Key moments

- Adobe reports Q1 adjusted earnings of $5.08 per share and revenue of $5.71 billion, surpassing analyst estimates.

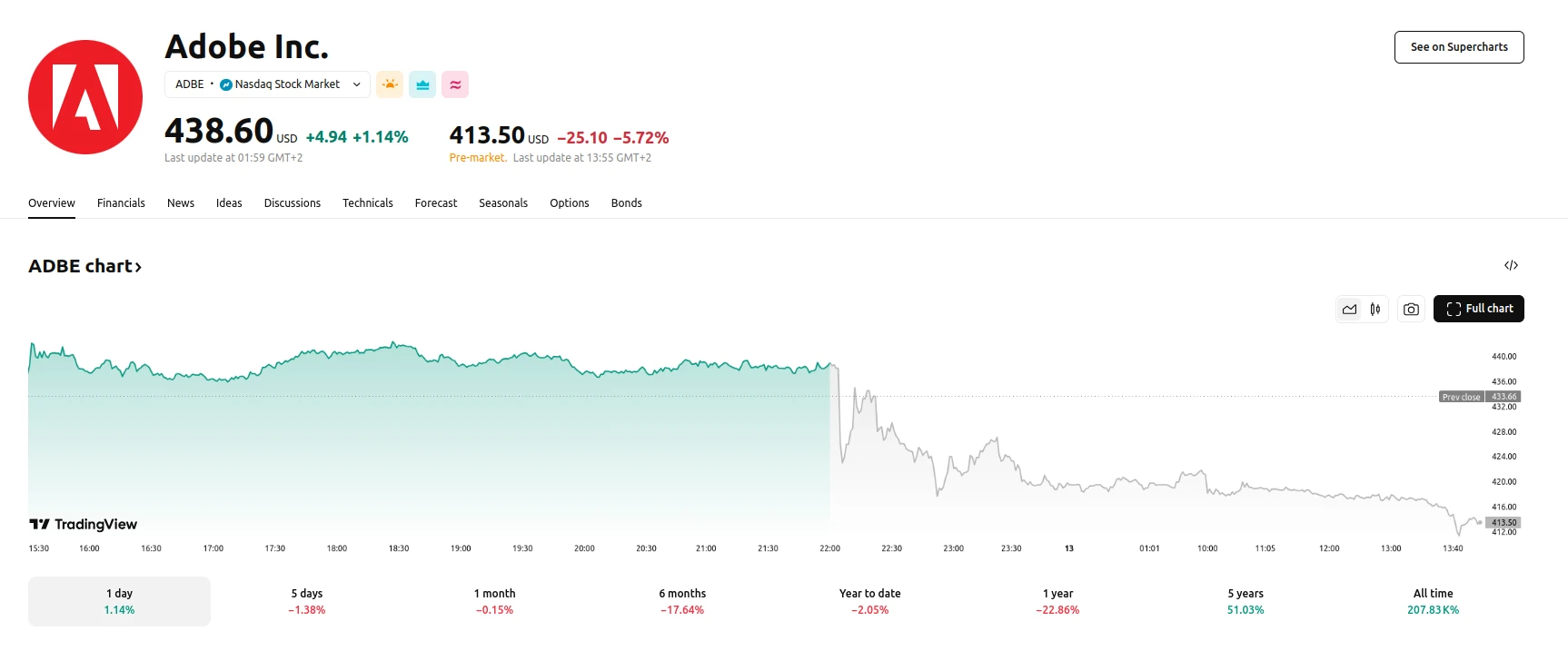

- Despite the earnings beat, Adobe shares experienced a decline in after-hours trading on Wednesday. As of Thursday, shares are up 1.14%.

- Adobe’s CFO expresses confidence in AI-driven revenue growth, targeting a doubling of annualized recurring revenue (ARR).

Software Giant Exceeds Financial Projections, Yet Investor Concerns Persist Regarding AI Revenue Growth

Adobe Systems reported robust first-quarter financial results, exceeding analyst expectations for both earnings and revenue. The company posted adjusted earnings of $5.08 per share on revenue of $5.71 billion, surpassing the projected $4.97 per share and $5.66 billion, respectively. However, despite these positive results, Adobe’s stock experienced a decline in after-hours trading this Wednesday. This response indicates that investor sentiment is being influenced by factors beyond the immediate quarterly performance.

A key area of focus for investors is Adobe’s progress in monetizing its artificial intelligence (AI) initiatives. The company’s Chief Financial Officer, Dan Durn, expressed optimism regarding AI-driven revenue growth, highlighting that AI-first products generated $125 million in ending annualized recurring revenue (ARR) during the quarter. Adobe intends to achieve a twofold increase in its ARR within the next year, a crucial figure for its subscription-driven business. This ambitious target underscores Adobe’s commitment to leveraging AI to drive future growth. Durn emphasized that the ARR book of business is a reliable indicator of future revenue, reinforcing the importance of achieving the targeted doubling.

Despite the positive outlook on AI monetization, Adobe’s stock decline suggests that investors remain cautious. Concerns may stem from the company’s full-year outlook, which, while reiterated, includes figures slightly below Wall Street’s median estimates. Additionally, broader economic uncertainties and potential reductions in consumer and enterprise spending on software could be contributing to investor apprehension. However, Adobe’s CFO conveyed a sense of resilience, stating that the company is focused on controlling what it can, remaining agile in response to external factors, and prioritizing customer execution. This strategy aims to navigate the current economic environment and maintain the company’s strong performance.