Key moments

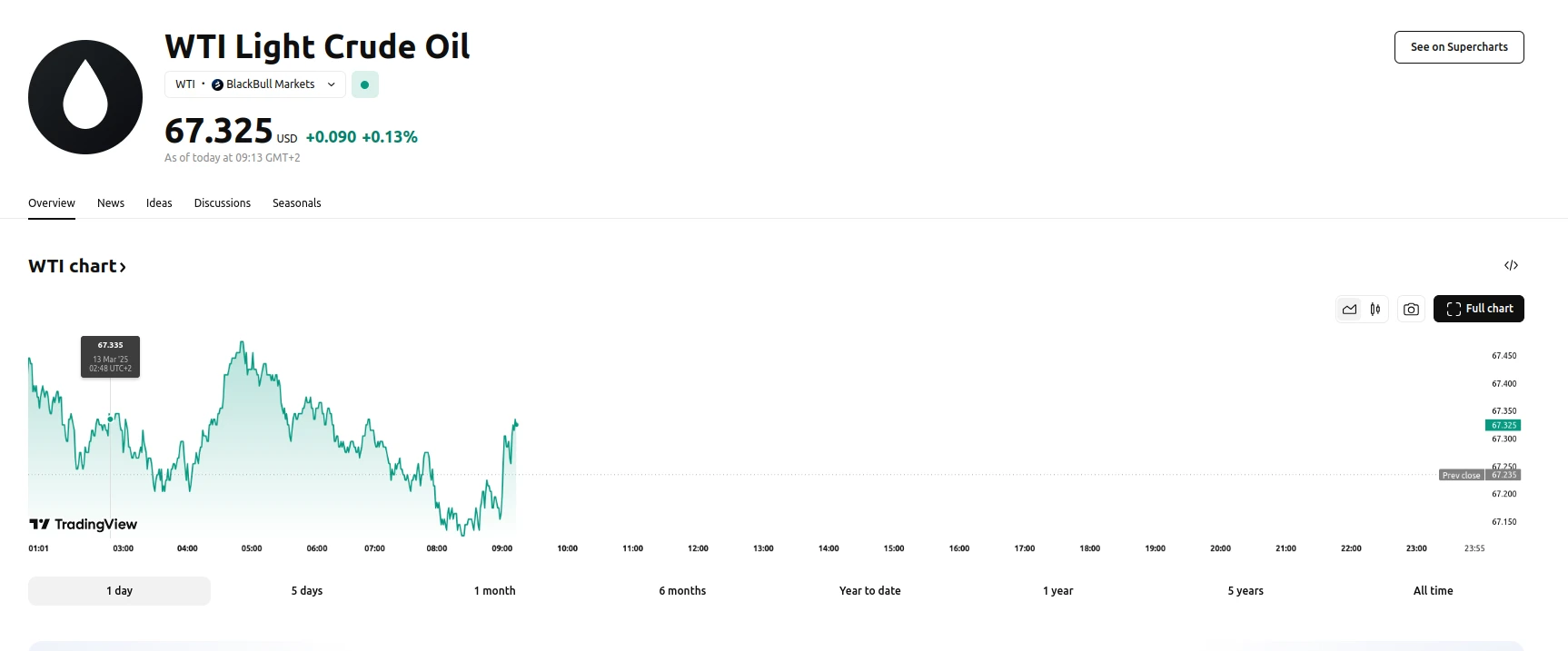

- WTI crude oil price rises to $67.50 in early Asian trading, indicating upward momentum.

- US crude oil stockpiles increase by 1.448 million barrels, according to the EIA, less than anticipated.

- Fears are escalating regarding a possible US economic deceleration and the repercussions of the newly implemented tariffs./li>

US Crude Benchmark Reaches $67.50 Amid Inventory Data and Trade Tensions

West Texas Intermediate (WTI) crude oil has experienced an upward trend, reaching approximately $67.50 in Thursday’s early Asian trading session. This movement occurs despite the reported increase in US crude oil stockpiles, as released by the Energy Information Administration (EIA). The EIA’s weekly report indicated a rise of 1.448 million barrels as of March 7th. This increase, although present, was lower than the previously predicted 2.1 million barrels, and also lower than the previous week’s increase of 3.614 million barrels, which is contributing to the price rise.

The market response to the inventory data suggests that while stockpiles have increased, the rate of increase was less than anticipated.

Furthermore, data indicates that Gasoline and diesel reserves decreased, which is a sign of stronger demand. These circumstances, including the lower-than-forecasted crude inventory growth, have helped drive WTI prices up. However, the upward trajectory of WTI faces potential headwinds stemming from broader economic concerns.

The imposition of new tariffs by the US administration raises concerns about potential economic slowdown. The 25% tariffs on imported steel and aluminum, which are set to take effect, are expected to increase costs for businesses, potentially leading to higher inflation and a decrease in consumer confidence. These factors could ultimately exert downward pressure on WTI prices. Market participants are closely monitoring the economic implications of these tariffs and their potential impact on global trade and economic growth.