Key moments

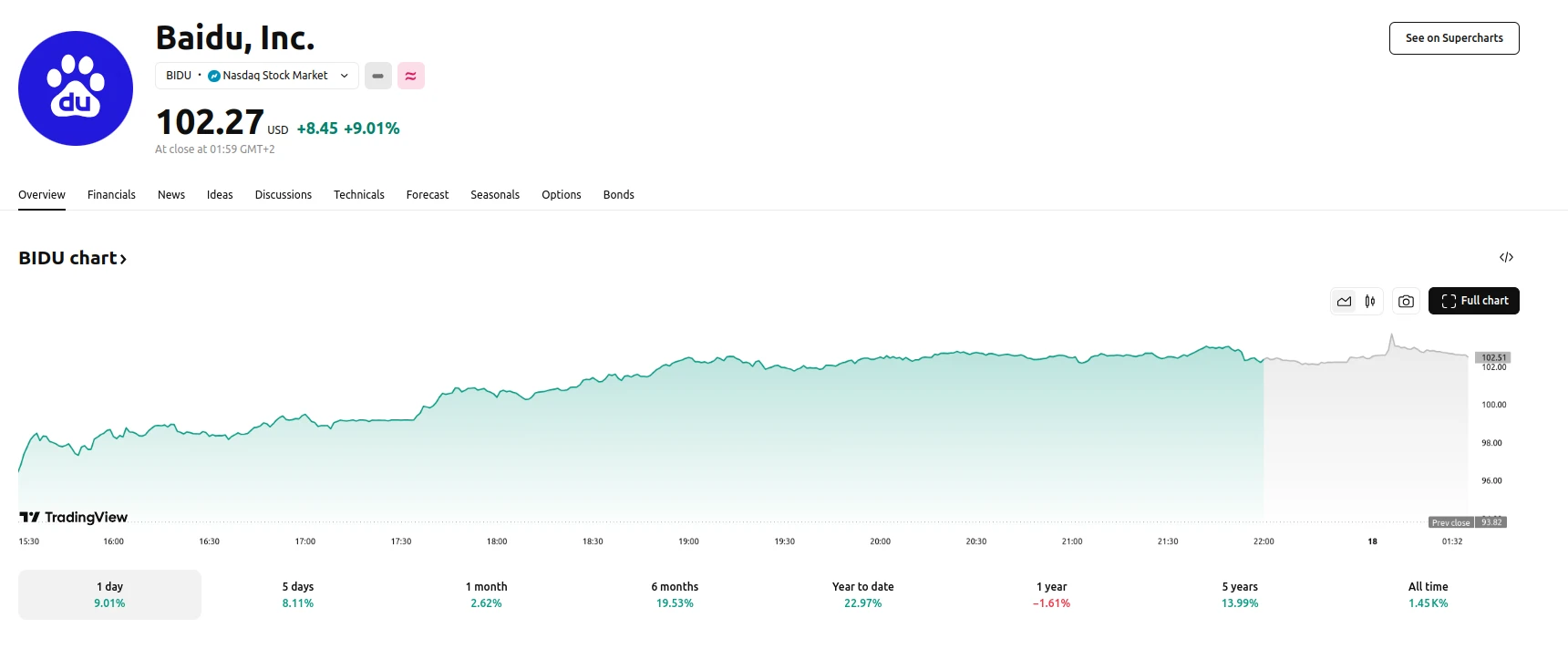

- Baidu’s stock experienced a significant surge, closing with a 9.8% gain on Monday.

- The company unveiled two new advanced AI models, ERNIE 4.5 and ERNIE X1.

- Baidu’s X1 model is positioned as a cost-effective alternative to rival AI models, boasting comparable performance at a reduced price.

Baidu’s AI Advancements Fuel Stock Market Rise

Baidu Inc. saw its stock price climb substantially on Monday, with shares increasing by 9.8% at market close, after reaching a peak of 9.9% earlier in the trading day. As of Tuesday, the stock price hovers around 102 USD. This notable performance occurred amidst a broader market downturn, where the S&P 500 and Nasdaq Composite indices experienced declines. The surge in Baidu’s stock is directly linked to the company’s announcement of two new sophisticated artificial intelligence (AI) models.

On Sunday, Baidu revealed the launch of ERNIE 4.5 and ERNIE X1, representing advancements in its AI capabilities. Notably, Baidu asserted that its X1 model delivers performance equivalent to DeepSeek’s R1, a competing Chinese AI model, but at half the cost. The claim is noteworthy because DeepSeek’s R1 was previously distinguished by its economical training relative to U.S.-developed alternatives. The X1 model is characterized as a ‘deep-reasoning’ AI, designed to handle diverse and intricate operations, encompassing image creation, code analysis, web content processing, and sophisticated computations.

Baidu’s strategic investment in AI is underscored by its position as the third-largest holder of AI-related patents globally. The introduction of these new models signifies a critical step forward for the company. Despite facing competition both domestically and internationally, Baidu is well-positioned to leverage its AI innovations, self-driving technology, and cloud infrastructure. While the company has observed some challenges in its advertising revenue, a core component of its business, its advancements in AI technology are anticipated to provide a significant competitive advantage.