Key moments

- Phoenix Group reports a significant pre-tax and attributable loss for 2024, due to “economic variances.”

- The company demonstrates strong growth in adjusted operating profit and retail gross inflows, exceeding strategic targets.

- Phoenix Group revises its future financial targets upward, anticipating increased cash generation and operating profit.

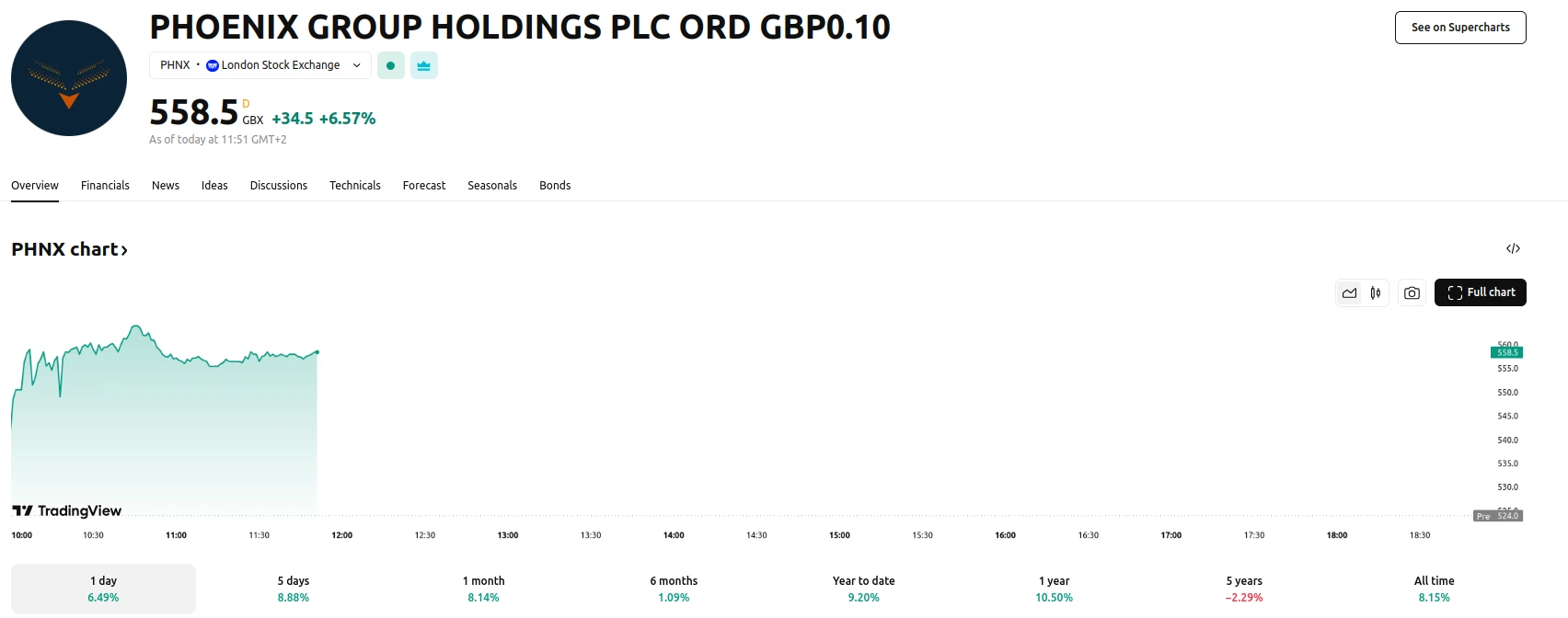

Phoenix Group Navigates Economic Fluctuations While Exceeding Strategic Goals

Phoenix Group Holdings PLC reported a substantial pre-tax loss of GBP1.11 billion for 2024, a notable reversal from the previous year’s profit. This shift was primarily attributed to “economic variances,” which included the impact of higher yields and rising global equity markets. Despite this bottom-line loss, the company emphasized its strong operational performance and strategic progress.

The London-based insurer and pensions provider highlighted a 31% increase in adjusted operating profit, reaching GBP825 million. Additionally, retail gross inflows saw a 34% improvement, demonstrating growth in core business activities. These positive indicators reflect the company’s successful execution of its three-year strategy, focusing on sustainable and profitable growth in its Pensions & Savings and Retirement Solutions businesses.

Looking ahead, Phoenix Group has revised its financial targets upward, reflecting confidence in its future performance. The company now anticipates increased operating cash generation and adjusted operating profit through 2026. Consistent growth in operating cash generation has enabled the company to increase its targets, facilitating faster debt reduction and continued dividend growth for shareholders. The company has increased its final dividend by 2.6% to 27.35 pence per share. This increase shows the company’s commitment to shareholder return in spite of the reported losses.

The company has increased its projected cash generation for 2024-2026, targeting GBP5.1 billion, up from GBP4.4 billion. Furthermore, Phoenix Group aims to achieve GBP1.1 billion in adjusted operating profit by 2026, a significant increase from its previous target. These revised targets underscore the company’s commitment to delivering strong financial performance and enhancing shareholder value, even in the face of economic volatility.