Key moments

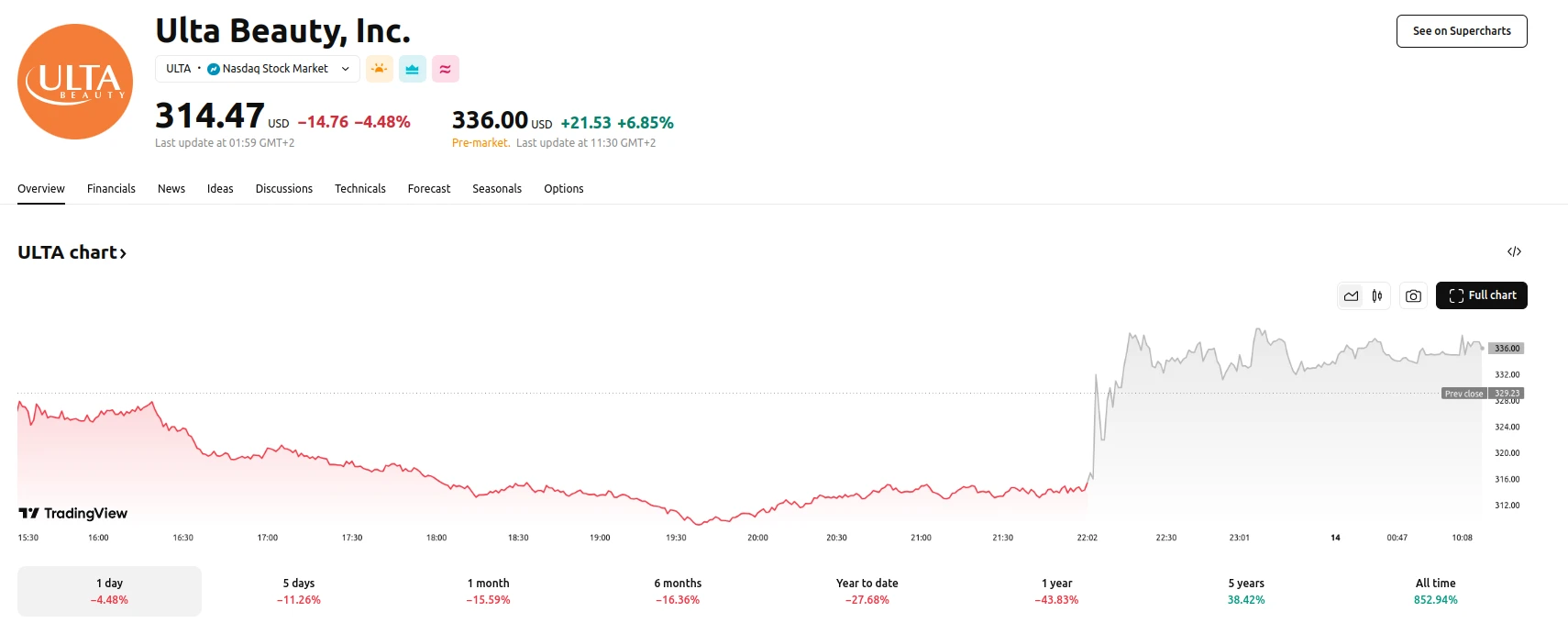

- Ulta Beauty reports fourth-quarter earnings exceeding market expectations, driving a significant after-hours stock price increase.

- The company announces a $900 million share repurchase plan for fiscal 2025, signaling confidence in its financial stability.

- Despite a positive sales outlook, Ulta Beauty projects lower earnings per share for fiscal 2025 compared to the previous year.

Retailer’s Share Price Rises on Earnings Beat and Strategic Fiscal 2025 Plans, Despite Projected Profit Decline

Ulta Beauty Inc. (ULTA) experienced a surge in its stock price following the release of its fourth-quarter earnings report, which surpassed analysts’ predictions. The company’s financial results, coupled with a forward-looking sales outlook and a substantial share repurchase initiative, resonated positively with investors. The reported fourth-quarter earnings per share of $8.46, exceeding the anticipated $7.15, served as a key driver of the after-hours trading increase. However, revenue for the quarter did decrease slightly from $3.55 billion, which was attributed to the benefit of having an extra week of sales in the 2023 fiscal year.

A significant component of Ulta Beauty’s financial strategy for fiscal 2025 is its plan to repurchase approximately $900 million worth of its own shares. This move underscores the company’s confidence in its financial health and its commitment to delivering value to shareholders. Furthermore, the company reported that it still had 2.7 billion dollars remaining of a previous 3 billion dollar buyback plan. This news was met with investor approval.

While Ulta Beauty projects positive sales growth for fiscal 2025, with net sales expected to range between $11.5 billion and $11.6 billion, the company anticipates a decline in earnings per share. This projected decrease, from $25.34 in fiscal 2024 to $22.50-$22.90 in fiscal 2025, is attributed to planned investments aimed at fueling future growth and optimizing business operations. Despite this anticipated decrease in earnings per share, the company’s leadership remains optimistic about the company’s future.