Key moments

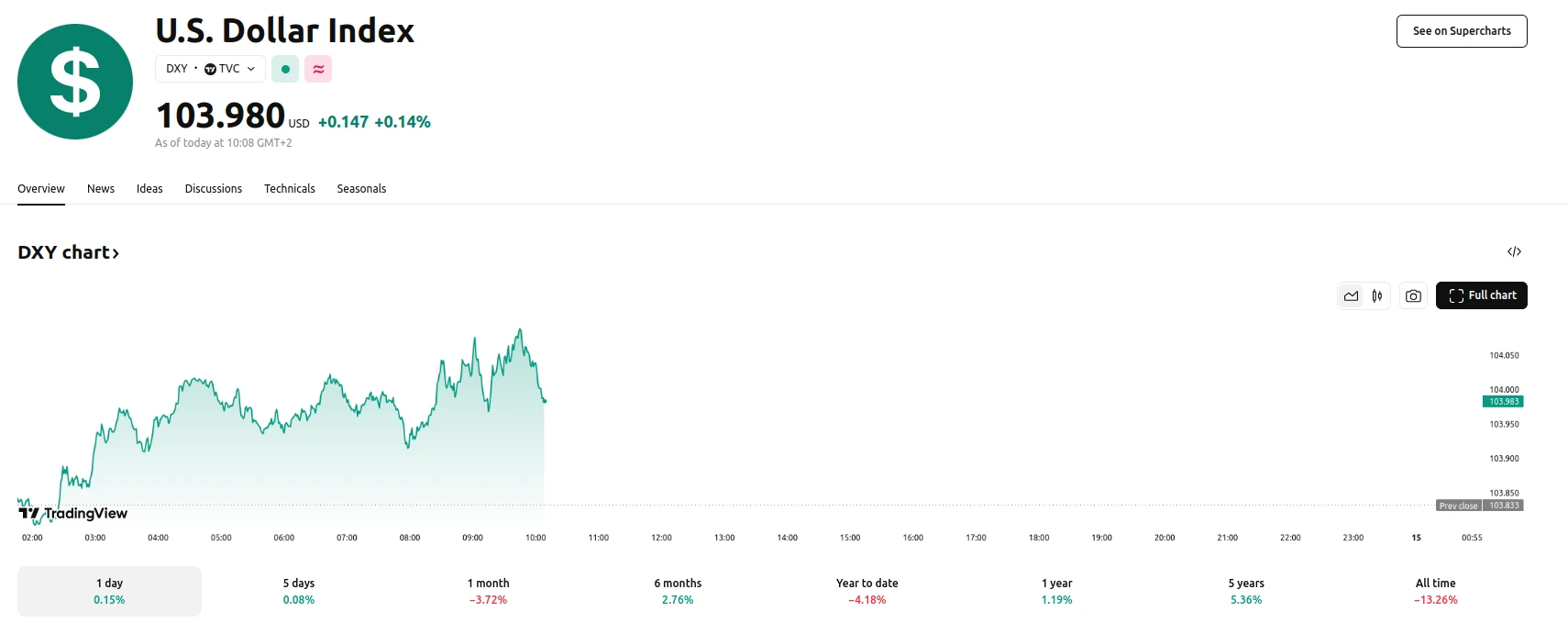

- With US Treasury yields providing support, the DXY is able to hold on to its gains in the vicinity of 104.00.

- Initial Jobless Claims surpass expectations, indicating a robust US labor market.

- President Trump’s tariff threat on European wines and champagne contributes to a shift in risk sentiment.

DXY Stability Observed as Treasury Yields and Jobless Claims Influence Market Sentiment

The US Dollar Index (DXY) has demonstrated sustained strength, holding its position near the 104.00 mark. This stability is largely attributed to the support provided by US Treasury yields, with the 2-year and 10-year yields registering at 3.96% and 4.29%, respectively. These elevated yields have contributed to the dollar’s upward trajectory, reinforcing its appeal to investors. The DXY’s performance reflects a combination of economic data and evolving policy considerations.

Recent economic data releases have played a significant role in shaping market sentiment. As for the week ending March 7, US Initial Jobless Claims showed 220,000, better than the anticipated 225,000. Additionally, continuing claims also demonstrated a positive trend, falling below forecasted levels. These figures suggest a resilient US labor market, which has contributed to the dollar’s strength. Conversely, the Producer Price Index (PPI) indicated a moderation in inflationary pressures, with both headline and core PPI figures falling below previous readings and market forecasts. These data points collectively influence market expectations regarding future Federal Reserve policy.

Furthermore, geopolitical developments have added another layer of complexity to the market landscape. President Trump’s announcement of a potential 200% tariff on European wines and champagne has introduced a degree of uncertainty, prompting a shift in risk sentiment. This announcement has increased concerns about the possibility of trade disputes. At the same time, ongoing domestic policy debates include Senate Democratic Leader Chuck Schumer’s indication of support for a temporary funding measure, and US Commerce Secretary Howard Lutnick’s presentation of budget balancing strategies. These policy developments, alongside the release of the Michigan Consumer Sentiment Index, are expected to further influence the DXY’s near-term performance.