Key moments

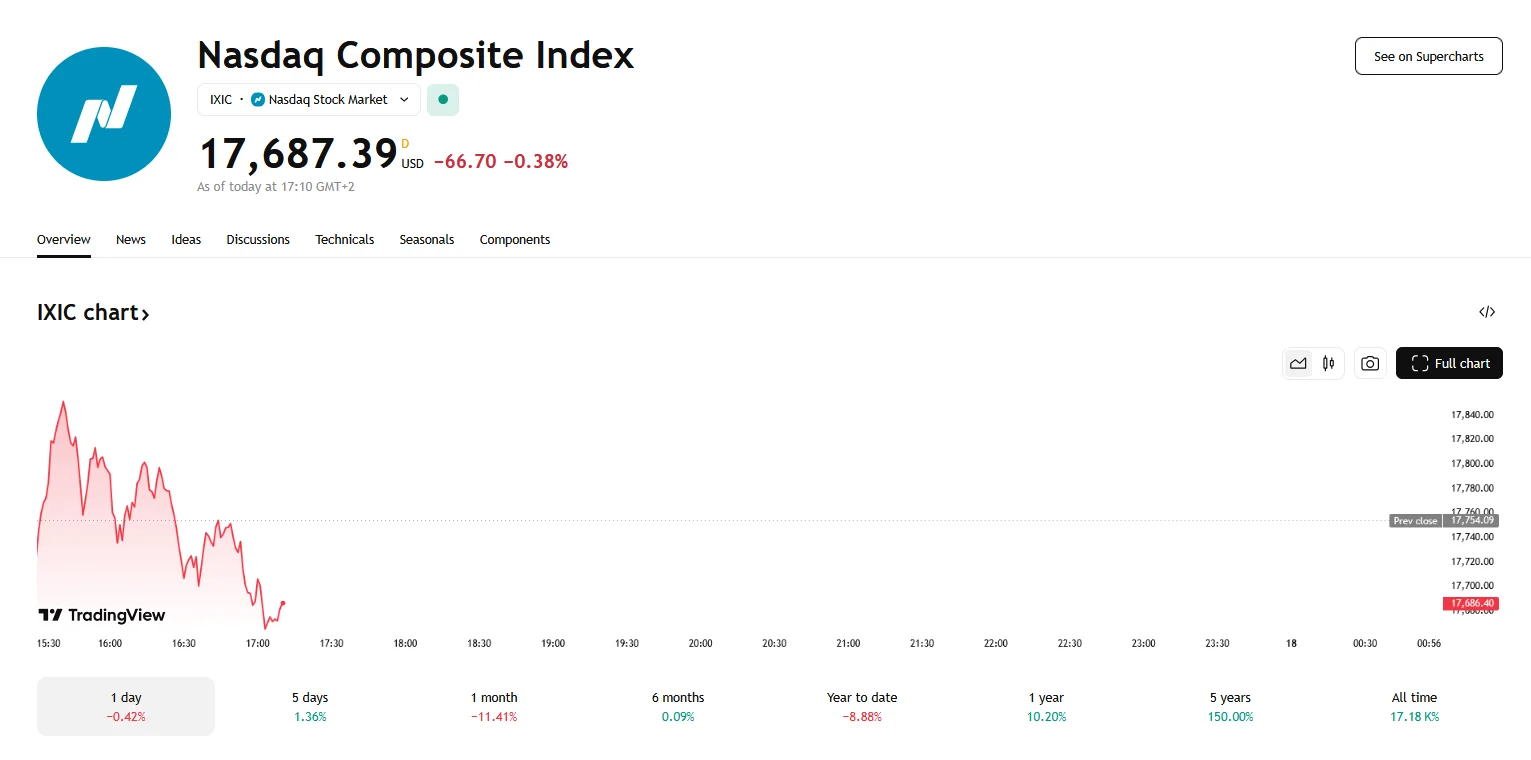

- The S&P 500 and Dow Jones posted gains on Monday, while the Nasdaq Composite experienced a 0.38% decline to below 17,690.

- Worries regarding a potential recession were fueled by the recent commentary of Treasury Secretary Scott Bessent.

- Market forecasts are being adjusted downward due to growing anxieties about future economic growth, signaling a more cautious outlook.

Market Reacts to Concerning Economic Data

The U.S. stock market experienced a mixed trading day, with key indices diverging in their performance. The S&P 500 edged up by 0.28%, trading around the 5,650 mark, as it sought to recover from a recent downturn. The Dow Jones Industrial Average demonstrated stronger performance, climbing 0.57% and surpassing the 41,720 level. Conversely, the Nasdaq Composite faced headwinds, declining by 0.38%.

The market’s mixed performance was influenced by a confluence of economic data and commentary. Retail sales figures released on Monday revealed a less robust 0.2% rise, which was short of the anticipated 0.6%, prompting reassessments of economic growth projections. Additionally, a manufacturing activity index from the New York Fed showed a significant contraction, further contributing to concerns about the economy’s health.

Market anxieties were amplified by Treasury Secretary Scott Bessent’s recent statements. He not only characterized stock market corrections as inherent to market behavior but also pointed to the country’s significant government deficits, now at 6.7% of GDP. Bessent’s assertion that the Trump administration foresees a “transition period” to manage these fiscal imbalances further stoked concerns about economic stability and the risk of a downturn.

Market forecasts are being revised downward due to growing anxieties about future economic growth. Lori Calvasina, head of US equity strategy at RBC Capital Markets, revised her year-end forecast for the index, reducing it from 6,600 to 6,200.

The retail sales report, while below initial estimates, provided a degree of relief to traders, suggesting that the situation was not as dire as some had feared. However, the Federal Reserve’s upcoming policy meeting, scheduled to conclude on Wednesday, remains a pivotal event for investors. Market participants are keen to glean insights into the central bank’s views on the economy and the potential timing of future interest rate adjustments.