Key moments

- Alphabet is reportedly in advanced negotiations to acquire cybersecurity startup Wiz for $30 billion.

- This possible acquisition comes after a prior $23 billion agreement was terminated, primarily because of anxieties related to investors and antitrust issues.

- The acquisition aims to strengthen Alphabet’s cloud computing offerings through Wiz’s enhanced security capabilities.

Alphabet’s Pursuit of Wiz: A Strategic Move in Cloud Cybersecurity

Alphabet, the parent company of Google, is reportedly nearing a $30 billion acquisition of cybersecurity firm Wiz, a move that would significantly bolster its cloud computing division. This development comes after a prior attempt at a $23 billion acquisition fell through last summer, highlighting the complexities of navigating large-scale tech mergers. The renewed negotiations signify Alphabet’s strategic focus on enhancing its cloud security capabilities through the integration of Wiz’s advanced platform.

The potential acquisition represents a substantial investment for Alphabet, surpassing its previous record of $12.5 billion for Motorola Mobility. The renewed interest in Wiz underscores the growing importance of robust cybersecurity solutions in the cloud computing sector. Wiz, which was valued at $12 billion following a recent funding round, has positioned itself as a leader in cloud security, emphasizing AI-driven solutions and comprehensive integration platforms. The company’s ability to provide a unified view of risk across various cloud environments aligns with Alphabet’s ambitions to offer a more comprehensive cloud service.

The initial failed acquisition attempt was attributed to concerns regarding investor and antitrust implications. However, the current advanced discussions suggest that these hurdles may have been addressed. If finalized, the acquisition would enable Alphabet to integrate Wiz’s technology into its Google Cloud Platform, providing its customers with enhanced security features and solidifying its position in the competitive cloud market. Wiz’s focus on vulnerability management and its role as a Common Vulnerability and Exposure (CVE) Numbering Authority further contribute to its appeal as a strategic asset for Alphabet.

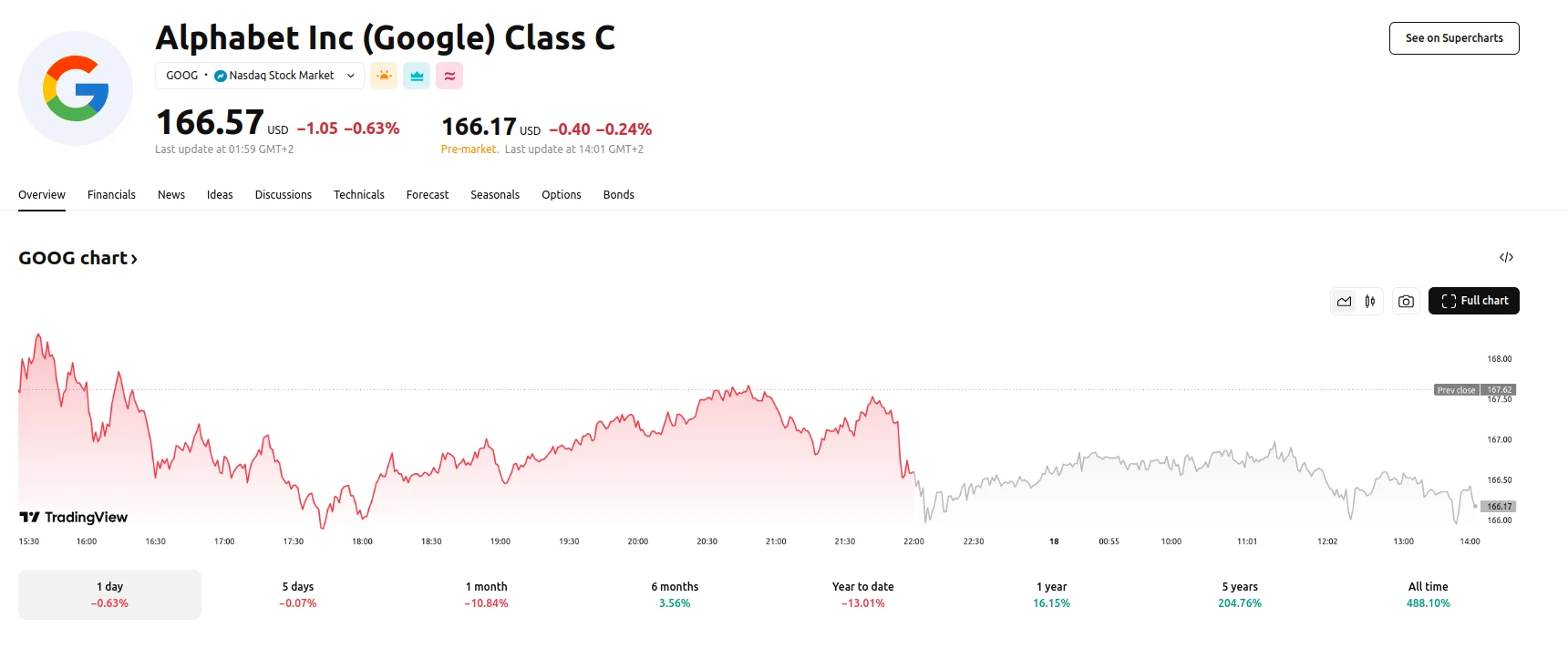

As of March 18, 2025, Alphabet shares trade at approximately 166 USD, a -0.63% change compared to the previous trading day. The company shares have registered a 3.56% rise within the last 6 months.