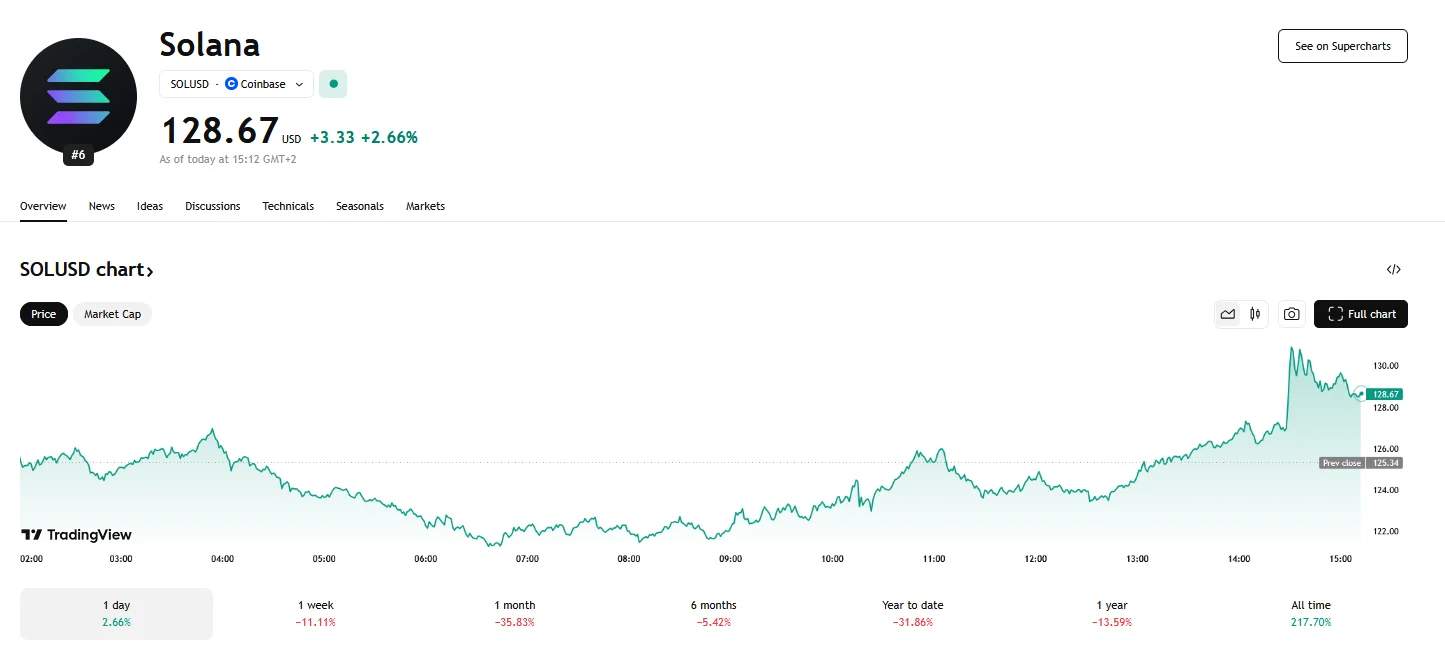

- Solana experienced price fluctuations on Monday, hitting a $130 peak after dipping below $124.

- Solana’s price has dropped 8% below its “Realized Price,” a key indicator of investor cost basis.

- This comes as the SEC delays ETF decisions for Solana and other altcoins until May, adding to existing market uncertainty.

Solana Managed to Reach $130

Solana’s market performance on Wednesday showcased a volatile trading pattern, with the cryptocurrency briefly touching $130, marking a daily increase of over 4%. However, this upward movement followed a significant dip to below $124 earlier in the day, reflecting the ongoing struggle for Solana to regain stability in 2025 as the currency experienced a decline of over 40% since the start of the year.

In addition, Solana fell below its “Realized Price,” as on-chain data indicates that Solana’s spot value has slipped approximately 8% below this metric, a significant event as the Realized Price represents the average cost basis for investors. When an asset’s price trades above this level, it signifies that holders are, on average, in profit; conversely, trading below suggests they are at a loss. Historically, the Realized Price has acted as a boundary between bullish and bearish trends for cryptocurrencies, including Solana and Bitcoin. The latest breach below this threshold raises concerns about a potential continuation of the bearish trend.

Adding to the uncertainty surrounding Solana and other cryptocurrencies, the U.S. Securities and Exchange Commission (SEC) has announced a delay in its decision on several proposed exchange-traded funds (ETFs) for XRP, Solana, Litecoin, and Dogecoin. The SEC has “designated a longer period” to make a ruling, with decisions on ETFs such as Grayscale’s XRP and Cboe BZX Exchange’s spot Solana filings now pushed until May.

Analysts note that this delay is standard procedure, and the eventual approval of these ETFs remains a possibility. The SEC’s current acting chairman has also proposed changes that could ease regulations for crypto firms, suggesting a potential shift in the agency’s approach. This comes after a period of what the crypto industry considered aggressive regulatory action under the previous SEC chair.