Key moments

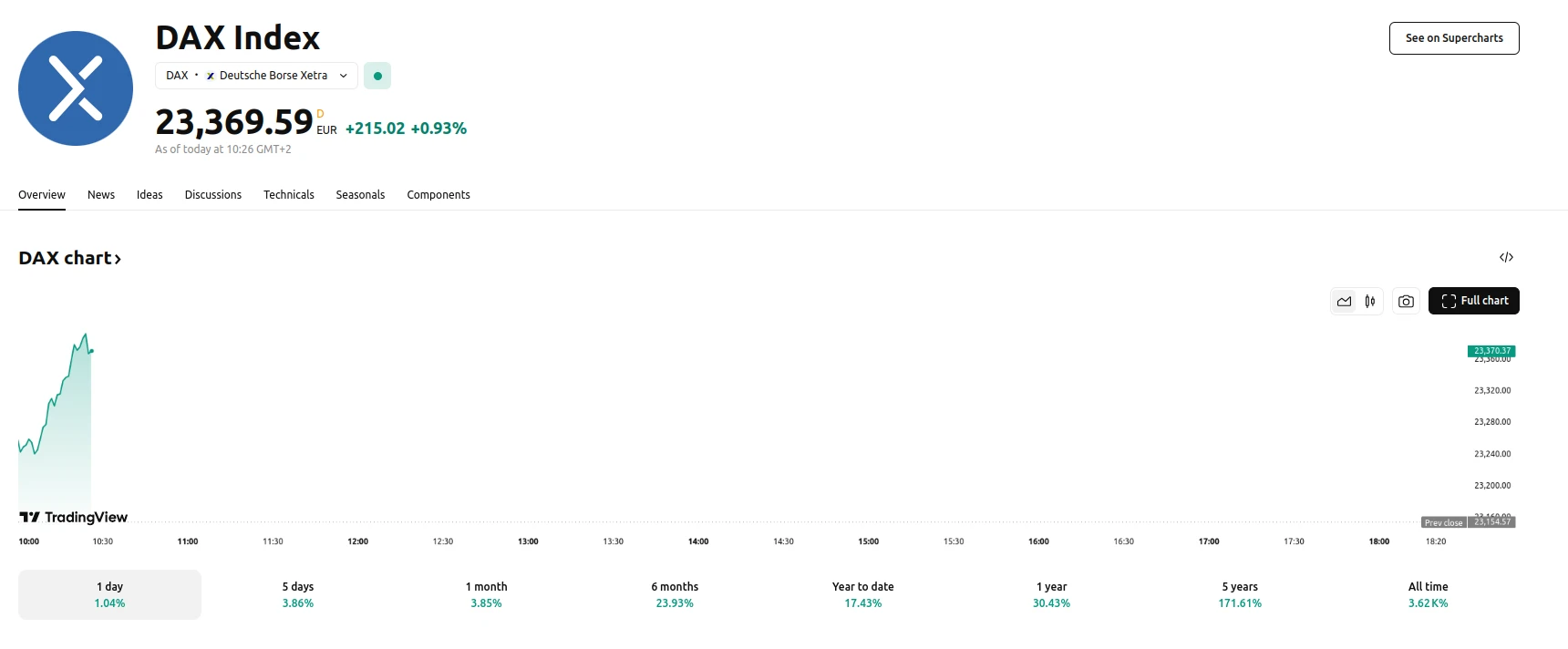

- DAX opens at 23,266 EUR, reflecting investor optimism surrounding Germany’s impending fiscal reform vote.

- Anticipated parliamentary approval of a €500 billion infrastructure fund and related fiscal measures drives sector-specific gains, notably in banking, construction, and defense.

- Market sentiment remains sensitive to potential US-EU trade tensions and the trajectory of central bank policies, creating a volatile near-term outlook.

German Market Reacts to Fiscal Policy Anticipation and Trade Uncertainties

The German DAX Index commenced trading with a notable increase, at 23,266 EUR, up almost 1% within the last trading day, as market participants closely monitored the approaching vote within the Bundestag regarding significant fiscal reforms. The observed uptrend suggests a prevailing sentiment of optimism, largely attributed to the potential for substantial governmental investment in infrastructure and climate-related initiatives. This positive outlook, however, is tempered by persisting concerns surrounding international trade relations and the evolving monetary policies of central banks.

The anticipated parliamentary decision on the proposed €500 billion infrastructure fund, coupled with related fiscal adjustments intended to stimulate economic growth, has triggered a surge in demand for stocks within specific sectors. Financial institutions, construction firms, and defense contractors experienced notable gains, reflecting investor confidence in the potential benefits of increased government spending.

Specifically, defense contractors, such as Rheinmetall AG, experienced a 0.24% increase, while construction materials provider Heidelberg Materials AG saw a 0.58% rise. The aerospace industry also benefited, with Airbus and MTU Aero Engines recording gains of 0.56% and 0.49%, respectively.

Furthermore, the prospect of fiscal stimulus has positively impacted the banking sector, with Commerzbank and Deutsche Bank witnessing increases of more than 1%. Concurrently, the automotive industry demonstrated significant growth, bolstered by a perceived reduction in immediate tariff threats. BMW and Porsche led the charge with gains of 1.36% and 1.57%, while Volkswagen and Mercedes-Benz Group also reported positive performance.

Conversely, the market remains susceptible to external factors, including the possibility of escalated trade tensions between the United States and the European Union. Ongoing discussions regarding potential tariff implementations continue to introduce an element of uncertainty, influencing market dynamics.

Furthermore, the trajectory of the DAX is contingent upon the forward guidance provided by central banking institutions, particularly the European Central Bank and the Federal Reserve. The nuanced interplay between fiscal policy implementation and monetary policy adjustments will likely dictate the market’s direction in the near term. Technical indicators, such as the Relative Strength Index, suggest that the DAX possesses the potential for further upward movement, although the inherent volatility associated with geopolitical and economic factors necessitates a cautious approach. The market remains highly sensitive to developments in US-EU trade relations, central bank communications, and the ultimate outcome of Germany’s fiscal policy deliberations.