Key moments

- Rheinmetall reports significant revenue growth for 2024, with defense sector sales surging by 50%.

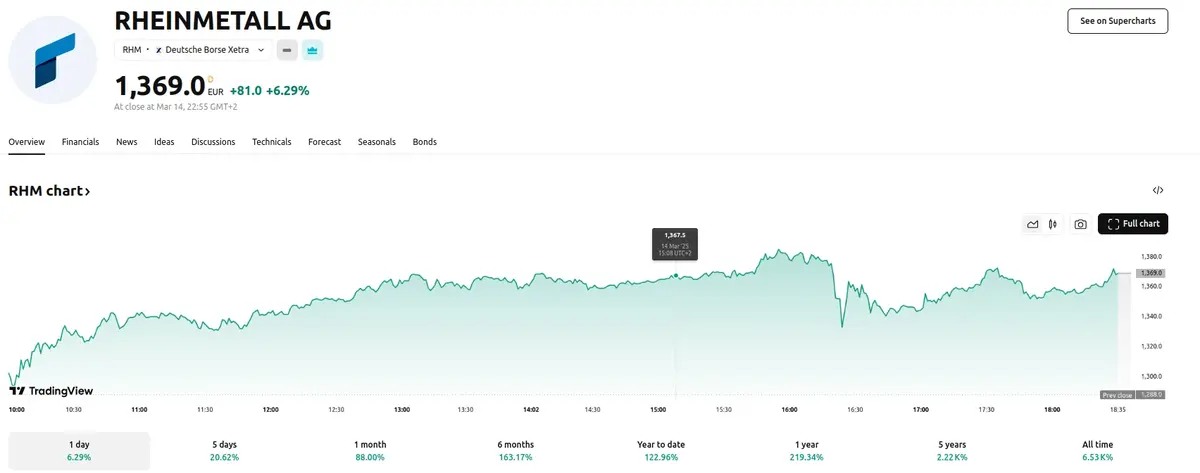

- The company’s stock price experiences substantial gains, exceeding a 1,000% increase since the onset of the conflict in Ukraine. Rheinmetall Stock is up 6.29% within the last day, +20.62% within the last five days, +88% within the last month, and 163.17% within the last six months.

- Anticipated increases in European Union defense spending, coupled with geopolitical uncertainties, drive Rheinmetall’s optimistic future projections.

Rheinmetall’s Expansion Amidst Increased European Defense Spending

German defense contractor Rheinmetall has reported substantial financial growth, primarily driven by heightened demand in the defense sector. The company’s 2024 total revenue reached €9.8 billion, a 36% increase from the previous year, with defense sales specifically rising by 50% to €7.6 billion. This growth is attributed to ongoing European military aid to Ukraine and broader increases in defense spending across the continent. Notably, the company’s order backlog has also increased to a record high of €55 billion, reflecting sustained demand.

The company’s stock performance reflects this growth, with a significant surge since the 2022 invasion of Ukraine. Recent trading data indicates continued positive momentum, highlighting investor confidence in Rheinmetall’s prospects. The European Union’s plan to increase defense spending by €800 billion further reinforces the company’s projected growth trajectory. Rheinmetall’s CEO, Armin Papperger, has expressed optimism about the company’s future, stating that the current circumstances present unprecedented growth opportunities.

Rheinmetall is actively expanding its production capabilities, having invested nearly €8 billion in new facilities, acquisitions, and supply chain improvements. This includes the acquisition of a majority stake in a software developer specializing in digitized warfare. The company is exploring further expansion within Germany, with interest in a Volkswagen plant in Osnabrück. While no formal plans exist, CEO Papperger has indicated the facility’s suitability for Rheinmetall’s expansion. The company’s diverse product portfolio, including tanks, air-defense systems, and munitions, positions it as a key player in the evolving European defense landscape.

The company’s outlook for 2025 projects further sales growth, with a forecasted 25-30% increase in total sales and a 35-40% rise in defense sales. However, Rheinmetall has cautioned that these projections do not factor in recent geopolitical developments, suggesting that future updates may be necessary as customer requirements become clearer. The company’s strategic investments and expanding production capacity aim to solidify its position as a leading global defense systems supplier.