Key moments

- Institutional investors, including Steward Partners Investment Advisory LLC, increased their holdings in Okta, Inc. during the fourth quarter.

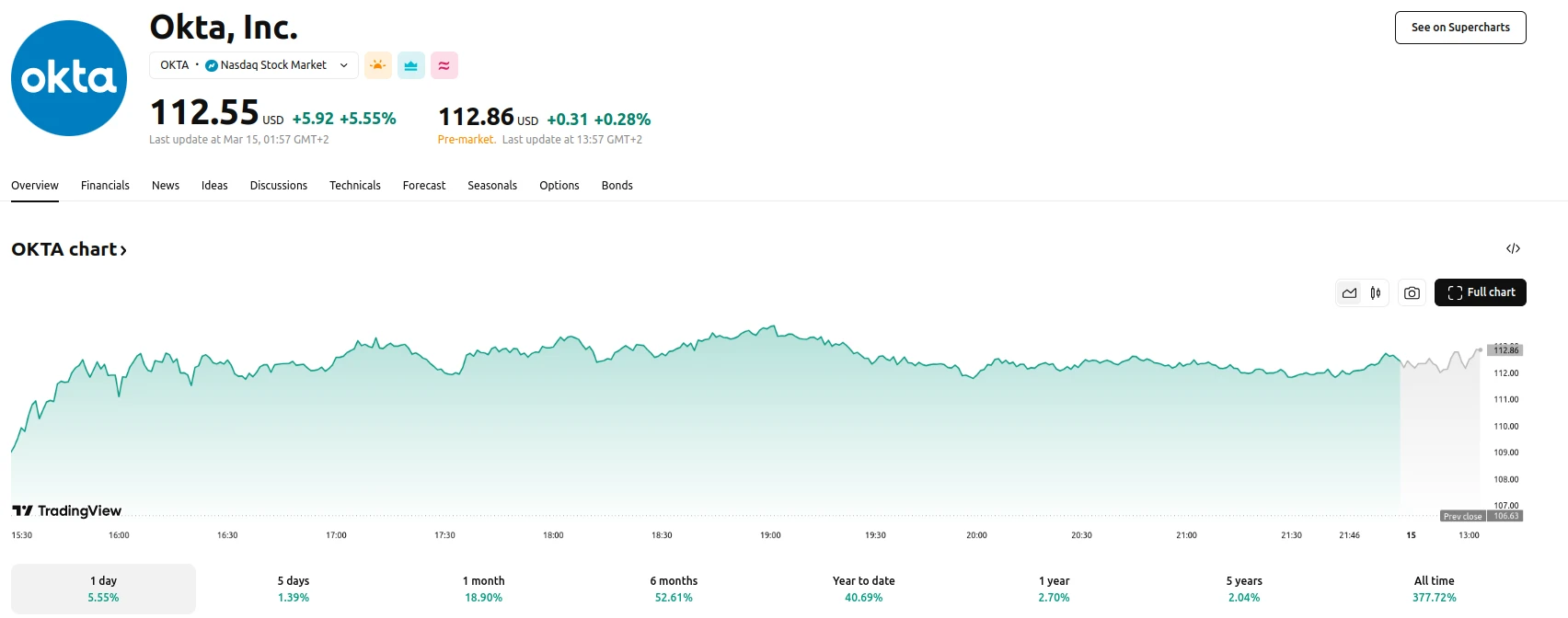

- Okta’s stock opened with a 5.6% increase on Monday, and analysts’ ratings generally indicate a “Moderate Buy” consensus.

- Corporate insiders, including the CEO, executed significant sales of Okta stock in recent months.

Okta, Inc. Sees Increased Institutional Investment Amidst Insider Sales

Okta, Inc., providing identity management platforms for corporate customers in the US and internationally, has experienced increased activity from institutional investors, with several firms expanding their holdings during the fourth quarter. Steward Partners Investment Advisory LLC, among others, reported a 14.5% increase in their Okta stock positions, reflecting confidence in the company’s prospects.

Okta, Inc. has seen a notable increase in institutional investor activity during the fourth quarter. In addition to Steward Partners Investment Advisory LLC’s increased stake, several other firms have adjusted their holdings. Stephens Inc. AR, Wealth Enhancement Advisory Services LLC, CHICAGO TRUST Co NA, Principal Securities Inc., and Metis Global Partners LLC all reported increased positions in Okta stock. This widespread activity contributed to the fact that, as of the latest reports, 86.64% of Okta’s stock is held by institutional investors, demonstrating significant interest and confidence in the company’s performance.

Concurrently, Okta’s stock demonstrated positive movement in recent trading, opening with a 5.6% increase on Monday. This uptick aligns with generally favorable analyst ratings, with a consensus “Moderate Buy” recommendation and an average price target of $114.39. Various research firms have adjusted their price targets and ratings, indicating ongoing analysis and adjustments to market expectations for Okta.

However, this positive investor sentiment contrasts with significant executive selling activity. Notably, CEO Todd McKinnon executed a substantial sale of Okta stock (233.028 shares of Okta stock), along with other insider transactions. These sales, disclosed in SEC filings, represent a considerable volume of shares and raise questions regarding insider perspectives on the company’s future performance.