Key moments

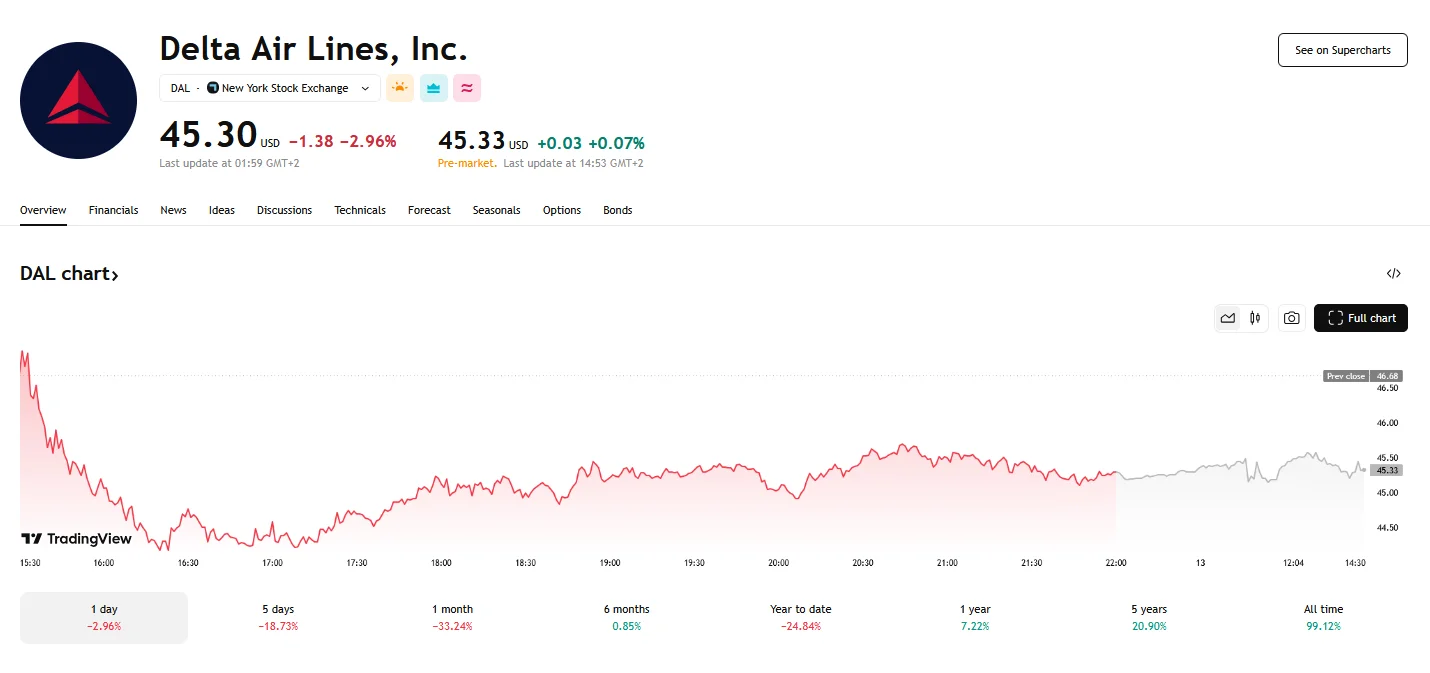

- Delta’s stock closed at $45.30 on Wednesday, down 2.96%.

- Despite maintaining a “buy” rating, UBS Group lowered Delta’s price target to $77. In contrast, Seaport Res Ptn recently raised Delta’s Q2 2025 EPS forecast to $2.75, signaling confidence in Delta’s future performance.

- Delta’s Q4 financial results exceeded analysts’ estimates, with a reported EPS of $1.85 and a 9.4% revenue increase compared to the previous year.

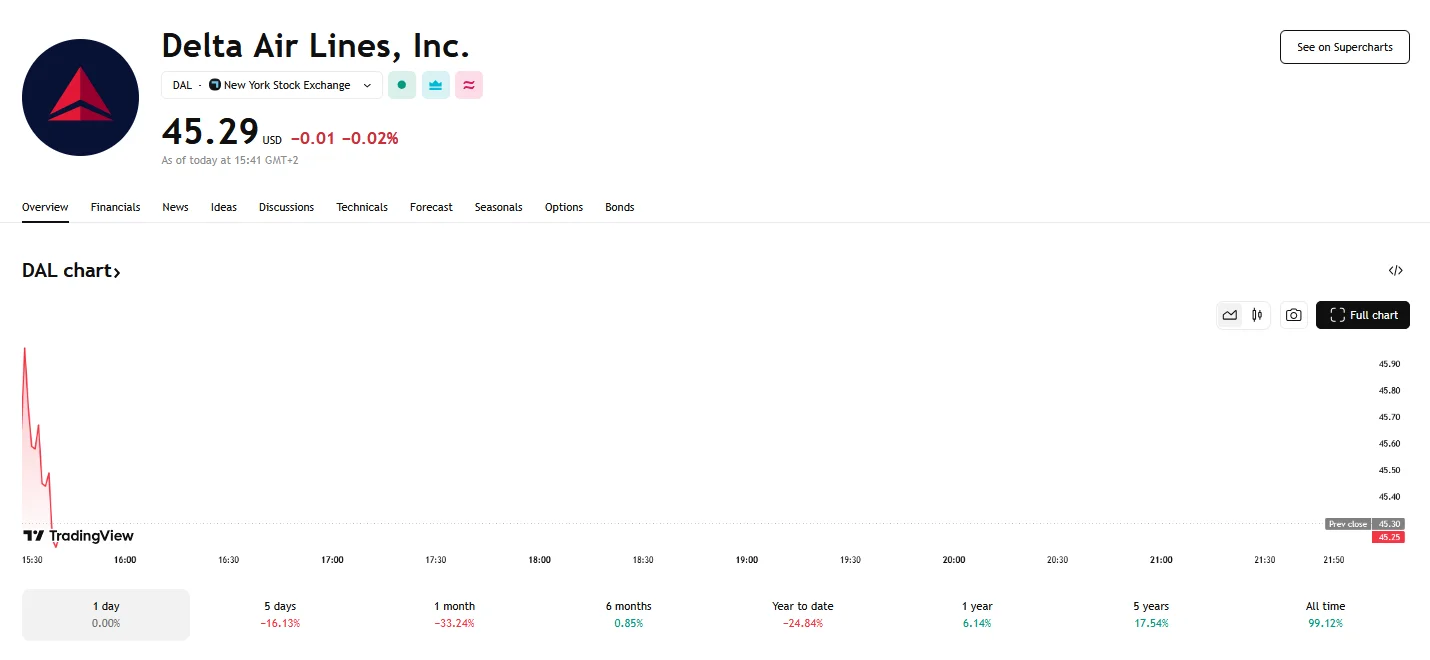

Delta’s Share Price Hits $45.30, Thursday’s Figures Remain Modest

Wednesday saw Delta Air Lines’ stock price closing at $45.30, marking a 2.96% decline. This drop reflects a confluence of factors, including analyst downgrades and evolving market conditions that are impacting the airline industry. Despite a slight 0.07% uptick in pre-market trading, reaching $45.33, the overall sentiment surrounding Delta’s stock remains cautious.

Operating across two sectors, Airline and Refinery, Delta Air Lines is a dominant force in global air travel. Its domestic footprint features core hubs in cities like Atlanta, Detroit, and Salt Lake City, alongside coastal hubs in Boston and New York. Internationally, Delta’s reach extends to key cities such as Amsterdam, London, and Tokyo, establishing a robust global network. At the time of writing, its Thursday share price figures were fluctuating around yesterday’s closing price.

Delta’s recent stock price decline is symptomatic of broader headwinds within the airline industry. Similar to its peers, the company has revised its financial projections, notably lowering its first-quarter profit outlook. This adjustment, driven by diminished consumer and corporate confidence, has resulted in a reduced revenue growth forecast, now 3-4%, down from the initial 7-9%, reflecting a drop in domestic demand.

Adding to the complexity of the situation, the stock price target made by UBS Group was recently downgraded to $77, a decrease of $13 that contributed to the stock’s downward pressure. This analyst adjustment, while maintaining a “buy” rating, reflects a reassessment of the company’s valuation in light of current market dynamics.

While some analysts adjusted their targets downward, Seaport Res Ptn’s equities research team offered a contrasting perspective. They recently revised their Q2 2025 earnings per share forecast for Delta upward, now predicting $2.75 per share, a $0.10 increase from their prior estimate. Another promising figure was the consensus estimate, standing at $7.63 per share.

Despite recent challenges, Delta’s financial performance in the last quarter exceeded expectations. In January, the company reported earnings per share of $1.85, contrary to analysts’ $1.76 consensus estimate. Delta also demonstrated strong revenue growth, with a 9.4% increase compared to the same quarter last year. The company’s return on equity of 30.41% and net margin of 5.61% further highlight its operational efficiency.