Key moments

- PNC Financial Services Group Inc. decreased its Microchip Technology holdings by 8.6% in the fourth quarter.

- Multiple new institutional investments in Microchip Technology were recorded during the third and fourth quarters.

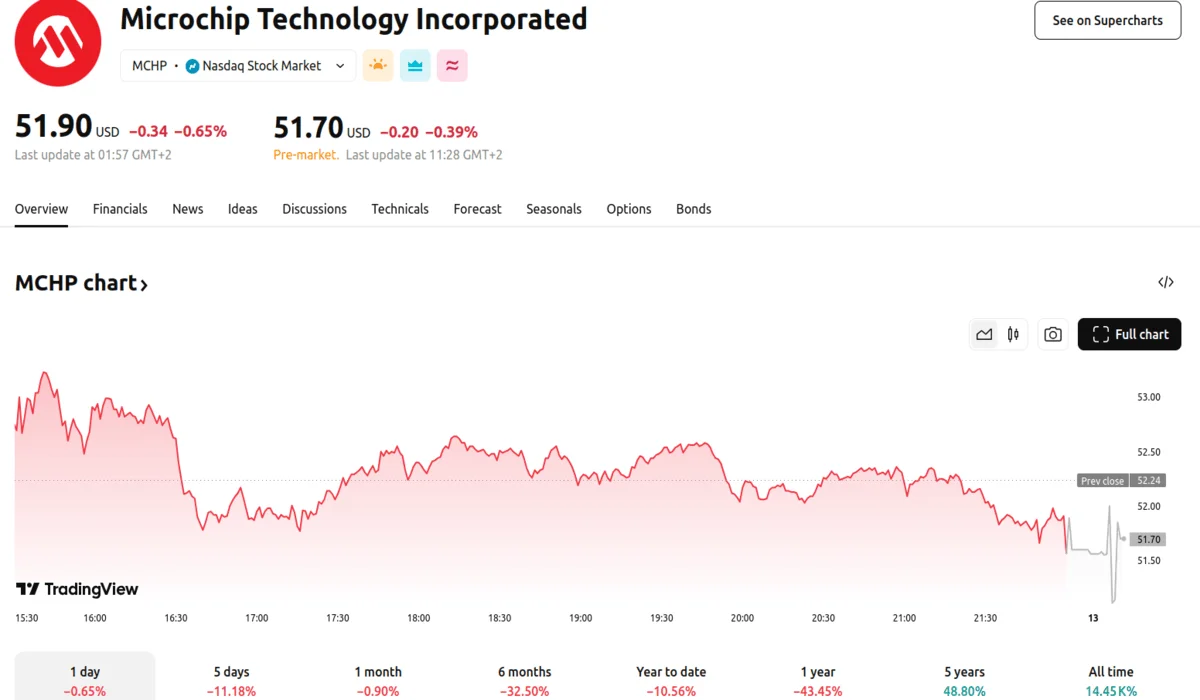

- Microchip Technology’s stock experienced a 0.7% decline, alongside the release of quarterly earnings that fell short of analyst expectations.

Institutional Investment Shifts in Semiconductor Sector: PNC Adjusts Holdings in Microchip Technology

PNC Financial Services Group Inc.’s decision to decrease its stake in Microchip Technology, resulting in a reduction of 11,504 shares, reflects a strategic adjustment within its investment portfolio. This action, documented in the firm’s SEC filings, places its total holdings at 121,783 shares, valued at $6,984,000 at the quarter’s end. This change signifies a calculated reassessment of the company’s position in the semiconductor sector, potentially influenced by broader market trends and internal risk assessments.

Simultaneously, the fourth and third quarters witnessed several institutional investors establishing new positions in Microchip Technology. These investments, ranging from approximately $26,000 to $34,000, indicate varying levels of confidence in the company’s future performance. Firms such as Mainstream Capital Management LLC, Prospera Private Wealth LLC, and others initiated these positions, showcasing a diverse range of investment strategies within the institutional investor community. Overall, institutional investors hold a significant majority, 91.51%, of Microchip Technology’s stock.

Microchip Technology’s stock experienced a 0.7% decline, with shares opening at $51.90. This fluctuation occurred alongside the release of the company’s quarterly earnings, which reported an EPS of $0.13, falling significantly short of the anticipated $0.28. The company’s financial metrics, including a price-to-earnings ratio of 92.68 and a beta of 1.52, contribute to the overall market assessment of its performance. Further contributing to investor consideration is the company’s dividend payout. The company recently paid a quarterly dividend of $0.455 per share.