Key moments

- WHP Global proposes to acquire Guess, Inc. for $13 per share in cash, representing a 34% premium over the previous closing price.

- Guess, Inc. establishes a special committee to assess the acquisition offer, acknowledging the uncertainty of a finalized agreement.

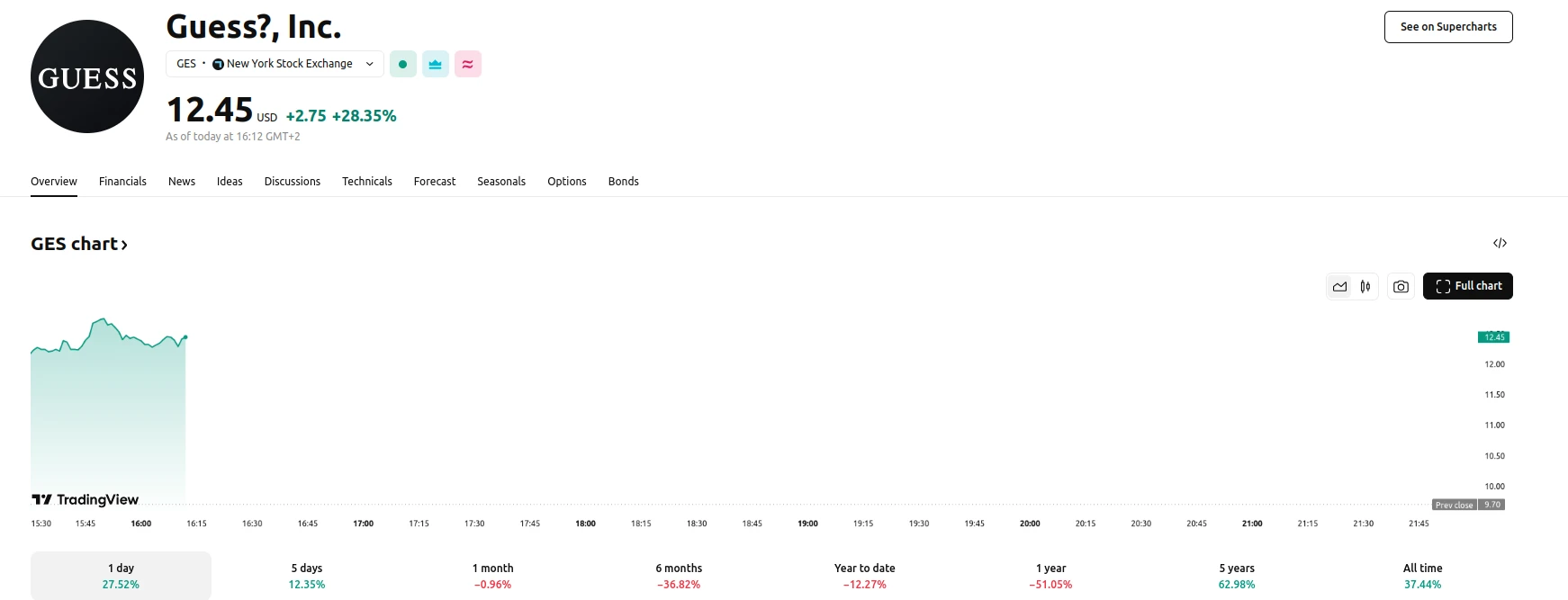

- Guess, Inc. stock experiences a significant surge in early trading following the acquisition proposal, despite a year-to-date decline.

Guess, Inc. Receives Acquisition Proposal Amidst Market Volatility

Guess, Inc. has received an acquisition proposal from WHP Global, a brand management firm, offering to purchase all outstanding shares of the apparel retailer for $13 per share in cash. This offer represents a 34% premium over the company’s closing stock price on the preceding trading day. WHP Global, known for owning various retail brands including Toys “R” Us and fashion brands like Anne Klein and Vera Wang, intends to exclude shares owned by Guess, Inc.’s co-founders, Paul and Maurice Marciano, and CEO Carlos Alberini from the acquisition.

In response to the proposal, Guess, Inc. has formed a special committee to conduct a thorough evaluation of the offer. The company has issued a statement acknowledging that there is no assurance of a definitive agreement or the completion of the proposed transaction. This cautious approach reflects the company’s commitment to due diligence and consideration of shareholder interests.

The acquisition proposal triggered a substantial increase in Guess, Inc.’s stock value during early trading, with shares rising by nearly 27% to $12.35. This surge contrasts with the company’s year-to-date stock performance, which has seen a decline of 9.6%. The company’s stock also experienced a nearly 34% decrease in the previous year. The market’s reaction to the acquisition proposal highlights the potential for significant fluctuations in stock value based on corporate developments. The special committee will now weigh the potential benefits of the acquisition against the company’s long-term strategic goals.