Key moments

- SentinelOne reports accelerated revenue growth in the fourth quarter of fiscal 2025, signaling strong market momentum.

- The company demonstrates significant progress towards profitability, achieving a non-GAAP net profit for the fiscal year.

- Despite a substantial stock decline from its 2021 peak, SentinelOne’s current valuation appears favorable compared to industry peers.

SentinelOne Demonstrates Growth Amid Market Reevaluation

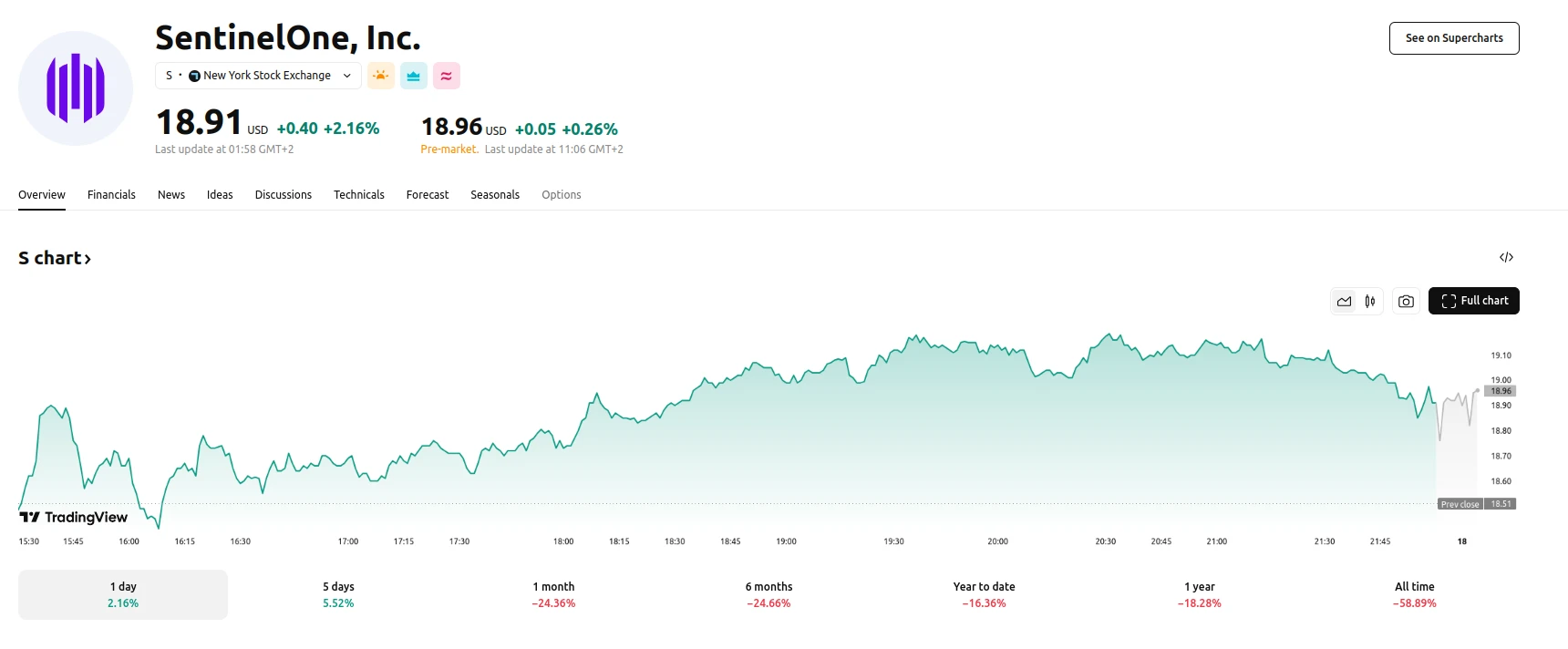

SentinelOne, a provider of AI-driven cybersecurity solutions, has released its fiscal 2025 fourth-quarter results, revealing an acceleration in revenue growth. The company’s Singularity platform, leveraging artificial intelligence for threat detection and incident response, continues to gain traction in a market experiencing increased demand for advanced cybersecurity tools. This growth is notable against the backdrop of a significant stock price correction since the company’s 2021 initial public offering. As of March 18, 2025, the stock is up 2.16% for the day and +5.52% within the last five trading days. However, it is down 16.36% YTD.

The reported revenue for the fourth quarter reached $225.5 million, marking a 29% year-over-year increase and representing an acceleration from the previous quarter’s growth rate. This performance is attributed to the company’s ability to attract and retain high-value clients, with more than 1,400 of them spending over $100,000 annually on the company’s platform. Furthermore, the company’s fiscal year revenue reached $821.4 million, a 32% increase from the previous year.

In addition to revenue growth, SentinelOne has made strides in improving its financial performance. The company achieved a non-GAAP net profit of $15.1 million for the fiscal year, a significant improvement from the previous year’s net loss. This progress toward profitability, coupled with the company’s demonstrated ability to deliver advanced cybersecurity solutions, has positioned SentinelOne as a competitive player in the market. Despite a 75% decline in its stock price from its 2021 peak, the company’s current valuation metrics suggest a favorable comparison to its industry peers, particularly when considering its growth rate. The company’s focus on AI-driven solutions and its proven performance in threat detection and response align with the increasing demand for sophisticated cybersecurity measures in the face of evolving cyber threats.