Key moments

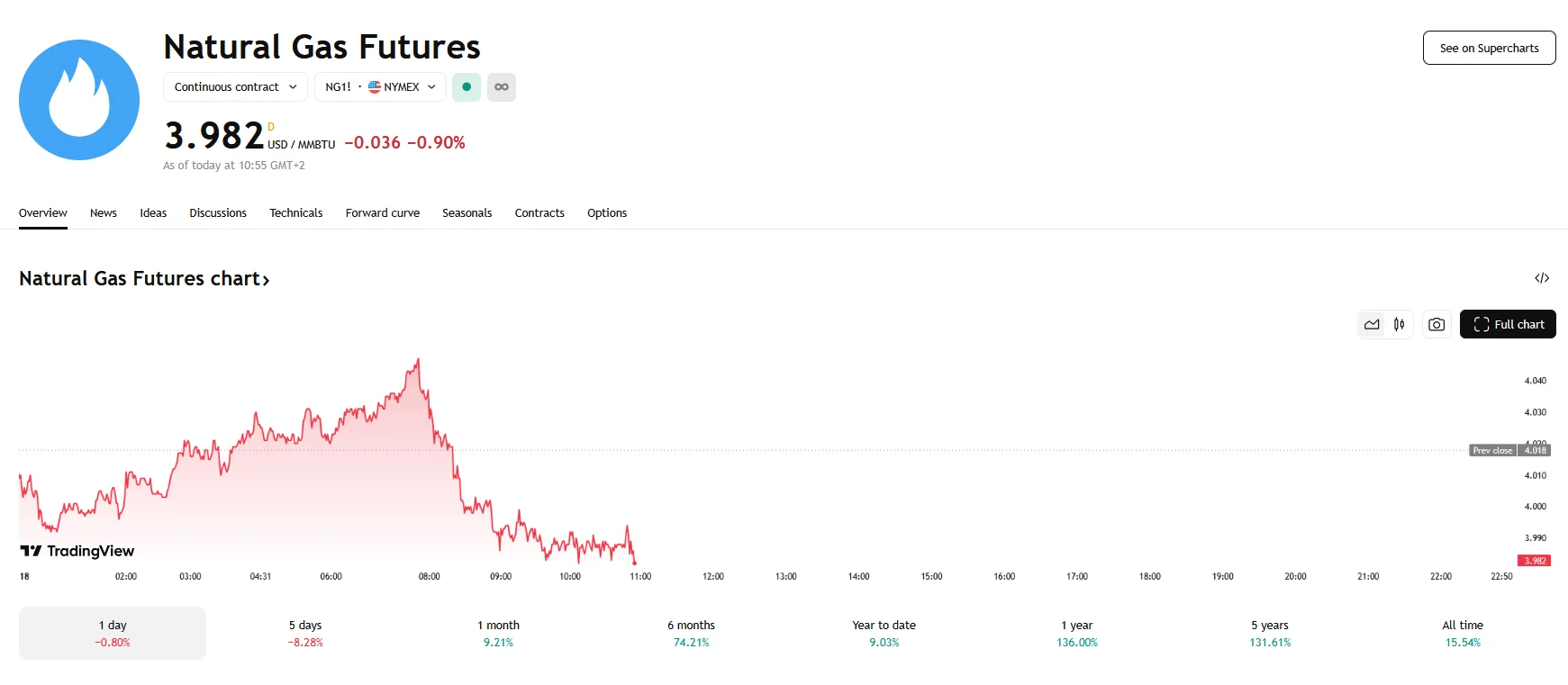

- U.S. natural gas futures saw a significant 2% drop on Monday, with further declines observed on Tuesday.

- A combination of record-breaking domestic gas production and forecasts of unseasonably warm temperatures through early April are the primary factors behind the recent decrease in price.

- European natural gas markets also experienced volatility, with European futures falling to €41.7/MWh.

Record Production and Warm Weather Forecasts Drive U.S. Natural Gas Price Decline

On Monday, U.S. natural gas futures experienced a 2% decline, sinking to its lowest value in two weeks. Tuesday’s figures have also been unimpressive. This downturn was attributed to a confluence of factors, notably record-breaking domestic production and forecasts indicating milder weather patterns extending into early April. These conditions are anticipated to lessen the demand for natural gas typically drawn from storage for heating purposes during this period.

Despite this price decrease, it is crucial to acknowledge the lingering effects of the severe cold experienced in January and February. These extreme weather conditions forced energy firms to deplete substantial amounts of gas from storage, resulting in the current supply being 12% lower than the typical March levels. This lingering deficit underscores the potential for future price volatility should unexpected weather patterns or supply disruptions emerge.

The price slide occurred even as flows to U.S. liquefied natural gas (LNG) export facilities experienced unprecedented production, with output surpassing all prior records. This reveals a market where production and export are strong, but domestic demand, due to weather, is not keeping pace.

A particularly striking development was the prices of West Texas’ Waha Hub going negative. This anomaly, the first of its kind since November, is attributed to pipeline maintenance that has effectively trapped natural gas associated with oil production within the Permian Basin. The rapid growth of Permian oil and gas production has outpaced the development of pipeline infrastructure, leading to negative pricing as producers seek to offload excess gas.

The situation in the U.S. mirrors, to some extent, trends observed in European markets. European natural gas futures also climbed 9% last week before dropping on Monday and settling at €41.7/MWh. While hopes for a swift resolution to the conflict in Ukraine remain subdued, the market continues to react to developments that could potentially impact natural gas flows.