h2>Key moments

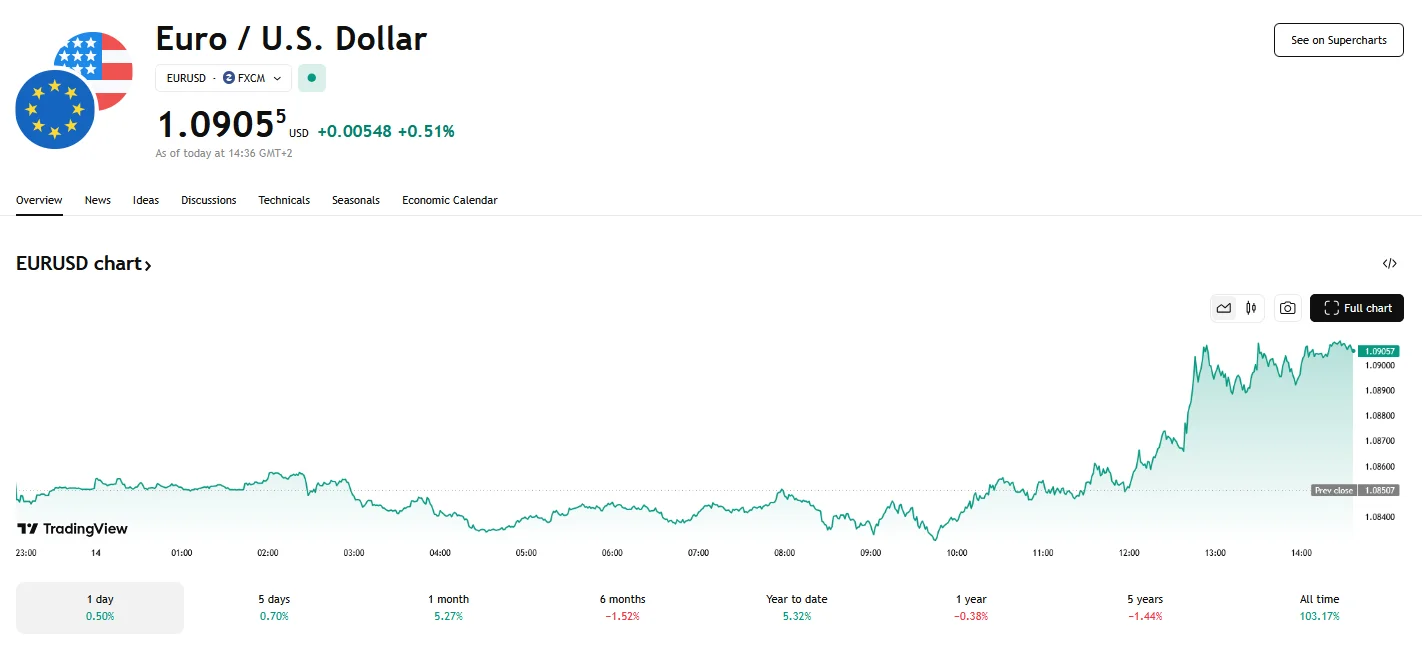

- The EUR/USD exchange rate was propelled to 1.0905 on Friday.

- The Euro soared as news surfaced of a fiscal agreement between German political parties.

- Tariff war continues to dampen investor enthusiasm.

Parliament Vote Will Take Place Next Week

A wave of optimism swept through Eurozone financial markets on Friday, with the EUR/USD exchange rate experiencing a notable surge, which saw the pair climb 0.51% to reach 1.0905. The primary catalyst for this upswing was the reported consensus between key German political figures concerning substantial increases in state borrowing.

Incoming German Chancellor Friedrich Merz reportedly forged a debt deal with the Greens political party that will result in a substantial increase in defense spending. Merz has actively pursued the enactment of a €500 billion financial package, intended for vital infrastructure development and substantial revisions to existing borrowing regulations. These revisions are designed to ignite economic expansion and significantly bolster military spending within Germany, Europe’s largest economy. Germany’s parliament is set to vote on the debt bill next week.

The financial markets’ response was immediate and pronounced. The Euro demonstrated a notable rise in value, reflecting the belief that the anticipated fiscal stimulus would positively impact the Eurozone’s economic outlook. This positive surge was observed across a range of currency pairs, with the EUR/USD being a notable example. Simultaneously, German borrowing costs began to ascend as investors processed the implications of increased government bond issuance necessary to fund the expansive spending plans. The proposed financial initiative and adjustment to the borrowing laws have led to an increased German 10-year bond yield, which is up by 2.92%.

While the markets reacted quickly to the news, questions concerning the timeline of these fiscal plans being implemented remained. The sheer magnitude of the proposed funding meant that some financial specialists indicated that they would watch for the yield of German bonds to break the 3% threshold. A concern raised by some market analysts was that the positive nature of the news should be tempered, as markets had already been primed for an agreement. However, with the confirmation of the agreement, the possibility of disappointment has been reduced.

Meanwhile, while the European market moved with news from Germany, other worldwide financial news was also being distributed. News from the United States, with claims of potential 200% tariffs against European alcohol, created a counterbalance to the rising euro.