Key moments

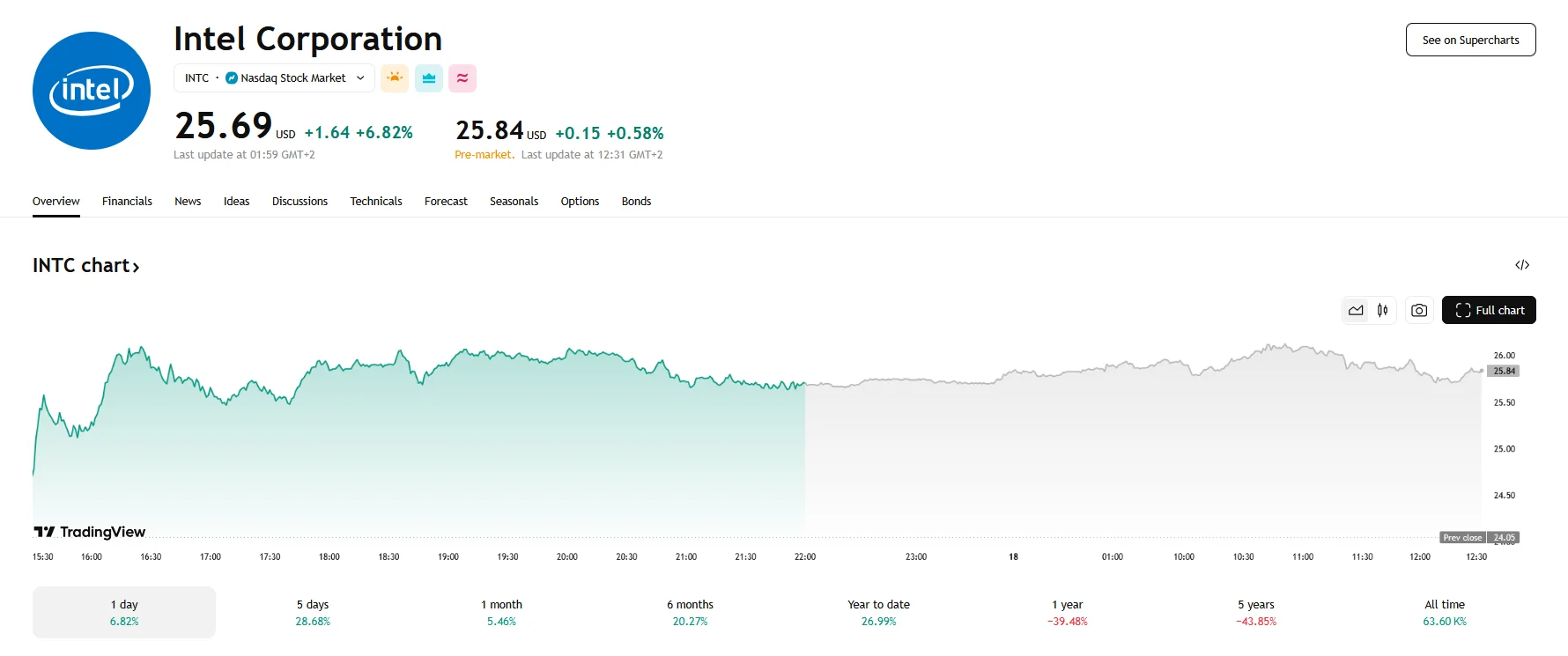

- On Monday, Intel’s share price increased by 6.82%, closing at $25.69 and signaling a strong positive reaction from investors.

- Since Lip-Bu Tan officially took over as CEO on Tuesday, Intel’s pre-market trading saw shares achieve a surge of almost 1%.

- It appears Tan plans to streamline Intel’s management and revitalize chip manufacturing, as well as focus on AI, in order to improve the company’s performance.

Intel’s stock enjoyed a significant surge on Monday, with the company’s share price climbing 6.82% to close at $25.69. This upward trajectory did not cease during Tuesday’s pre-market trading hours, with shares rising nearly 1%, reflecting growing investor optimism.

The catalyst for this continued investor confidence is the official commencement of Lip-Bu Tan’s tenure as Intel’s CEO on Tuesday. Tan’s appointment, announced the previous week, has already generated considerable momentum for Intel. The company’s share price has now experienced four consecutive days of gains, amounting to a nearly 30% increase.

Reports indicate that Tan is poised to implement substantial changes within Intel. According to Reuters, he intends to streamline the company’s organizational structure by reducing “slow-moving middle management.” This move is seen as a crucial step in enhancing operational efficiency and fostering a more agile decision-making process.

Furthermore, as reported by Reuters, Tan is expected to prioritize the revitalization of Intel’s chip manufacturing capabilities. He aims to improve the company’s production processes to regain its competitive edge in the semiconductor industry. Additionally, he plans to focus on the development and introduction of new semiconductors designed to power artificial intelligence (AI) servers. This strategic shift reflects Intel’s recognition of the burgeoning AI market and its determination to establish a strong presence in this rapidly expanding sector.

Tan’s appointment comes at a critical juncture for Intel, which has faced challenges in recent years. His track record as the former CEO of Cadence Design Systems has instilled confidence among investors and analysts. While at the helm of the semiconductor software company, Tan demonstrated his ability to drive growth and innovation, doubling revenue and significantly increasing the company’s stock value.

The market’s positive reaction to Tan’s appointment and his announced plans underscores the anticipation surrounding Intel’s potential turnaround. Investors are optimistic that his strategic vision and leadership will enable the company to overcome its recent setbacks and capitalize on emerging opportunities in the semiconductor and AI markets.