Key moments

- A one-month trial period for Tesla’s Full Self-Driving (FSD) service has begun in China, spanning from March 17 to April 16.

- The trial requires compatible hardware, software, and updated navigation maps, reflecting specific Chinese market adaptations.

- Tesla collaborates with Baidu to enhance FSD performance in China, addressing data localization challenges.

Tesla Launches FSD Trial in China Amidst Data Localization Efforts

Tesla has announced a month-long free trial of its Full Self-Driving (FSD) service in China, commencing on March 17th. This initiative aims to introduce advanced driving-assistance technology to Chinese consumers, providing access to features designed to handle complex traffic scenarios. The trial is contingent upon vehicles possessing compatible hardware and software, as well as the latest navigation maps, indicating Tesla’s tailored approach to the Chinese market.

Unlike its approach in the United States, where FSD relies heavily on AI training from local data, Tesla’s rollout in China faces data localization challenges. Due to Chinese data regulations, Tesla has been unable to utilize the vast data pool from its approximately two million electric vehicles in the country for AI training. To mitigate this, Tesla is collaborating with Baidu, a Chinese technology giant, to improve the system’s performance. This partnership focuses on enhancing the accuracy and reliability of navigation maps, which are crucial for FSD’s functionality in China.

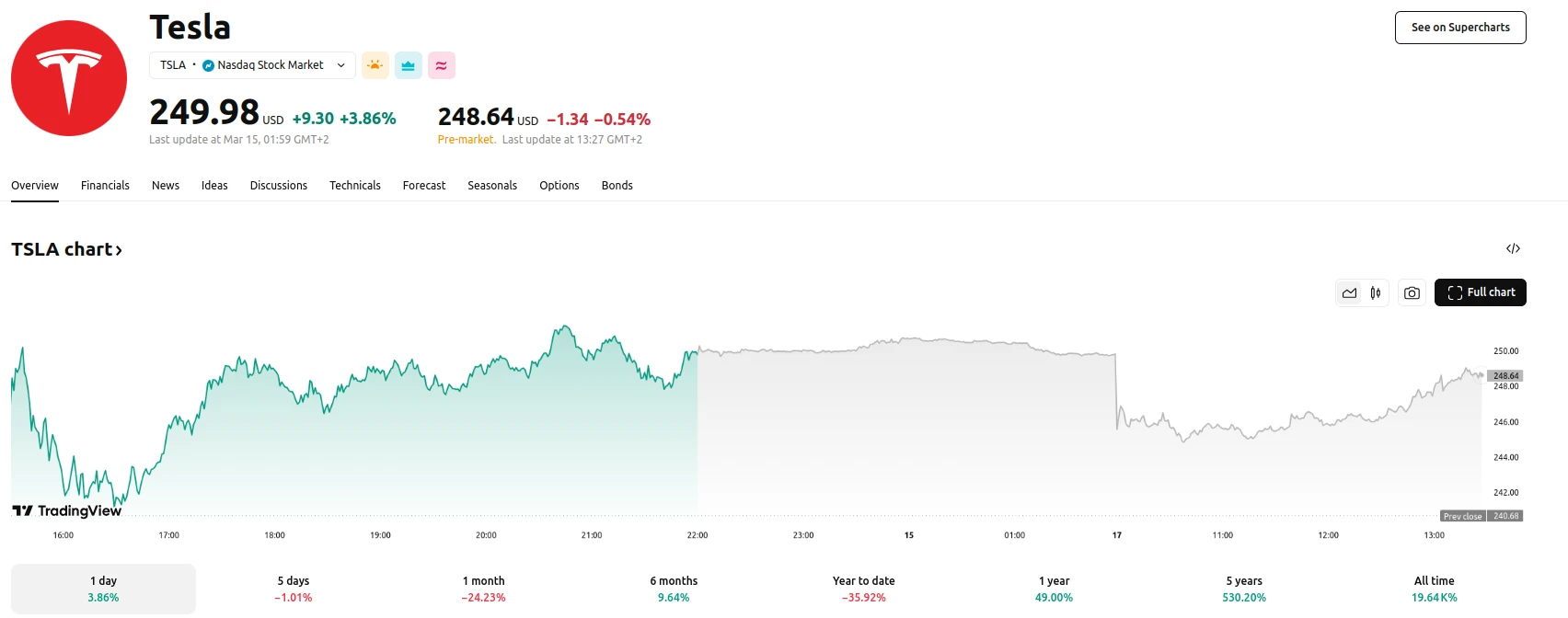

The trial period reflects Tesla’s ongoing efforts to expand its FSD technology globally while navigating region-specific regulatory landscapes. The company’s strategy involves adapting its technology to meet local requirements, demonstrating a commitment to market penetration despite existing hurdles. The recent stock performance of Tesla has been volatile. Despite a 3.86% increase on March 17, 2025, the stock has experienced an eight-week losing streak. This volatility is attributed to various factors, including the CEO’s political activities. The FSD trial could serve as a potential catalyst for renewed interest in the company’s technological advancements.