Key moments

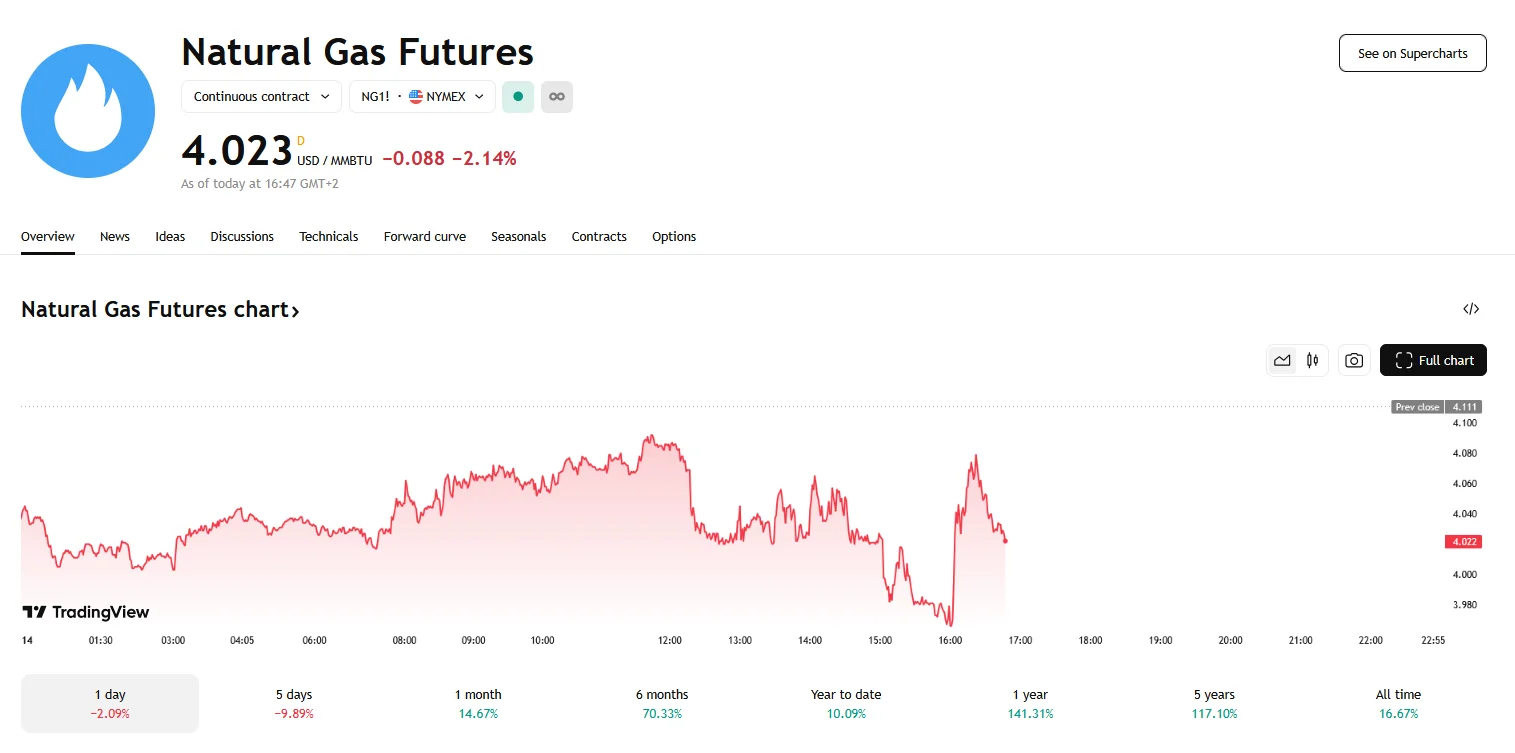

- U.S. natural gas futures fell 2.14% on Friday.

- Revised weather projections predicting milder temperatures across the Lower 48 states led to a substantial reduction in heating degree day (HDD) estimates.

- Natural gas storage levels remain below the five-year average, providing some support against a more dramatic price collapse.

U.S. Natural Gas Futures’ Price Dropped to a Notable Extent

A wave of selling pressure swept through the U.S. natural gas futures market on Friday, resulting in a significant price decline. Initially, the front-month contract, slated for April delivery on the New York Mercantile Exchange (NYMEX), experienced a sharp drop of 3%. This translated to a 13-cent decrease, bringing the price down to $3.98 per million British thermal units (mmBtu). Although there was a brief attempt at recovery, with prices rebounding to $4.023 and reducing the loss to 2.14%, the market ultimately failed to sustain the upward momentum, leaving the contract firmly in negative territory.

This downturn contributed to a broader weekly decline of 8.7%, highlighting the market’s sensitivity to shifting weather forecasts and demand expectations. The primary catalyst behind this price action was the revision of weather projections, indicating a period of warmer-than-average temperatures across the Lower 48 U.S. states. This led to a subsequent reduction in anticipated heating demand for the next two weeks.

According to Robert DiDona, president of Energy Ventures Analysis, the supply side of the equation remained relatively stable, with no significant changes observed. He attributed the major swing in prices to a moderation of demand forecasts, largely driven by updated weather models.

Financial firm LSEG further solidified this assessment, revising its heating degree day (HDD) estimates downward. The firm now anticipates 185 HDDs for the next two weeks, a decrease from the 205 HDDs projected on Thursday. This figure is notably lower than the historical average of 254 HDDs for this time of year, signaling a substantial decrease in expected heating needs.

Despite the anticipated decline in heating demand, LSEG forecasts a slight increase in overall gas demand within the Lower 48 states, including exports, from 106.3 billion cubic feet per day (bcfd) to 107.8 bcfd. This marginal increase suggests that while heating consumption may decrease, other demand factors, such as industrial use and liquefied natural gas (LNG) exports, are expected to provide some offset.

On the supply side, LSEG data indicated a continued rise in average gas output, reaching 105.7 bcfd in March, up from the record 105.1 bcfd registered in February. 1 Additionally, flows to the eight major U.S. LNG export plants remained robust, averaging 15.6 bcfd in March, matching the record high achieved in February.

This week’s decline stands in stark contrast to the previous week’s performance when natural gas prices surged by over 14%. That surge was fueled by record-high LNG export flows and concerns surrounding potential reductions in Canadian gas exports due to tariff disputes.

It must also be noted that even with the warmer weather predictions, recent reports show that natural gas storage is below the 5-year average. This is providing some level of bottom for the prices, keeping them from dropping even more dramatically. Global market fluctuations related to renewable energy also affect the overall global gas market.