Key moments

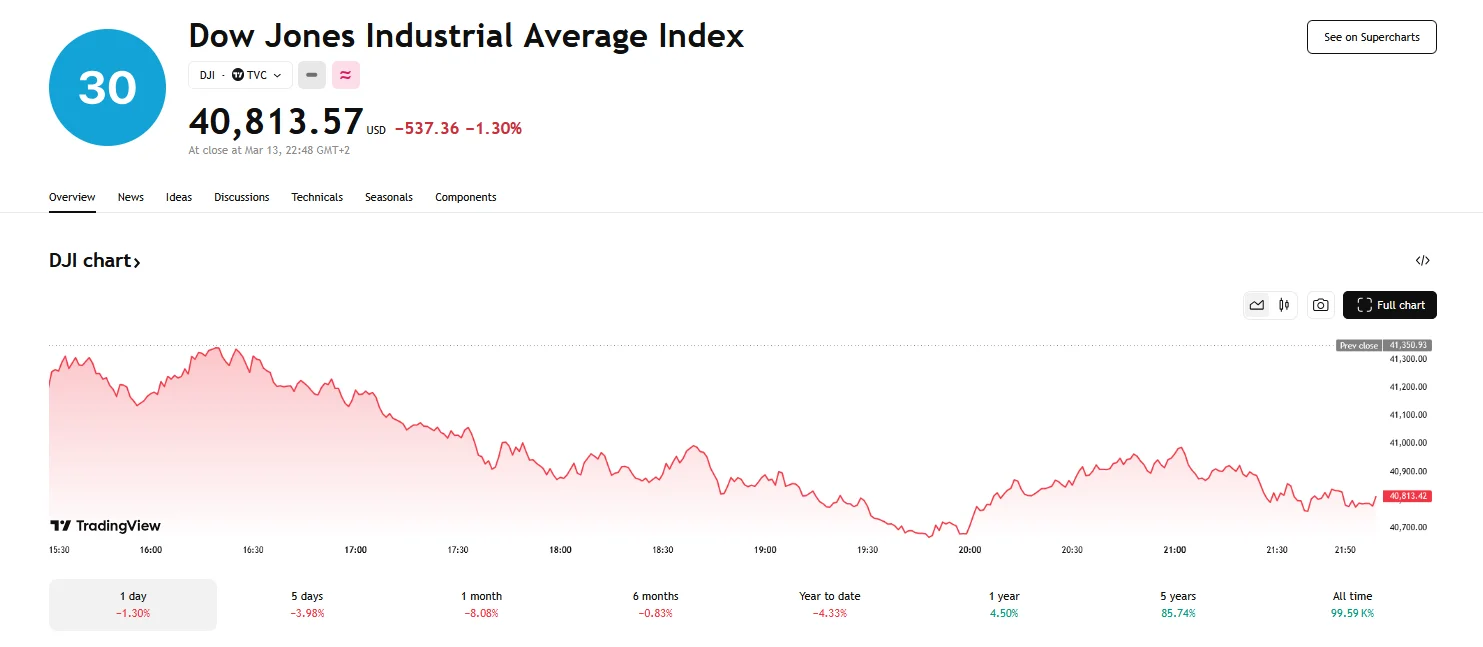

- The Dow Jones Industrial Average fell 1.30% to 40,813.57.

- The S&P 500 suffered as well, plunging 1.39% as it entered correction territory.

- Markets reacted negatively to U.S. President Donald Trump’s threat to impose a 200% tariff on European alcohol.

Trade Tensions and Shutdown Affect Major U.S. Indices

Thursday witnessed a significant downturn in U.S. stock markets, marked by substantial losses and the S&P 500 officially entering correction territory. The Dow Jones Industrial Average experienced a 1.30% decline, closing at 40,813.57, while the S&P 500 fell by 1.39%. This sell-off, a continuation of recent market volatility, was largely attributed to escalating trade tensions and growing economic uncertainties. The speed of the market’s decline, transitioning from record highs to correction territory in just three weeks, has been particularly alarming to analysts.

The S&P 500’s correction, its first in over a year, marked a decline of over 10% from the 6,144.15 peak reported on February 19th. This milestone reflects the market’s response to a confluence of factors, including President Trump’s aggressive trade policies.

President Trump’s threats of new tariffs on the European Union played a pivotal role in the market’s decline. Investor anxiety surged as President Trump threatened a 200% tariff on European alcoholic beverages, a countermeasure to the EU’s 50% tariff on U.S. spirits. This escalation, a direct result of prior U.S. tariffs on steel and aluminum, has fueled fears of a full-blown trade war and generated substantial market uncertainty. Despite some positive economic data, such as cooling inflation figures that fell short of the expected 0.3% and a brief tech stock rebound on Wednesday, the escalating trade tensions between Washington and Brussels ultimately prevailed.

Investors, already burdened by trade-related anxieties, face additional pressure from the impending threat of a U.S. government shutdown. Political gridlock, particularly the Senate Democrats’ plan to block a Republican spending bill, further complicated the situation and increased the likelihood of a shutdown.

The convergence of trade war escalations, the potential for a government shutdown, and fluctuating economic data created a volatile environment. Investor sentiment was deeply affected, with many expressing concern over the potential long-term impacts of these factors on the U.S. and global economy.