Key moments

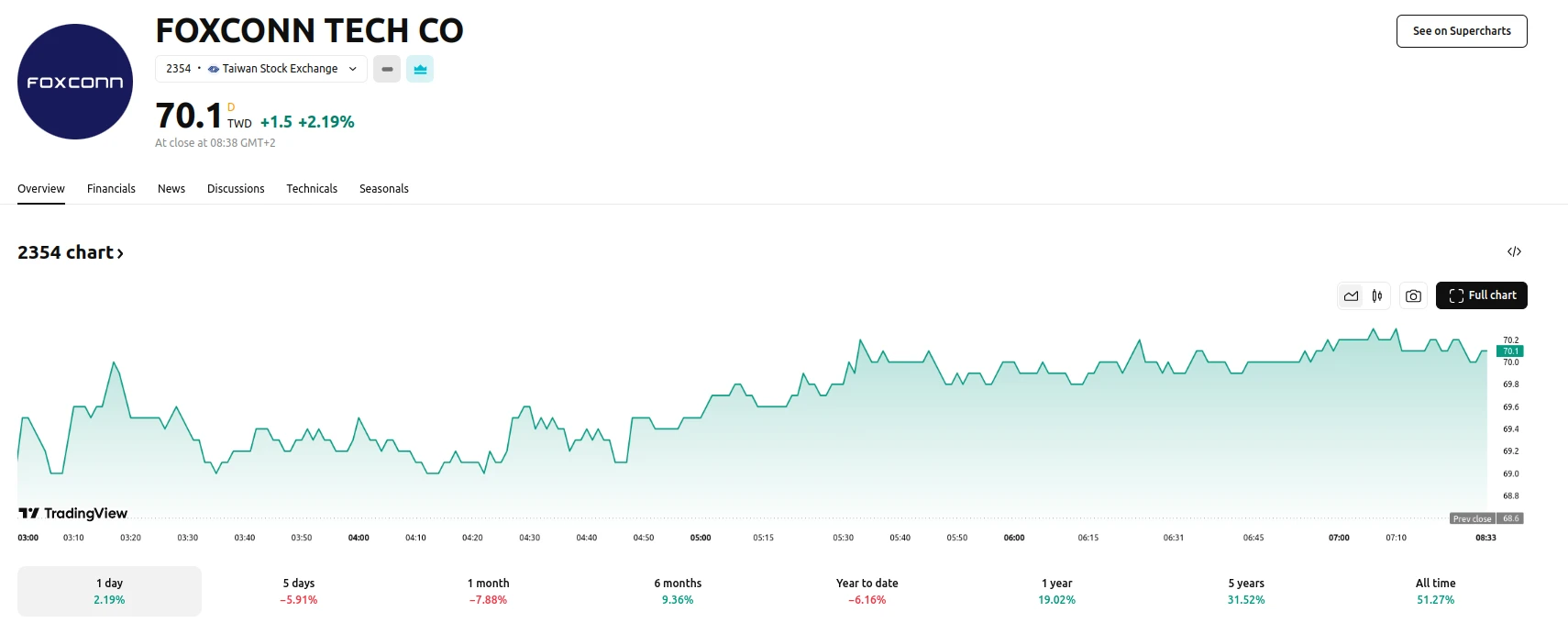

- Foxconn stock price reached 70.1 TWD, an increase of 1.5 TWD, showing a +2.19% change as of March 14, 2025.

- Foxconn forecasts substantial first-quarter revenue growth, exceeding the average of the past five years, propelled by strong demand for AI servers and cloud infrastructure.

- AI server revenue is projected to more than double year-over-year and quarter-over-quarter, with AI servers comprising over half of the company’s total server revenue in 2025.

Technology Manufacturer Anticipates Significant Revenue Increase Driven by Cloud Service Provider and AI Hardware Sales

Foxconn Technology Co., Ltd., a leading global electronics manufacturer, has released an optimistic outlook for the first quarter of 2025. The company anticipates significant revenue growth, primarily fueled by the sustained demand for artificial intelligence (AI) servers and cloud service provider (CSP) infrastructure. Chairman Young Liu addressed analysts, dismissing market rumors of a potential slowdown in CSP demand, stating that Foxconn has not observed any indications of such a decline. The company’s projections are notably positive, contrasting with the more cautious forecasts from other businesses navigating the complexities of evolving international trade policies. As of March 14, 2025, Foxconn stock price was recorded at 70.1 TWD, with a +1.5 TWD increase showing a +2.19% change. Also, it is important to note that Foxconn reported an October-December net profit of T$46.33 billion ($1.41 billion), which was less than the analyst estimates.

A key driver of Foxconn’s projected growth is the exponential increase in AI server revenue. The company expects this segment to experience a growth rate exceeding 100% both quarter-over-quarter and year-over-year. This surge is attributed to Foxconn’s expanding production for Nvidia. Furthermore, Foxconn anticipates that AI servers will constitute more than 50% of its total server revenue in 2025, highlighting the company’s strategic focus on this rapidly expanding sector. Based on an LSEG SmartEstimate from 15 analysts, Foxconn’s first-quarter net profit is projected to be T$43.56 billion, a 98% year-over-year increase. The company’s expansion into the United States, including its partnership with Apple to build a server assembly plant in Houston, further illustrates this focus.

Despite the positive outlook, Foxconn acknowledges the potential impact of evolving U.S. trade policies. Acknowledging its extensive manufacturing operations in China and Mexico, the company is aware of the potential impact of fluctuating tariffs. However, Foxconn emphasizes its proactive approach to mitigating these risks through a diversified global production strategy. The company has been strategically establishing production facilities in various regions, enhancing its supply chain resilience. In response to the U.S. government’s emphasis on domestic manufacturing, Foxconn is committed to replicating its global production experience by establishing production bases within the United States. While acknowledging the unpredictability of future trade policies, Foxconn remains focused on controlling the factors within its purview.