Key moments

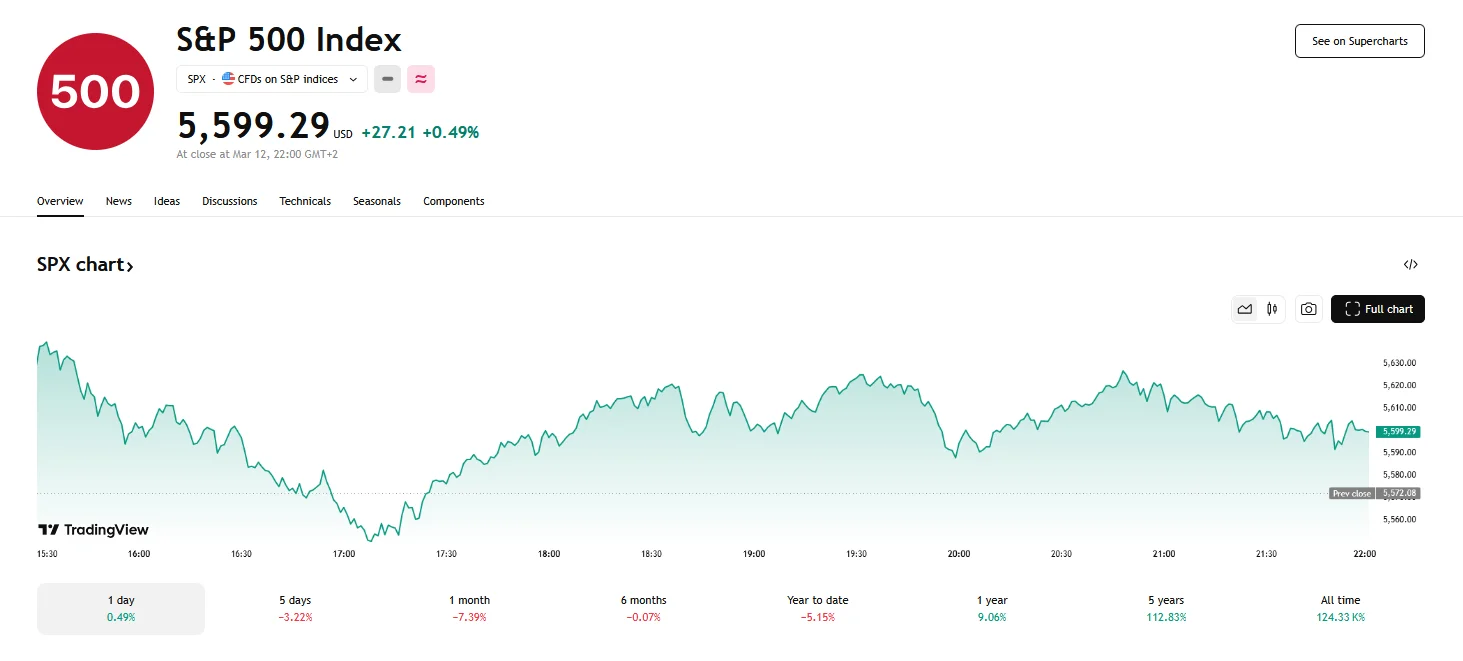

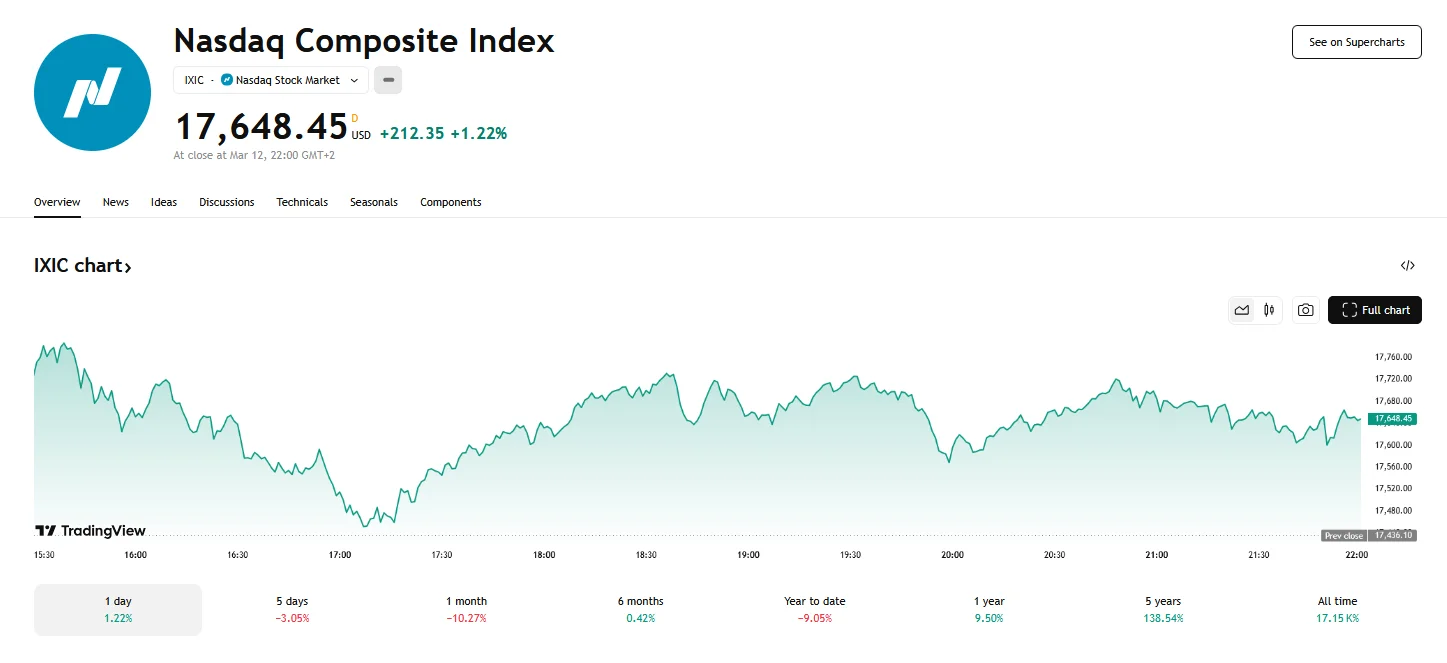

- Wall Street has experienced a surge of renewed confidence, with the Nasdaq Composite climbing to 17,648.45 and the S&P 500 rising to 5,599.30.

- The release of the CPI data, showing a moderate 0.2% increase in consumer prices, helped to alleviate concerns about stagflation and provided a buffer against increasingly negative market sentiments.

- The technology sector witnessed a powerful resurgence, with Nvidia climbing over 6%.

Tech Comeback and Inflation Relief Fuel Market Rally

A wave of renewed confidence swept through Wall Street on Wednesday, propelling key market indices into positive territory. The Nasdaq Composite experienced a robust surge, climbing 1.22% to settle at 17,648.45, while the broader S&P 500 Index saw a respectable gain of 0.49%, closing at 5,599.30.

The driving force behind this market uplift was the release of the Consumer Price Index (CPI) data, which revealed a moderate 0.2% increase in consumer prices for February. This figure fell below analysts’ projections, alleviating concerns about persistent inflationary pressures and bolstering hopes for potential interest rate adjustments by the Federal Reserve later in the year. The figures served to dampen rising fears of stagflation and offered a counterbalance to the uncertainty stemming from ongoing trade tensions, which had previously fueled market anxieties.

Despite a challenging week for the technology sector, which had witnessed a cumulative decline of over 3%, Wednesday’s trading session saw a powerful resurgence. Tech stocks led the charge, spearheading the S&P 500’s advance. Notably, Nvidia experienced a significant surge, gaining 6.4%. This improvement indicated a renewed appetite for growth-oriented stock.

While the inflation data provided a welcome boost, the market still erred on the side of caution when it came to optimism. The lingering effects of geopolitical uncertainties and potential economic headwinds continued to be factors investors considered. The market’s response, however, showed investor confidence to be sensitive to economic data and highlighted the potential for swift shifts in sentiment based on perceived improvements in the economic landscape.

Furthermore, the tech sector’s strong rebound highlighted its enduring importance as a market driver. Despite recent volatility, the sector’s capacity to deliver significant gains remained evident, demonstrating its resilience and its continued appeal to investors seeking growth opportunities.